Wink, Inc. Releases 1st Quarter, 2021 Deferred Annuity Sales Results

June 22, 2021 by Press Release

— FOR IMMEDIATE DISTRIBUTION —

NEWS RELEASE

STRUCTURED ANNUITY SALES BEGIN TO CLOSE THE GAP ON INDEXED ANNUITIES’ SALES

Wink, Inc. Releases 1st Quarter, 2021 Deferred Annuity Sales Results

Des Moines, Iowa. June 21st, 2021– Wink’s Sales & Market Report is the insurance industry’s #1 resource for annuity sales data since 1997. Sixty-one indexed annuity providers, 46 fixed annuity providers, 66 multi-year guaranteed annuity (MYGA) providers, 14 structured annuity providers, and 43 variable annuity providers participated in the 95th edition of Wink’s Sales & Market Report for 1st Quarter, 2021.

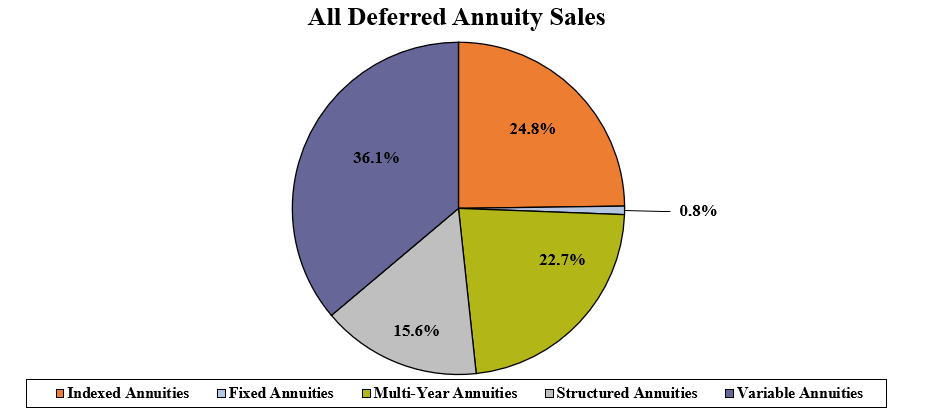

Total first quarter sales for all deferred annuities were $58.1 billion; an increase of 3.2% when compared to the previous quarter and an increase of 10.3% when compared to the same period last year. Total deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for all deferred annuity sales in the first quarter include Jackson National Life ranking as the #1 carrier overall for deferred annuity sales, with a market share of 8.1%. New York Life continued in second place, while AIG, Equitable Financial, and Lincoln National Life rounded out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the #1 selling deferred annuity, for all channels combined in overall sales for the ninth consecutive quarter.

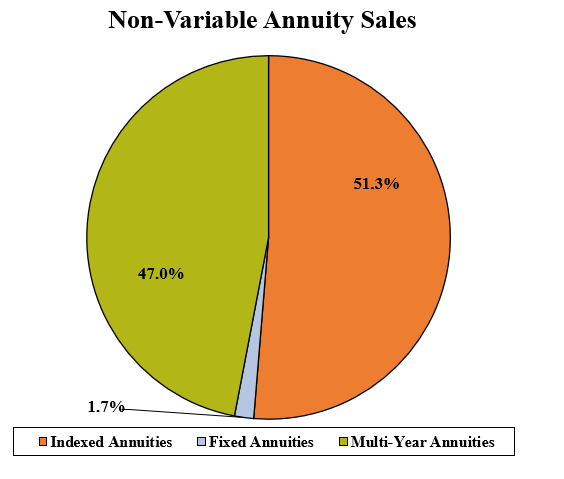

Total first quarter non-variable deferred annuity sales were $28.0 billion; down 2.8% when compared to the previous quarter and up 5.8% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the first quarter include New York Life ranking as the #1 carrier overall for non-variable deferred annuity sales, with a market share of 8.9%. American Equity Companies moved into second place, while Global Atlantic Financial Group, AIG, and Athene USA completed the top five carriers in the market, respectively. Allianz Life’s Allianz Benefit Control Annuity, an indexed annuity, was the #1 selling non-variable deferred annuity, for all channels combined in overall sales.

