FOURTH QUARTER 2021 ANNUITY SALES

March 22, 2022 by Sheryl J. Moore

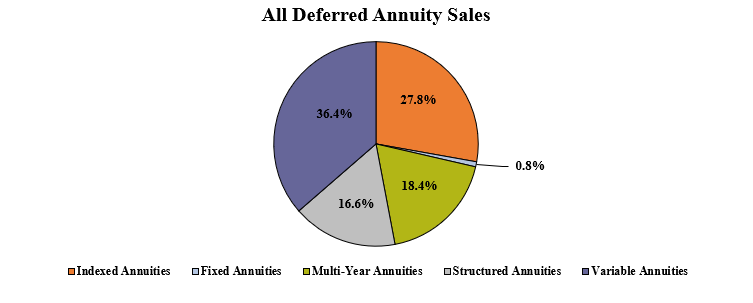

Deferred Annuity Sales

Total 4Q2021 deferred annuity sales are $60,924 million, compared with sales of $56,314 million for the fourth quarter of 2020. Fourth quarter deferred annuity sales were up nearly 2% when compared to the previous quarter and up more than 8% when compared to the same period last year. Deferred annuities include sales of fixed, indexed, multi-year guaranteed, structured and variable deferred annuities.

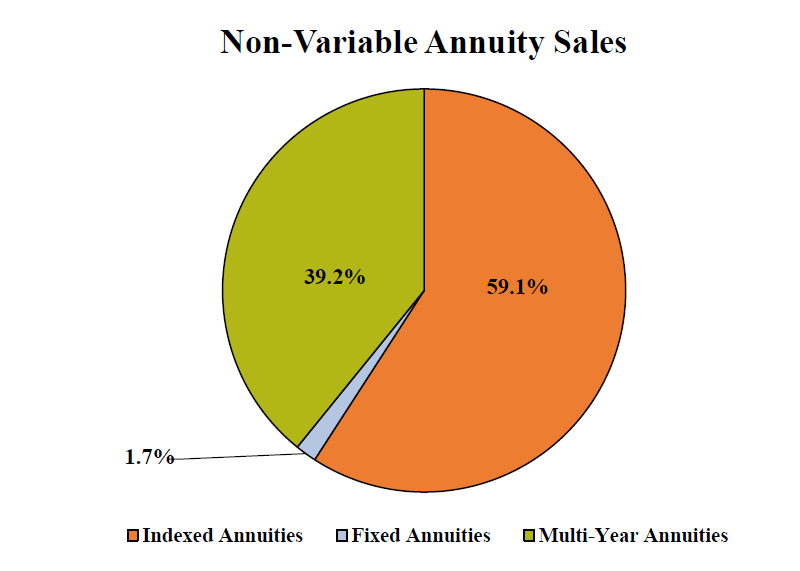

Non-Variable Deferred Annuity Sales

Total 4Q2021 non-variable deferred annuity sales were $28,646 million, compared with sales of $28,779 million for the fourth quarter of 2020. Fourth quarter non-variable deferred annuity sales were down nearly 2% when compared to the previous quarter, and less than 1% when compared to the same period last year. Non-variable deferred annuities include sales of fixed, indexed, and multi-year guaranteed deferred annuities.

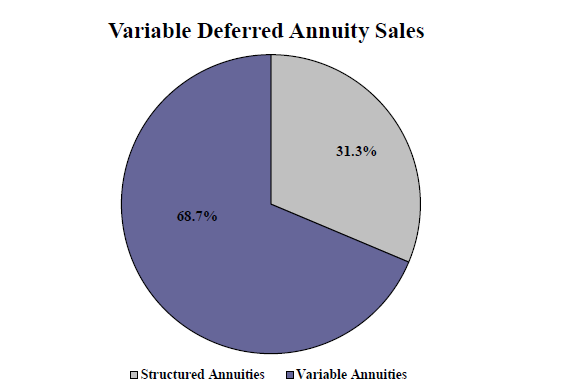

Variable Deferred Annuity Sales

Total 4Q2021 variable deferred annuity sales were $32,278 million, compared with sales of $27,534 million for the fourth quarter of 2020. Fourth quarter variable deferred annuity sales were up more than 5% when compared to the previous quarter, and up more than 17% when compared to the same period last year. Variable deferred annuities include sales of structured and variable deferred annuities.

