FOURTH QUARTER 2023 LIFE INSURANCE SALES

March 13, 2024 by Sheryl J. Moore

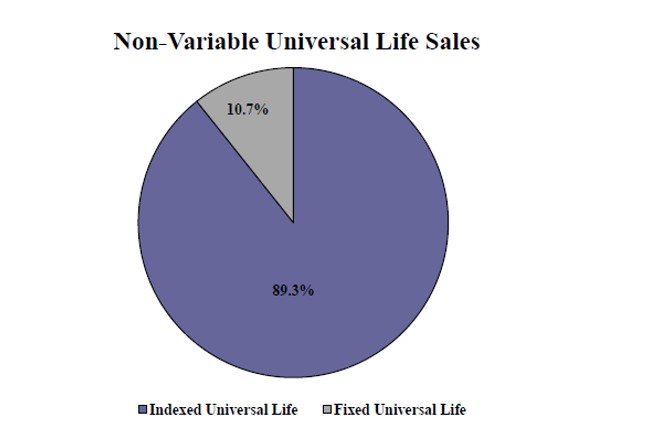

Non-Variable UL

Sales for the fourth quarter of 2023 were $894 million, compared with sales of $859 million for the fourth quarter of 2022. Fourth quarter non-variable life sales were up nearly 16% when compared to the previous quarter and up more than 4% as compared to the same period last year.

Total 4Q2023 non-variable universal life sales were $894,514,477.

Indexed Life

Sales for the fourth quarter of 2023 were $799 million, compared with sales of $760 million for the fourth quarter of 2022. Fourth quarter indexed life sales were up more than 16% when compared with the previous quarter, and up more than 5% as compared to the same period last year. This was a record-setting quarter for indexed life sales, topping the prior 4th quarter 2022 record by 5.08%. This was also a record-setting year for indexed life sales, topping the prior 2022 record by 3.69%.

Total 4Q2023 indexed life sales were $799,163,850.

THE TOP FIVE INDEXED LIFE CARRIERS:

- National Life Group

- Transamerica

- Pacific Life Companies

- Nationwide

- Lincoln National Life

AVERAGE TARGET PREMIUM:

The average target premium was $11,974, an increase of nearly 3% from the prior quarter.

Primary Pricing objective:

76.0% of sales were through products with a primary pricing objective of Cash Accumulation.

LEADERS BY CHANNEL:

Bank- Pacific Life Companies

Career- National Life Group

Direct Response- Corebridge Financial

Independent Agent- National Life Group

Independent Broker Dealer- Protective Life

National Broker Dealer- Nationwide

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Transamerica Life’s Transamerica Financial Foundation IUL

Bank- National Western Life’s Lifetime Returns Select

Career- Life Insurance Co. of the SW SummitLife

Direct Response- American General Life QoL Value+ Protector III

Independent Agent- Transamerica Life’s Transamerica Financial Foundation IUL

Independent Broker Dealer- Protective Life’s Protective Indexed Choice UL

National Broker Dealer- Nationwide’s Nationwide IUL Accumulator II 2020

Universal Life

Sales for the fourth quarter of 2023 were $95 million, compared with sales of $107 million for the fourth quarter of 2022. Fourth quarter universal life sales were up more than 10% when compared with the previous quarter and down nearly 11% as compared to the same period last year.

Total 4Q2023 universal life sales were $95,673,448.

AVERAGE TARGET PREMIUM:

The average target premium paid was $5,736 an increase of more than 4% from the prior quarter.

Primary Pricing Objective:

50.1% of sales were through products with a primary pricing objective of No Lapse Guarantee.

Whole Life

Sales for the fourth quarter of 2023 were $1,162 million, compared with sales of $1,241 million for the fourth quarter of 2022. Fourth quarter whole life sales were up more than 14% when compared with the previous quarter, and down more than 6% as compared to the same period last year.

Total 4Q2023 whole life sales were $1,162,355,226.

AVERAGE Annual Premium:

The average annual whole life premium per policy reported was $4,051, a decline of more than 5% from the prior quarter.

primary pricing objective:

54.5% percent of sales were through products with a primary pricing objective of Final Expense.