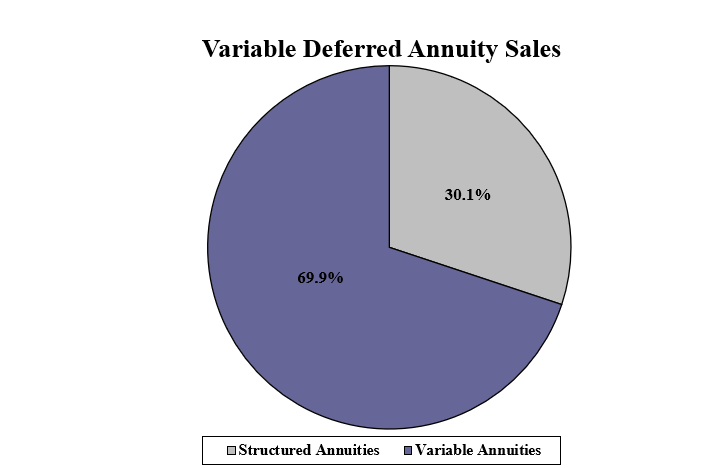

Total first quarter variable deferred annuity sales were $30.0 billion; an increase of 9.4% when compared to the previous quarter and an increase of 17.6% when compared to the same period last year. Variable deferred annuities include the structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the first quarter include Jackson National Life ranking as the #1 carrier overall for variable deferred annuity sales, with a market share of 15.5%. Equitable Financial held onto the second-place position, as Lincoln National Life, Nationwide, and Brighthouse Financial concluded the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the #1 selling variable deferred annuity, for all channels combined in overall sales for the ninth consecutive quarter.

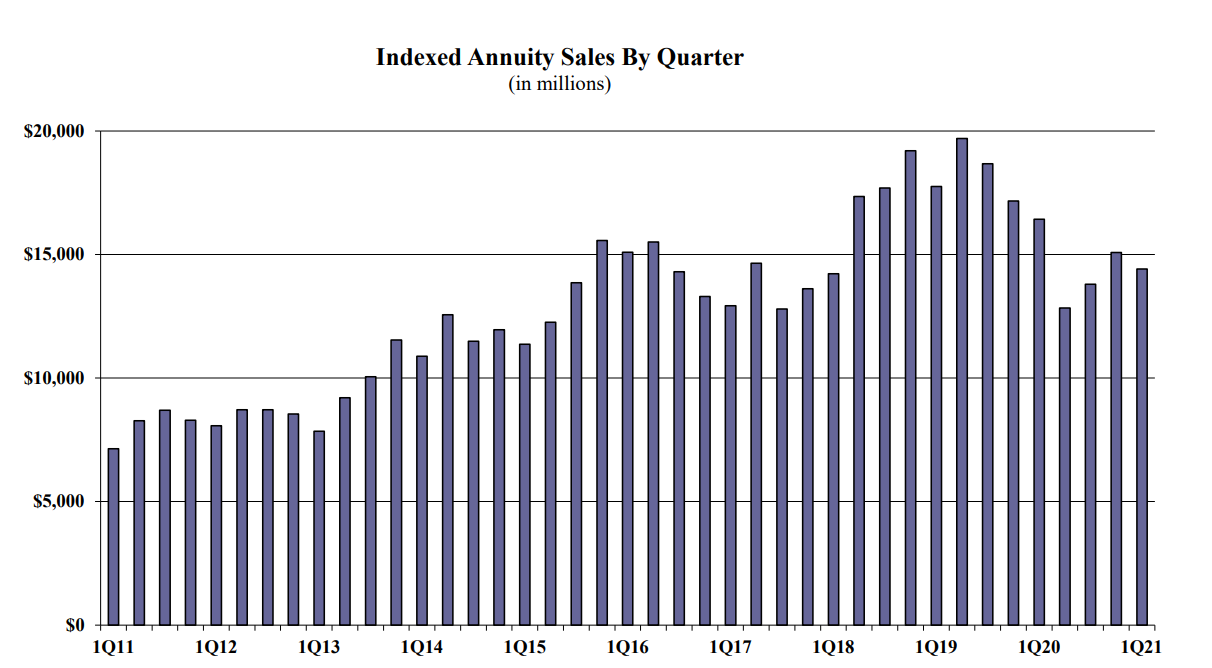

Indexed annuity sales for the first quarter were $14.4 billion; down 4.4% when compared to the previous quarter, and down 12.2% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500®.

Noteworthy highlights for indexed annuities in the first quarter include Athene USA ranking as the #1 in indexed annuities, with a market share of 11.6%. AIG retained the second-ranked position while Allianz Life, Fidelity & Guaranty Life and Sammons Financial Companies rounded out the top five carriers in the market, respectively. Allianz Life’s Allianz Benefit Control Annuity was the #1 selling indexed annuity, for all channels combined for the second consecutive quarter.