Indexed Annuity

Sales for the fourth quarter of 2021 were $16,940 million, compared with sales of $15,085 million for the fourth quarter of 2020. Fourth quarter indexed annuity sales were down more than 2% when compared to the previous quarter, and up more than 12% when compared to the same period last year.

Total 4Q2021 indexed annuity sales were $16,940,751,258.

Total 2021 indexed annuity sales were $65,513,177,494.

THE TOP TEN INDEXED ANNUITY CARRIERS FOR THE FOURTH QUARTER OF 2021:

- Athene USA

- Allianz Life

- AIG

- Sammons Financial Companies

- Fidelity & Guaranty Life

- American Equity Companies

- Massachusetts Mutual Life Companies

- Global Atlantic Financial Group

- SILAC Insurance Company

- Security Benefit Life

AVERAGE COMMISSION:

The indexed annuity commission received by the agent averaged 6.32% of premium for the fourth quarter of 2021; a trend that is down 0.02% from prior quarter.

LEADERS BY CHANNEL:

Bank- AIG

Career- CNO Companies

Direct Response- N/A

Independent Agent- Athene USA

Independent Broker Dealer- Sammons Financial Companies

National Broker Dealer- AIG

Registered Investment Advisor- Massachusetts Mutual Life Companies

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Allianz Life Allianz Benefit Control Annuity

Bank- American General Power Index 5 Plus Annuity

Career- C.M. Life Index Horizons

Direct Response- N/A

Fee-Based Overall- American General Power Index Advisory IA

Independent Agent- Allianz Life Allianz Benefit Control Annuity

Independent Broker Dealer- Allianz Life Allianz Benefit Control Annuity

National Broker Dealer- American General Power Index 5 Plus Annuity

Registered Investment Advisor- Great American Index Protector 7

Fixed Annuity

Sales for the fourth quarter of 2021 were $486 million, compared to sales of $474 million for the fourth quarter of 2020. Fourth quarter fixed annuity sales were up nearly 35% when compared to the previous quarter, and up nearly 3% when compared with the same period last year.

Total 4Q2021 fixed annuity sales were $486,905,906.

Total 2021 fixed annuity sales were $1,786,728,226.

THE TOP TEN FIXED ANNUITY CARRIERS FOR THE FOURTH QUARTER OF 2021:

- Global Atlantic Financial Group

- Modern Woodmen of America

- American National

- Jackson National Life

- EquiTrust

- Brighthouse Financial

- Kuvare Companies

- OneAmerica

- National Life Group

- Massachusetts Mutual Life Companies

AVERAGE COMMISSION:

The fixed annuity commission received by the agent 5.91% of premium for the fourth quarter of 2021; a trend that is up 0.15% when compared to last quarter.

LEADERS BY CHANNEL:

Bank- Global Atlantic Financial Group

Career- Modern Woodmen of America

Direct Response- AIG

Independent Agent- Global Atlantic Financial Group

Independent Broker Dealer- Brighthouse Financial

National Broker Dealer- Global Atlantic Financial Group

Registered Investment Advisor- N/A

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Forethought Life ForeCare Fixed Annuity

Bank Forethought Life ForeCare Fixed Annuity

Career- Bankers Life & Casualty Bonus Annuity

Direct Response- N/A

Fee-Based Overall- N/A

Independent Agent- Forethought Life ForeCare Fixed Annuity

Independent Broker Dealer- Forethought Life ForeCare Fixed Annuity

National Broker Dealer- Forethought Life ForeCare Fixed Annuity

Multi-Year Guaranteed Annuity

Sales for the fourth quarter of 2021 were $11,218 million, compared with sales of $13,220 million for the fourth quarter of 2020. Fourth quarter MYGA sales were down nearly 3% when compared to the previous quarter, and down more than 15% when compared to the same period last year.

Total 4Q2021 MYGA sales were $11,218,529,844.

Total 2021 MYGA sales were $50,455,671,962.

