FIRST QUARTER 2022 ANNUITY SALES

May 31, 2022 by Sheryl J. Moore

Deferred Annuity Sales

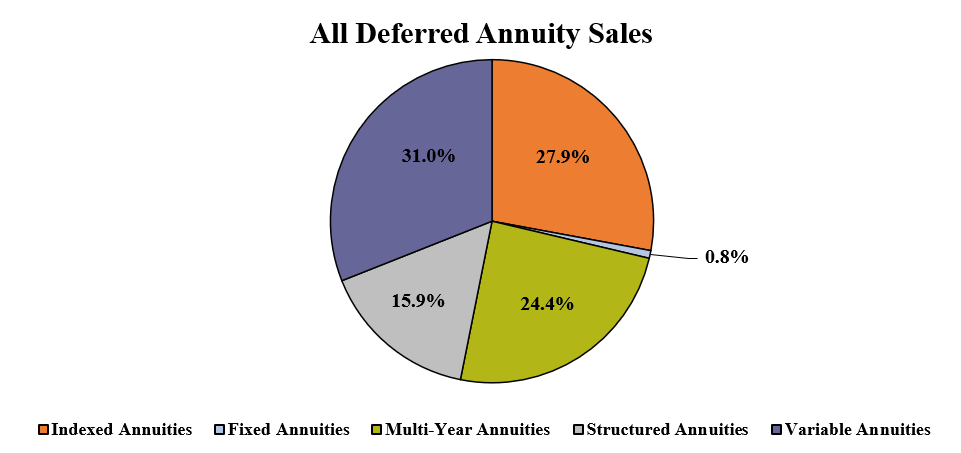

Total 1Q2022 deferred annuity sales were $59,716 million, compared with sales of $58,395 million for the first quarter of 2021. First quarter deferred annuity sales were down nearly 2% when compared to the previous quarter and up more than 2% when compared to the same period last year. Deferred annuities include sales of fixed, indexed, multi-year guaranteed, structured and variable deferred annuities.

Non-Variable Deferred Annuity Sales

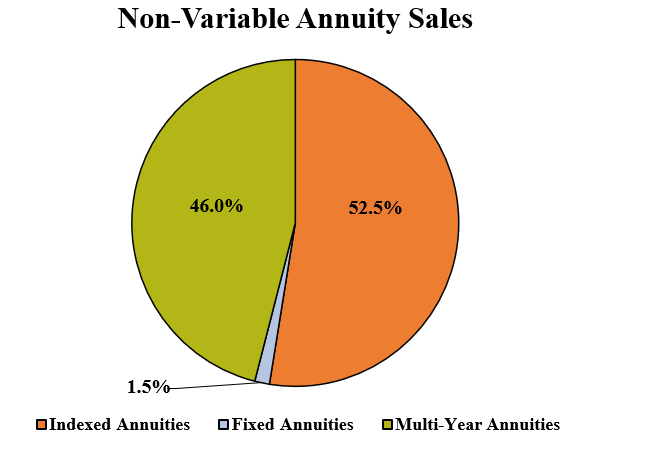

Total 1Q2022 non-variable deferred annuity sales were $31,730 million, compared with sales of $28,321 million for the first quarter of 2021. First quarter non-variable deferred annuity sales were up nearly 11% when compared to the previous quarter, and up more than 12% when compared to the same period last year. Non-variable deferred annuities include sales of fixed, indexed, and multi-year guaranteed deferred annuities.

Variable Deferred Annuity Sales

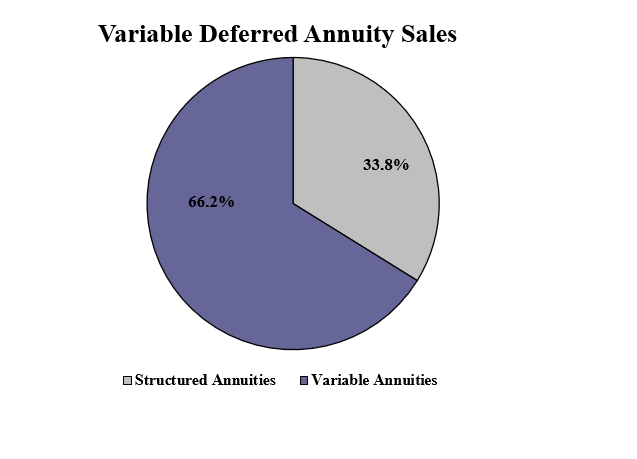

Total 1Q2022 variable deferred annuity sales were $27,985 million, compared with sales of $30,073 million for the first quarter of 2021. First quarter variable deferred annuity sales were down more than 13% when compared to the previous quarter, and down nearly 7% when compared to the same period last year. Variable deferred annuities include sales of structured and variable deferred annuities.