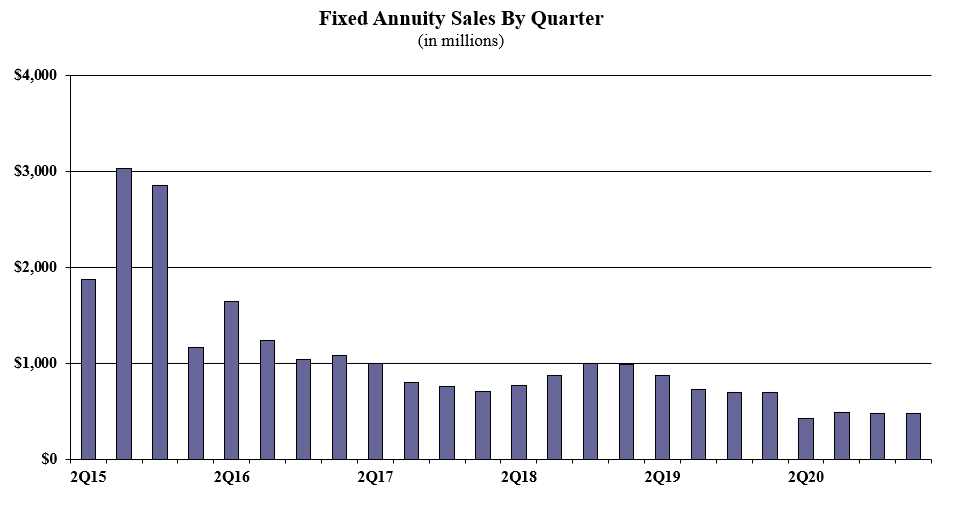

Traditional fixed annuity sales in the first quarter were $477.0 million; sales were up 0.6% when compared to the previous quarter, and down 31.0% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the first quarter include Modern Woodmen of America ranking as the #1 carrier in fixed annuities, with a market share of 21.7%. Global Atlantic Financial Group ranked second while Jackson National Life, EquiTrust, and Brighthouse Financial rounded out the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the #1 selling fixed annuity, for all channels combined for the third consecutive quarter.

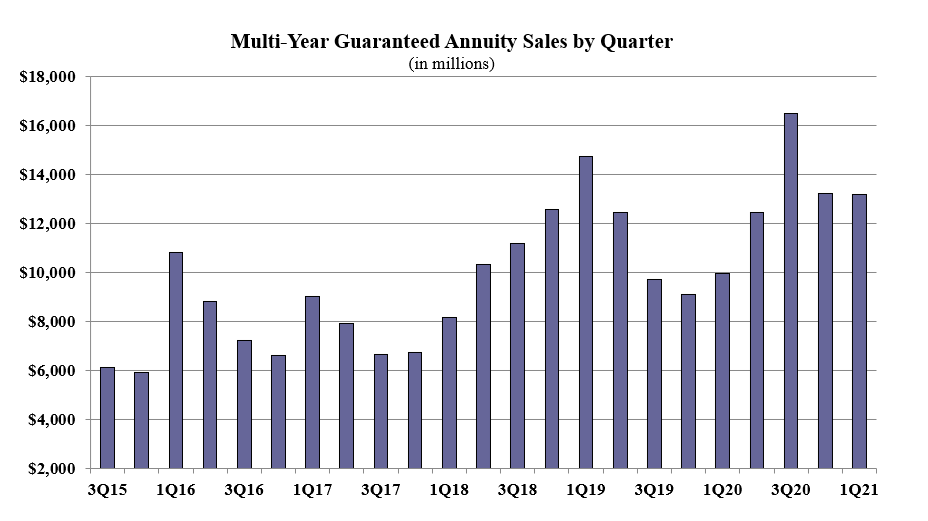

Multi-year guaranteed annuity (MYGA) sales in the first quarter were $13.2 billion; down 0.1% when compared to the previous quarter, and up 32.4% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the first quarter include New York Life ranking as the #1 carrier, with a market share of 19.0%. American Equity Companies took the second-ranked position, as Global Atlantic Financial Group, Symetra Financial, and AIG rounded out the top five carriers in the market, respectively. Eagle Life’s Eagle Guarantee Focus 3 was the #1 selling multi-year guaranteed annuity for all channels combined.