THE TOP TEN MYGA CARRIERS FOR THE FOURTH QUARTER OF 2021:

- Massachusetts Mutual Life Companies

- New York Life

- AIG

- Pacific Life Companies

- Western-Southern Life Assurance Company

- Oceanview Life and Annuity Company

- Global Atlantic Financial Group

- Symetra Financial

- Athene USA

- Prosperity Life Insurance Group

AVERAGE COMMISSION:

The multi-year guaranteed annuity commission received by the agent averaged 1.64% of premium for the fourth quarter of 2021; a decline of 0.16% from last quarter.

LEADERS BY CHANNEL:

Bank- AIG

Career- New York Life

Direct Response- Puritan Life

Independent Agent- Oceanview Life and Annuity Company

Independent Broker Dealer- Sammons Financial Companies

National Broker Dealer- Massachusetts Mutual Life Companies

Registered Investment Advisor- Security Benefit Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Massachusetts Mutual Life Stable Voyage 3-Year

Bank- Reliance Standard Life Eleos-MVA

Career- Massachusetts Mutual Life Stable Voyage 5-Year

Direct Response- Puritan Life Canvas 3-Year

Fee-Based Overall- Security Benefit Life Advanced Choice Annuity 4-Year

Independent Agent- Oceanview Life Harbourview 3-Year

Independent Broker Dealer- Great American SecureGain 5

National Broker Dealer- Massachusetts Mutual Life Stable Voyage 3-Year

Registered Investment Advisor- Security Benefit Life Advanced Choice Annuity 4-Year

Structured Annuity

Sales for the fourth quarter of 2021 were $10,115 million compared with sales of $8,415 million for the fourth quarter of 2020. Fourth quarter structured sales were up nearly 11% when compared to the previous quarter, and up more than 20% when compared to the same period last year. This was a record-setting year for structured annuity sales, topping the prior 2020 record by nearly 59%.

Total 4Q2021 structured annuity sales were $10,115,367,613.

Total 2021 structured annuity sales were $38,149,408,856.

THE TOP TEN STRUCTURED ANNUITY CARRIERS FOR THE FOURTH QUARTER OF 2021:

- Allianz Life

- Equitable Financial

- Brighthouse Financial

- Prudential

- Lincoln National Life

- RiverSource Life

- CUNA Mutual Life

- Massachusetts Mutual Life Companies

- Athene USA

- Symetra Financial

LEADERS BY CHANNEL:

Bank- Equitable Financial

Career- RiverSource Life

Direct Response- N/A

Independent Broker Dealer- Allianz Life

National Broker Dealer- Allianz Life

Registered Investment Advisor- Lincoln National Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Pruco Life Prudential FlexGuard Indexed VA

Bank- Equitable Financial Structured Capital Strategies Plus

Career- RiverSource Life Structured Solutions 6-Year

Direct Response- N/A

Fee-Based Overall- Lincoln National Life Lincoln Level Advantage Advisory

Independent Broker Dealer- Allianz Life Allianz Index Advantage Income

National Broker Dealer- Allianz Life Allianz Index Advantage

Registered Investment Advisor- Lincoln National Life Lincoln Level Advantage Advisory

Variable Annuity

Sales for the fourth quarter of 2021 were $22,163 million, compared with sales of $19,119 million for the fourth quarter of 2020. Fourth quarter variable annuity sales were up nearly 3% when compared to the previous quarter, and up nearly 16% when compared to the same period last year.

Total 4Q2021 variable annuity sales were $22,163,404,639.

Total 2021 variable annuity sales were $87,797,311,100.

THE TOP TEN Variable CARRIERS FOR FOURTH QUARTER OF 2021:

- Jackson National Life

- Equitable Financial

- Nationwide

- Lincoln National Life

- Pacific Life Companies

- New York Life

- AIG

- RiverSource Life

- Thrivent Financial

- Brighthouse Financial

LEADERS BY CHANNEL:

Bank- Jackson National Life

Career- Equitable Financial

Direct Response- Fidelity Investments

Independent Broker Dealer- Jackson National Life

National Broker Dealer- Jackson National Life

Registered Investment Advisor- Nationwide

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Bank- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Career- Equitable Financial Equi-Vest

Direct Response- Fidelity Equip Personal Retirement Annuity

Fee-Based Overall- Fidelity Fidelity Personal Retirement Annuity

Independent Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

National Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Registered Investment Advisor- Jefferson National Life Monument Advisor

Wink anticipates compiling first quarter, 2022’s sales with a release date of May 2022