Indexed Annuity

Sales for the first quarter of 2022 were $16,669 million, compared with sales of $14,557 million for the first quarter of 2021. First quarter indexed annuity sales were down nearly 2% when compared to the previous quarter, and up nearly 15% when compared to the same period last year.

Total 1Q2022 indexed annuity sales were $16,669,487,629.

THE TOP TEN INDEXED ANNUITY CARRIERS FOR THE FIRST QUARTER OF 2022:

- Athene USA

- Allianz Life

- AIG

- Sammons Financial Companies

- Fidelity & Guaranty Life

- Massachusetts Mutual Life Companies

- American Equity Companies

- Global Atlantic Financial Group

- SILAC Insurance Company

- Nationwide

AVERAGE COMMISSION:

The indexed annuity commission received by the agent averaged 6.35% of premium for the first quarter of 2022; a trend that is down 0.03% from the prior quarter.

LEADERS BY CHANNEL:

Bank- AIG

Career- CNO Companies

Direct Response- N/A

Independent Agent- Athene USA

Independent Broker Dealer- Allianz Life

National Broker Dealer- AIG

Registered Investment Advisor- Massachusetts Mutual Life Companies

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Allianz Life Allianz Benefit Control Annuity

Bank- American General Power Index 5 Plus Annuity

Career- C.M. Life Index Horizons

Direct Response- N/A

Fee-Based Overall- Great American Index Protector 5 MVA

Independent Agent- Allianz Life Allianz Benefit Control Annuity

Independent Broker Dealer- Allianz Life Allianz Benefit Control Annuity

National Broker Dealer- American General Power Index 5 Plus Annuity

Registered Investment Advisor- Great American Index Protector 5 MVA

Fixed Annuity

Sales for the first quarter of 2022 were $463 million, compared to sales of $477 million for the first quarter of 2021. First quarter fixed annuity sales were down nearly 5% when compared to the previous quarter, and down nearly 3% when compared with the same period last year.

Total 1Q2022 fixed annuity sales were $463,532,214.

THE TOP TEN FIXED ANNUITY CARRIERS FOR THE FIRST QUARTER OF 2022:

- Modern Woodmen of America

- Global Atlantic Financial Group

- Jackson National Life

- American National

- EquiTrust

- Brighthouse Financial

- Massachusetts Mutual Life Companies

- OneAmerica

- AIG

- National Life Group

AVERAGE COMMISSION:

The fixed annuity commission received by the agent averaged 5.75% of premium for the first quarter of 2022; a trend that is down 0.16% when compared to last quarter.

LEADERS BY CHANNEL:

Bank- Global Atlantic Financial Group

Career- Modern Woodmen of America

Direct Response- AIG

Independent Agent- Global Atlantic Financial Group

Independent Broker Dealer- Brighthouse Financial

National Broker Dealer- Global Atlantic Financial Group

Registered Investment Advisor- N/A

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Forethought Life ForeCare Fixed Annuity

Bank Forethought Life ForeCare Fixed Annuity

Career- Farm Bureau Life Select IV Portfolio 6

Direct Response- N/A

Fee-Based Overall- N/A

Independent Agent- Forethought Life ForeCare Fixed Annuity

Independent Broker Dealer- Forethought Life ForeCare Fixed Annuity

National Broker Dealer- Forethought Life ForeCare Fixed Annuity

Multi-Year Guaranteed Annuity

Sales for the first quarter of 2022 were $14,597 million, compared with sales of $13,286 million for the first quarter of 2021. First quarter MYGA sales were up more than 30% when compared to the previous quarter, and up nearly 10% when compared to the same period last year.

