TIAA Traditional Increases Income Payments by 3% for 2023

December 20, 2022 by TIAA

A Fixed Annuity with a Long History of Paying Increases

NEW YORK, Dec. 19, 2022 /PRNewswire/ — Beginning in January 2023, income payments to TIAA Traditionali annuitants, will increase by 3%. The TIAA Traditional fixed annuity has paid more than the guaranteed minimum income payment every year since 1949. In the past 25 years, TIAA has given 15 pay increases.

“TIAA is a mission-based organization that is fundamentally focused on helping our participants retire securely. Our flagship product, TIAA Traditional, is unlike other fixed annuities in that it has a long history of increasing income payment amounts. TIAA seeks to share profitsii with TIAA Traditional participants through competitive returnsiii while they’re saving and additional income in retirement through higher initial payout rates for long-term contributors and annual increases in income paymentsiv,” said Christine Dugan, Product General Manager, Institutional Lifetime Income at TIAA. “As more and more Americans have faced an ever-growing retirement crisis, TIAA Traditional has helped millions of its participants build and prepare a solid retirement foundation.” v

TIAA Traditional offers clients the security to know their retirement savings are protected and guaranteed to increase every single day during accumulation—even in the most volatile markets.

At retirement, clients have the opportunity, but not the obligation, to turn savings into guaranteed income that lasts for lifevi to help cover everyday living expenses. And those who consistently contributed to TIAA Traditional throughout their careers saw 22% higher lifetime income payments on average (versus those who transferred in equal savings amounts shortly before selecting lifetime income.)vii,viii

TIAA Traditional plays a vital role in a diversified income strategy that includes Social Security and income from variable investments and offers the peace of mind that comes with guaranteed income.

TIAA is able to provide these strong rates due, in part, to TIAA’s company structure that seeks to share profitsix, with participants. TIAA is one of only three insurance groups in the U.S. to currently hold the highest possible ratings from three of the four leading independent ratings agencies, for its stability, claims-paying ability and overall financial strength.x

In addition, its disciplined risk-management process is designed with a long-term investing approach to ensure that the TIAA General Account can provide the stability and liquidity needed to support the product’s guarantees through periods of market stress.

TIAA is a leading provider of secure retirements and outcome-focused investment solutions to millions of people and thousands of institutions. It is the #1 not-for-profit retirement market providerxi, paid more than $6.4 billion in lifetime income to retired clients in 2021 and has $1.2 trillion in assets under management (as of 9/30/2022)xii.

Learn more about TIAA

Read the latest TIAA news

i As of July 21, 2022. Based on data in PLANSPONSOR’s 403(b) 2022 DC Recordkeeping Survey, combined 457 and 403(b) data.

ii TIAA may share profits with TIAA Traditional Annuity owners through declared additional amounts of interest during accumulation, higher initial annuity income, and through further increases in annuity income benefits during retirement. These additional amounts are not guaranteed beyond the period for which they were declared.

iii Any guarantees under annuities issued by TIAA are subject to TIAA’s claims-paying ability. TIAA Traditional is a guaranteed insurance contract and not an investment for federal securities law purposes.

iv Past performance is no guarantee of future results.

v TIAA Traditional Annuity income benefits include guaranteed amounts plus additional amounts as may be established on a year-by-year basis by the TIAA Board of Trustees. The additional amounts, when declared, remain in effect through the “declaration year”, which begins each January 1 for payout annuities. Additional amounts are not guaranteed beyond the period for which they are declared.

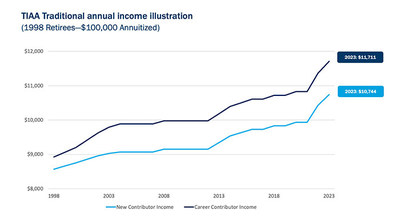

This TIAA Traditional Lifetime Income chart reflects two hypothetical participants with equivalent ending account balances of approximately $100,000 that retire at age 65 and select the same single life annuity using TIAA’s Standard payout annuity where payments begin on 1/1/98. One participant accumulated within TIAA Traditional Retirement Annuity contract making level monthly contributions of about $65 per month over a 30-year career. The other transferred the same amount into TIAA Traditional on 12/31/97. The career contributor received more initial lifetime income, in part, because of TIAA’s return of excess profits that have built up on older contributions. The chart also reflects any post-retirement increases in lifetime income, also as a result returning these excess profits. Interest or income in excess of the guaranteed amount is not guaranteed for periods other than the period for which it is declared. Past performance is no guarantee of future results.

vi Converting some or all of your savings to income benefits (referred to as “annuitization”) is a permanent decision. Once income benefit payments have begun, you are unable to change to another option.

viiTIAA may provide a loyalty bonus that is only available when electing lifetime income. The amount of the bonus is discretionary and determined annually.

viii Based on a study that compared the initial lifetime income amount two hypothetical participants would have received for income starting in each of the 301 months from January 1, 1997, through January 1, 2022. Two 67-year-old participants each elected a single-life annuity with a 10-year guarantee period. The career contributor made level monthly contributions to TIAA Traditional under the Retirement Annuity Contract over 30 years prior to their retirement date. The new contributor transferred the same accumulation as the career contributor to TIAA Traditional shortly before selecting lifetime income. Over the study period, the career contributor’s initial lifetime income exceeded the new contributor’s in 291 of the 301 months, with an average lifetime income advantage of 15.1%. The career contributor’s initial lifetime income exceeded the new contributor’s in all 120 months of the final 10 years, with an average lifetime income advantage of 22.4%. Past performance is no guarantee of future results.

ix As of July 21, 2022. Based on data in PLANSPONSOR’s 403(b) 2022 DC Recordkeeping Survey, combined 457 and 403(b) data.

x For its stability, claims-paying ability and overall financial strength, Teachers Insurance and Annuity Association of America (TIAA) is a member of one of only three insurance groups in the United States to currently hold the highest rating available to U.S. insurers from three of the four leading insurance company rating agencies: A.M. Best (A++ as of 7/22), Fitch (AAA as of 10/22) and Standard & Poor’s (AA+ as of 9/22), and the second highest possible rating from Moody’s Investors Service (Aa1 as of 6/22). There is no guarantee that current ratings will be maintained. The financial strength ratings represent a company’s ability to meet policyholders’ obligations and do not apply to variable annuities or any other product or service not fully backed by TIAA’s claims-paying ability. The ratings also do not apply to the safety or the performance of the variable accounts, which will fluctuate in value.

xi As of July 21, 2022. Based on data in PLANSPONSOR’s 403(b) 2022 DC Recordkeeping Survey, combined 457 and 403(b) data.

xii As of September 30, 2022, assets under management across Nuveen Investments affiliates and TIAA investment management teams are $1,179 billion.

This material is for informational or educational purposes only and does not constitute fiduciary investment advice under ERISA, a securities recommendation under all securities laws, or an insurance product recommendation under state insurance laws or regulations. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on the investor’s own objectives and circumstances.

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Annuity contracts may contain terms for keeping them in force. For full details, including costs, call us at (800) 842-2252.

TIAA Traditional is a fixed annuity product issued through these contracts by Teachers Insurance and Annuity Association of America (TIAA), 730 Third Avenue, New York, NY, 10017: Form series including but not limited to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8. Not all contracts are available in all states or currently issued.

2611838

SOURCE TIAA