Wink, Inc. Releases Second Quarter, 2024 Life Sales Results

September 4, 2024 by Wink's Press Release

LIFE INSURANCE SALES REBOUND IN THE SECOND QUARTER

Wink, Inc. Releases Second Quarter, 2024 Life Sales Results

Des Moines, Iowa. September 3, 2024– Wink, Inc. released the second quarter, 2024 life sales results in its 108th edition of Wink’s Sales & Market Report. Wink’s Sales & Market Report is the insurance industry’s #1 resource for life insurance sales data, since 1997.

All universal life sales for the second quarter were over $1.1 billion; up 11.9% compared to the previous quarter. All universal life (UL) sales include fixed UL, indexed UL, and variable UL product sales.

Noteworthy highlights for total all universal life sales in the second quarter included National Life Group ranking as #1 in overall sales for all universal life sales, with a market share of 11.3%. Transamerica Life’s Transamerica Financial Foundation IUL was the #1 selling product for all universal life sales, for all channels combined for the second consecutive quarter.

Non-variable universal life sales for the second quarter were $847.4 million; up 12.0% compared to the previous quarter and up 2.3% compared to the same period last year. Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the second quarter included National Life Group retaining the #1 overall sales ranking for non-variable universal life sales, with a market share of 15.2%. Transamerica Life’s Transamerica Financial Foundation IUL was the #1 selling product for non-variable universal life sales, for all channels combined for the thirteenth consecutive quarter.

Fixed UL sales for the second quarter were $100.5 million, up 12.2% compared to the previous quarter and down 1.0% compared to the same period last year.

Items of interest in the fixed UL market included Nationwide as the #1 ranking in fixed universal life sales, with a 14.7% market share, John Hancock, Prudential, Protective Life Companies, and Pacific Life Companies completed the top five, respectively.

Nationwide’s Nationwide Care Matters II was the #1 selling fixed universal life insurance product, for all channels combined for the second consecutive quarter. The top primary pricing objective of No Lapse Guarantee capturing 43.7% of sales. The average fixed UL target premium for the quarter was $6,892, an increase of more than 26.0% from the prior quarter. Moore commented, “Had half of the participants not had sales declines, sales over this quarter last year would have fared better…”

Indexed life sales for the second quarter were $747.2 million, up 12.0% compared with the previous quarter, and up 2.8% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

Items of interest in the indexed life market included National Life Group keeping their #1 ranking in indexed life sales, with a 17.1% market share, Transamerica, Pacific Life Companies, Nationwide, and John Hancock rounded the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the #1 selling indexed life insurance product, for all channels combined, for the thirteenth consecutive quarter. The top primary pricing objective for sales this quarter was Cash Accumulation, capturing 73.1% of sales. The average indexed life target premium for the quarter was $10,783, a decline of nearly 11.0% from the prior quarter.

“It is worth noting that one of the top ten best sellers of indexed life made waves this quarter,” commented Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. “They launched a brand-new instant decision underwriting product that buoyed their sales up triple digits!”

Variable Universal Life sales for the second quarter were $291.6 million; up 11.4% compared with the previous quarter.

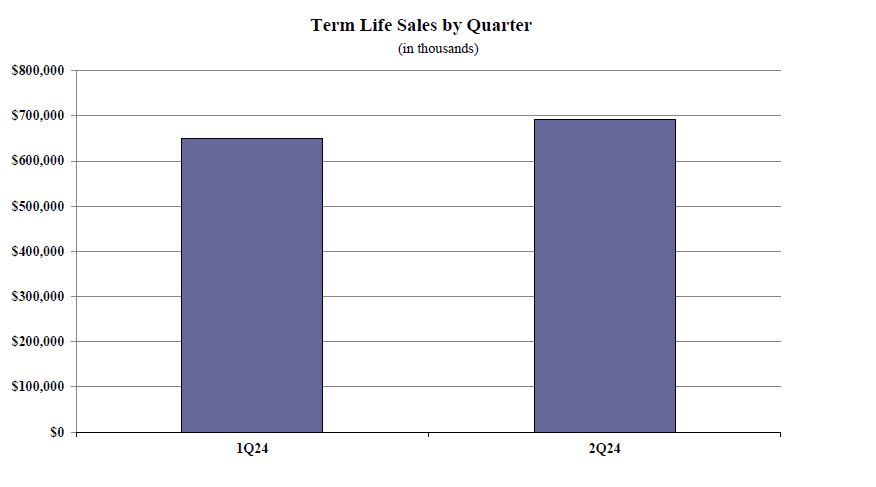

Term life second quarter sales were $692.8 million; up 6.8% compared with the previous quarter.