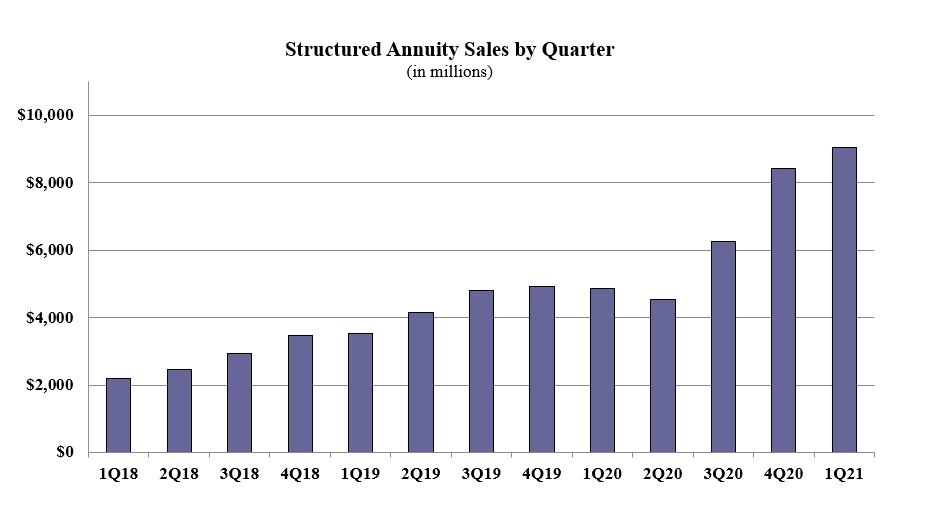

Structured annuity sales in the first quarter were $9.0 billion; up 7.5% as compared to the previous quarter, and up 85.7% as compared to the previous year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the first quarter include Equitable Financial ranking as the #1 carrier in structured annuity sales, with a market share of 19.3%. Prudential ranked second, while Allianz Life, Lincoln National Life, and Brighthouse Financial completed the top five carriers in the market, respectively. Prudential’s Prudential FlexGuard Indexed Variable Annuity was the #1 selling structured annuity for all channels combined, for the second consecutive quarter.

“Things couldn’t look brighter for the structured annuity market” observed Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. “My latest forecasts show structured annuity sales eclipsing indexed annuities’ before 2022 closes. Low fixed interest rates and market volatility have not been kind to indexed annuity sales!”

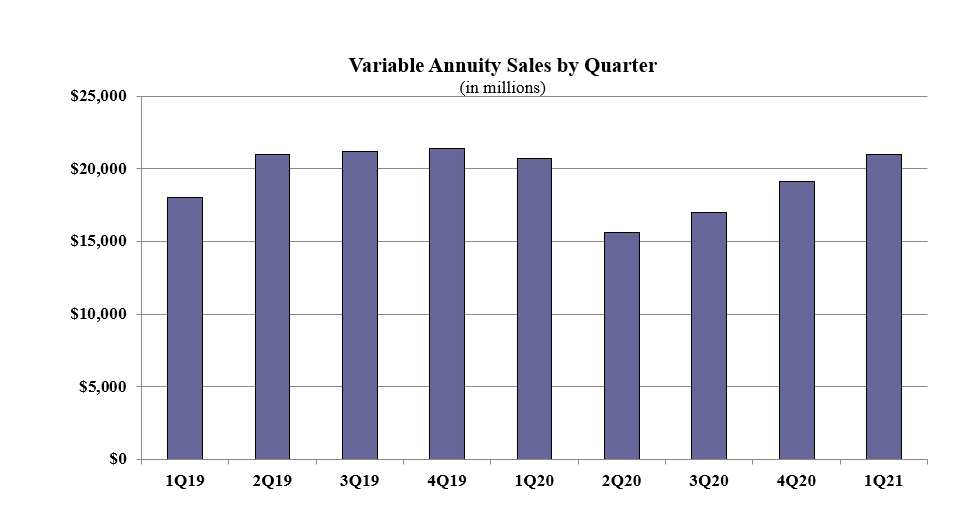

Variable annuity sales in the first quarter were $21.0 billion, an increase of 9.9% as compared to the previous quarter and an increase of 1.3% as compared to the same period last year. Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the first quarter include Jackson National Life ranking as the #1 carrier in variable annuities, with a market share of 22.2%. Nationwide ranked second, while Equitable Financial, Lincoln National Life, and Pacific Life Companies finished out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the #1 selling variable annuity for the ninth consecutive quarter, for all channels combined.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future.

****

For more information, go to www.WinkIntel.com

Wink, Inc. is the company behind the most comprehensive life insurance and annuity due-diligence tools, AnnuitySpecs and LifeSpecs at www.WinkIntel.com. Wink, Inc. is the distributor of the quarterly Wink’s Sales & Market Report. Serving as the insurance industry’s #1 resource of indexed insurance product sales since 1997, this report provides sales by product, company, crediting method, index, distribution, surrender charge period, and more. Wink’s Sales & Market Report expanded to cover all deferred annuity products in 2015, all deferred variable annuity products in 2019 and all non-variable cash value life insurance products in 2017.

The staff of Wink, Inc. has a combined experience of more than 175 years working with insurance products, more than a decade of which is specific to competitive intelligence. Based in Des Moines, Iowa, the firm offers competitive intelligence and market research in the life insurance and annuity industries; serving financial services professionals, distributors, manufacturers, regulators, and consultants on both a domestic and global basis.

Sheryl J. Moore, CEO is the guiding force behind Wink, Inc. Ms. Moore previously worked as a market research analyst for top carriers in the life insurance and annuity industries. Her views on the direction of the market are frequently heard in seminars and quoted by industry trade journals.

June 21st, 2021

Des Moines, IA

(855) ASK-WINK