FOURTH QUARTER 2022 ANNUITY SALES

March 21, 2023 by Sheryl J. Moore

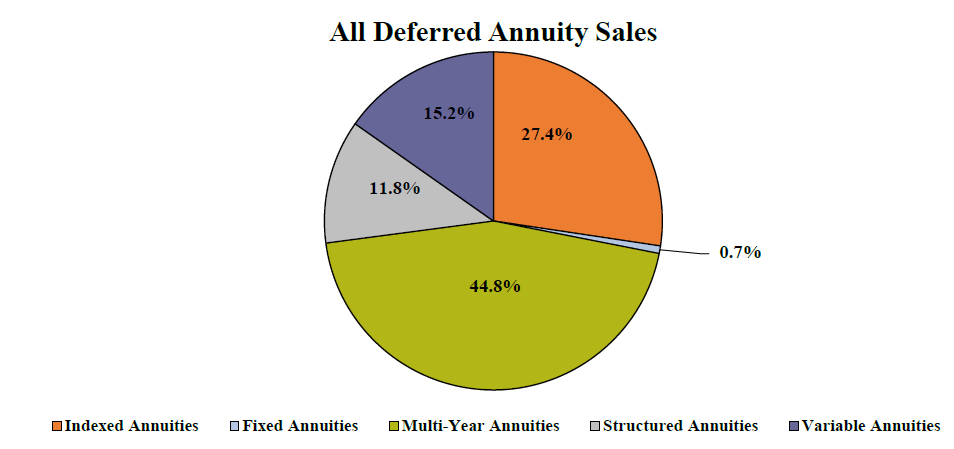

Deferred Annuity Sales

Total 4Q2022 deferred annuity sales were $79,309 million, compared with sales of $60,924 million for the fourth quarter of 2021. Fourth quarter deferred annuity sales were up more than 9% when compared to the previous quarter and up more than 30% when compared to the same period last year.

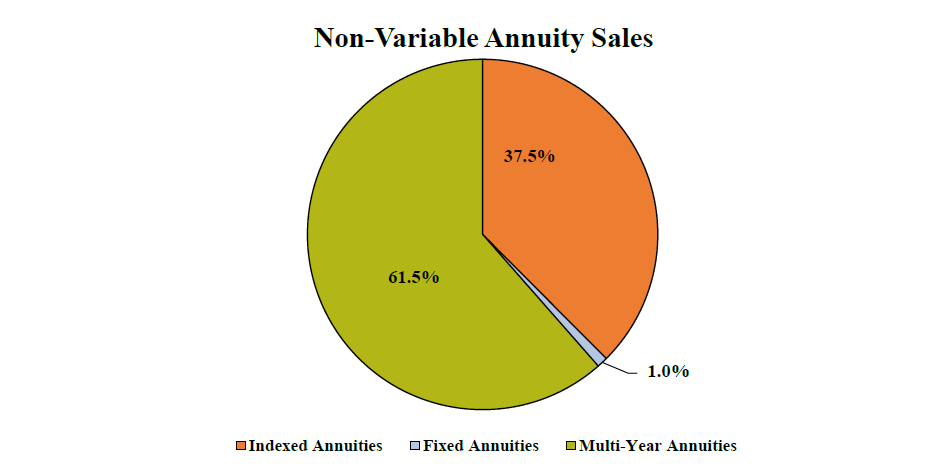

Non-Variable Deferred Annuity Sales

Total 4Q2022 non-variable deferred annuity sales were $57,825 million, compared with sales of $28,646 million for the fourth quarter of 2021. Fourth quarter non-variable deferred annuity sales were up more than 18% when compared to the previous quarter, and up nearly 102% when compared to the same period last year. Non-variable deferred annuities include sales of fixed, indexed, and multi-year guaranteed deferred annuities.