Total 1Q2022 MYGA sales were $14,597,390,064.

THE TOP TEN MYGA CARRIERS FOR THE First QUARTER OF 2022:

- New York Life

- Massachusetts Mutual Life Companies

- AIG

- Western-Southern Life Assurance Group

- Global Atlantic Financial Group

- Symetra Financial

- Oceanview Life and Annuity Group

- Fidelity & Guaranty Life

- Athene USA

- Prosperity Life Insurance Group

AVERAGE COMMISSION:

The multi-year guaranteed annuity commission received by the agent averaged 1.79% of premium for the first quarter of 2022; an increase of 0.15% from last quarter.

LEADERS BY CHANNEL:

Bank- AIG

Career- New York Life

Direct Response- Puritan Life

Independent Agent- Sagicor Life

Independent Broker Dealer- Global Atlantic Financial Group

National Broker Dealer- New York Life

Registered Investment Advisor- Massachusetts Mutual Life Companies

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Western-Southern Life SmartSelect 3-Year

Bank- Forethought Life SecureFore 3 Fixed Annuity

Career- Massachusetts Mutual Life Stable Voyage 5-Year

Direct Response- Puritan Life Canvas 3-Year

Fee-Based Overall- Great American Advantage 5 Advisory

Independent Agent- Sagicor Life Milestone MYGA 5-Year

Independent Broker Dealer- Forethought Life SecureFore 3 Fixed Annuity

National Broker Dealer- Western-Southern Life SmartSelect 3-Year

Registered Investment Advisor- Great American Advantage 5 Advisory

Structured Annuity

Sales for the first quarter of 2022 were $9,470 million compared with sales of $9,052 million for the first quarter of 2021. First quarter structured sales were down more than 6% when compared to the previous quarter, and up nearly 5% when compared to the same period last year.

Total 1Q2022 structured annuity sales were $9,470,575,878.

THE TOP TEN STRUCTURED ANNUITY CARRIERS FOR THE FIRST QUARTER OF 2022:

- Equitable Financial

- Allianz Life

- Prudential

- Brighthouse Financial

- Lincoln National Life

- RiverSource Life

- CUNA Mutual Life

- Massachusetts Mutual Life Companies

- Athene USA

- Jackson National Life

LEADERS BY CHANNEL:

Bank- Equitable Financial

Career- RiverSource Life

Direct Response- N/A

Independent Broker Dealer- Allianz Life

National Broker Dealer- Allianz Life

Registered Investment Advisor- Lincoln National Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Pruco Life Prudential FlexGuard Indexed VA

Bank- Equitable Financial Structured Capital Strategies Plus

Career- RiverSource Life Structured Solutions 6-Year

Direct Response- N/A

Fee-Based Overall- Lincoln National Life Lincoln Level Advantage Advisory

Independent Broker Dealer- Lincoln National Life Lincoln Level Advantage B Share

National Broker Dealer- Allianz Life Allianz Index Advantage

Variable Annuity

Sales for the first quarter of 2022 were $18,515 million, compared with sales of $21,021 million for the first quarter of 2021. First quarter variable annuity sales were down more than 16% when compared to the previous quarter, and down nearly 12% when compared to the same period last year.

Total 1Q2022 variable annuity sales were $18,515,356,378.

THE TOP TEN Variable CARRIERS FOR FIRST QUARTER OF 2022:

- Jackson National Life

- Equitable Financial

- Lincoln National Life

- Nationwide

- New York Life

- Pacific Life Companies

- AIG

- Thrivent Financial

- Brighthouse Financial

- Fidelity Investments

LEADERS BY CHANNEL:

Bank- Jackson National Life

Career- Equitable Financial

Direct Response- Fidelity Investments

Independent Broker Dealer- Jackson National Life

National Broker Dealer- Jackson National Life

Registered Investment Advisor- Nationwide

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Bank- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Career- Equitable Financial Equi-Vest

Direct Response- Fidelity Fidelity Personal Retirement Annuity

Fee-Based Overall- Fidelity Fidelity Personal Retirement Annuity

Independent Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

National Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Registered Investment Advisor- Jefferson National Life Monument Advisor

Wink anticipates compiling second quarter, 2022’s sales with a release date of August 2022