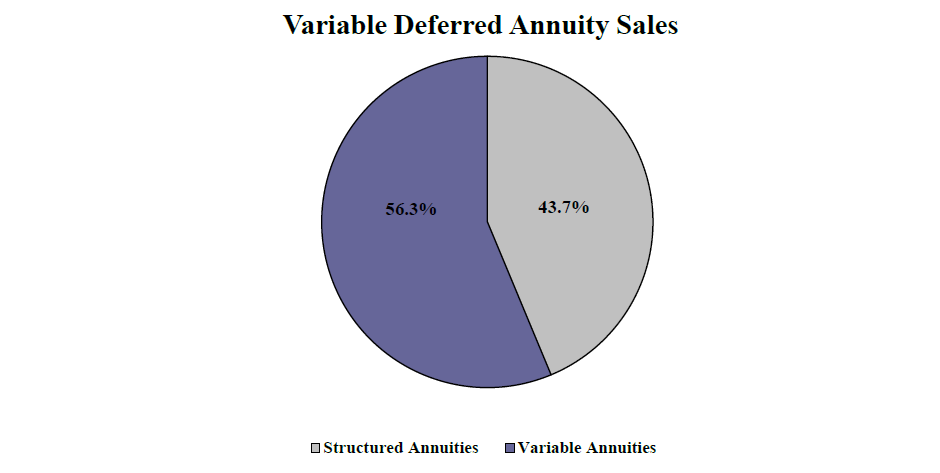

Variable Deferred Annuity Sales

Total 4Q2022 variable deferred annuity sales were $21,484 million, compared with sales of $32,278 million for the fourth quarter of 2021. Fourth quarter variable deferred annuity sales were down nearly 9% when compared to the previous quarter, and down more than 33% when compared to the same period last year. Variable deferred annuities include sales of structured and variable deferred annuities.

Indexed Annuity

Sales for the fourth quarter of 2022 were $21,703 million, compared with sales of $16,940 million for the fourth quarter of 2021. Fourth quarter indexed annuity sales were up more than 3% when compared to the previous quarter, and up more than 28% when compared to the same period last year. This was a record-setting quarter for indexed annuity sales, topping the prior 3rd quarter 2022 record by 3.47%. This was also a record-setting year for indexed annuity sales, topping the prior 2019 record by 7.74%.

Total 4Q2022 indexed annuity sales were $21,703,982,204.

Total 2022 indexed annuity sales were $78,965,122,275.

THE TOP TEN INDEXED ANNUITY CARRIERS FOR THE FOURTH QUARTER OF 2022:

- Athene USA

- Allianz Life

- Corebridge Financial

- Sammons Financial Companies

- Nationwide

- Fidelity & Guaranty Life

- Security Benefit Life

- Lincoln National Life

- Massachusetts Mutual Life Companies

- Global Atlantic Financial Group

AVERAGE COMMISSION:

The indexed annuity commission received by the agent averaged 6.38% of premium for the fourth quarter of 2022; a trend that is up 0.03% from the prior quarter.

LEADERS BY CHANNEL:

Bank- Corebridge Financial

Career- CNO Companies

Direct Response- Prudential

Full Service National Broker Dealer- Corebridge Financial

Independent Agent- Athene USA

Independent Broker Dealer- Corebridge Financial

Registered Investment Advisor- Massachusetts Mutual Life Companies

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Allianz Life Allianz Benefit Control Annuity

Bank- American General Power Index 5 Plus Annuity

Career- Bankers L&C Premium Bonus IA

Direct Response- Pruco Life PruSecure 5-Year

Full Service National Broker Dealer- Forethought Life ForeAccumulation II FIA 5-Year

Independent Agent- Allianz Life Allianz Benefit Control Annuity

Independent Broker Dealer- Allianz Life Allianz Benefit Control Annuity

Registered Investment Advisor- MassMutual Ascend Index Protector 5 MVA

Fee-Based Overall- American General Power Index Advisory IA

Fixed Annuity

Sales for the fourth quarter of 2022 were $575 million, compared to sales of $486 million for the fourth quarter of 2021. Fourth quarter fixed annuity sales were up more than 27% when compared to the previous quarter, and up more than 18% when compared with the same period last year.

Total 4Q2022 fixed annuity sales were $575,389,788.

Total 2022 fixed annuity sales were $1,975,183,516.

THE TOP TEN FIXED ANNUITY CARRIERS FOR THE FOURTH QUARTER OF 2022:

- Modern Woodman of America

- National Life Group

- EquiTrust

- Global Atlantic Financial Group

- Western-Southern Life Assurance Company

- Nationwide

- CNO Companies

- American National

- Reliance Standard

- Brighthouse Financial

AVERAGE COMMISSION:

The fixed annuity commission received by the agent averaged 5.73% of premium for the fourth quarter of 2022; a trend that is flat when compared to last quarter.

LEADERS BY CHANNEL:

Bank- Global Atlantic Financial Group

Career- Modern Woodmen of America

Direct Response- Corebridge Financial

National Broker Dealer- Western-Southern Life Assurance Company

Independent Agent- National Life Group

Independent Broker Dealer- Brighthouse Financial

Registered Investment Advisor- N/A

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Forethought Life ForeCare Fixed Annuity

Bank- Forethought Life ForeCare Fixed Annuity

Career- United of Omaha Bonus Flexible Annuity

Direct Response- N/A

Full Service National Broker Dealer- Western-Southern Life Senior Select 1-Year

Independent Agent- EquiTrust ChoiceFour with Liquidity Rider

Independent Broker Dealer- Forethought Life ForeCare Fixed Annuity

Registered Investment Advisor- N/A

Multi-Year Guaranteed Annuity

Sales for the fourth quarter of 2022 were $35,546 million, compared with sales of $11,218 million for the fourth quarter of 2021. Fourth quarter MYGA sales were up nearly 30% when compared to the previous quarter, and up nearly 217% when compared to the same period last year. This quarter and this year are the greatest MYGA sales have been since Wink began tracking sales of the products in 2015.

Total 4Q2022 MYGA sales were $35,546,244,408.

Total 2022 MYGA sales were $103,736,933,038.

THE TOP TEN MYGA CARRIERS FOR THE FOURTH QUARTER OF 2022:

- Massachusetts Mutual Life Companies

- Athene USA

- New York Life

- Corebridge Financial

- Brighthouse Financial

- Global Atlantic Financial Group

- Sammons Financial Group

- Pacific Life Companies

- Nationwide

- Fidelity & Guaranty Life

AVERAGE COMMISSION:

The multi-year guaranteed annuity commission received by the agent averaged 1.73% of premium for the fourth quarter of 2022; a decline of 0.46% from last quarter.

LEADERS BY CHANNEL:

Bank- Athene USA

Career- New York Life

Direct Response- Puritan Life

Independent Agent- Oceanview Life

Full Service National Broker Dealer- Massachusetts Mutual Life Companies

Independent Broker Dealer- Nationwide

Registered Investment Advisor- Sammons Financial Companies

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Massachusetts Mutual Life Stable Voyage 3-Year

Bank- Athene Annuity Athene MYG 5

Career- Massachusetts Mutual Life Stable Voyage 3-Year

Direct Response- Puritan Life Canvas 3-Year

Full Service National Broker Dealer- Massachusetts Mutual Life Stable Voyage 3-Year

Independent Agent- Athene Annuity Athene MaxRate 5

Independent Broker Dealer- Nationwide Life Nationwide Secure Growth 5 5-Year

Registered Investment Advisor- Midland National Life Oak ADVantage 3-Year

Fee-Based Overall- Midland National Life Oak ADVantage 3-Year

Structured Annuity

Sales for the fourth quarter of 2022 were $9,392 million compared with sales of $10,115 million for the fourth quarter of 2021. Fourth quarter structured annuity sales were down nearly 8% when compared to the previous quarter, and down more than 7% when compared to the same period last year.

Total 4Q2022 structured annuity sales were $9,392,837,002.

Total 2022 structured annuity sales were $39,589,795,786.

THE TOP TEN STRUCTURED ANNUITY CARRIERS FOR THE FOURTH QUARTER OF 2022:

- Equitable Financial

- Brighthouse Financial

- Allianz Life

- Lincoln National Life

- Prudential

- RiverSource Life

- Jackson National Life

- CUNA Mutual Life

- Athene USA

- Nationwide

LEADERS BY CHANNEL:

Bank- Equitable Financial

Career- RiverSource Life

Direct Response- N/A

Full Service National Broker Dealer- Allianz Life

Independent Broker Dealer- Allianz

Registered Investment Advisor- Lincoln National Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Equitable Financial Structured Capital Strategies Plus 21

Bank- Equitable Financial Structured Capital Strategies Plus 21

Career- RiverSource Life Structured Solutions 6-Year

Direct Response- N/A

Full Service National Broker Dealer- Allianz Life Allianz Index Advantage

Independent Broker Dealer- Lincoln National Life Lincoln Level Advantage B Share

Registered Investment Advisor- Lincoln National Life Lincoln Level Advantage Advisory

Fee-Based Overall- Lincoln National Life Lincoln Level Advantage Advisory

Variable Annuity

Sales for the fourth quarter of 2022 were $12,091 million, compared with sales of $22,163 million for the fourth quarter of 2021. Fourth quarter variable annuity sales were down nearly 10% when compared to the previous quarter, and down more than 45% when compared to the same period last year.

Total 4Q2022 variable annuity sales were $12,091,397,760.

Total 2022 variable annuity sales were $59,939,825,568.

THE TOP TEN Variable CARRIERS FOR THE FOURTH QUARTER OF 2022:

- Jackson National Life

- Equitable Financial

- New York Life

- Nationwide

- Lincoln National Life

- Corebridge Financial

- Pacific Life Companies

- Thrivent Financial

- Fidelity Investments

- RiverSource Life

LEADERS BY CHANNEL:

Bank- Jackson National Life

Career- Equitable Financial

Direct Response- Fidelity Investments

Full Service National Broker Dealer- Jackson National Life

Independent Broker Dealer- Jackson National Life

Registered Investment Advisor- Transamerica

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Bank- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Career- Equitable Financial Equi-Vest

Direct Response- Fidelity Fidelity Personal Retirement Annuity

Full Service National Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Independent Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Registered Investment Advisor- Pacific Life Pacific Advisory Variable Annuity

Fee-Based Overall- Jefferson National Life Monument Advisor

Wink anticipates compiling first quarter, 2023’s sales with a release date of May 2023.