Wink, Inc. Releases Fourth Quarter, 2020 Life Sales Results

May 25, 2021 by Press Release

— FOR IMMEDIATE DISTRIBUTION —

NEWS RELEASE

INDEXED LIFE SALES BACK ON THE UPTICK, AS DEATH KNELL SOUNDS FOR TRADITIONAL UL

Wink, Inc. Releases Fourth Quarter, 2020 Life Sales Results

Des Moines, Iowa. May 20, 2021– Wink, Inc. released the fourth quarter, 2020 life sales results in its 94th edition of Wink’s Sales & Market Report. Wink’s Sales & Market Report is the insurance industry’s #1 resource for life insurance sales data, since 1997.

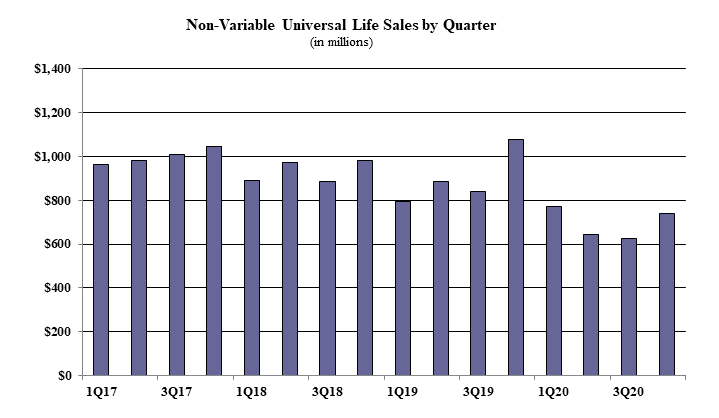

Non-variable universal life sales for the fourth quarter were $740.0 million; up 18.4% when compared to the previous quarter and down 31.2% as compared to the same period last year. Total 2020 non-variable universal life sales were $2.7 billion. Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the fourth quarter included Pacific Life Companies gaining the #1 ranking overall, for non-variable universal life sales, with a market share of 12.6%. Transamerica’s Transamerica Financial Foundation IUL was the #1 selling product for non-variable universal life sales, for all channels combined.

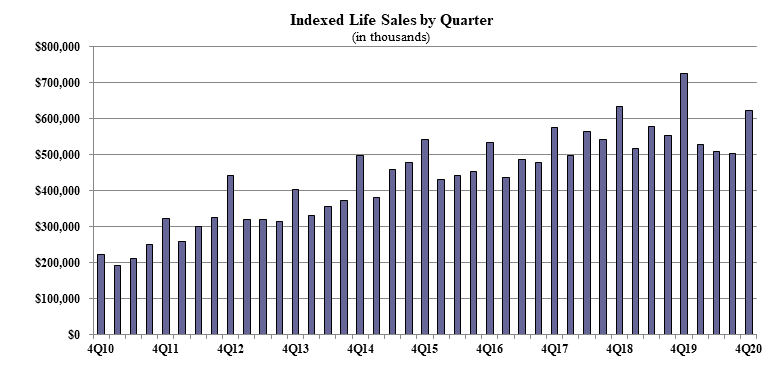

Indexed life sales for the fourth quarter were $621.3 million, up 23.3% when compared with the previous quarter, and down 14.3% as compared to the same period last year. Total 2020 indexed life sales were $2.1 billion. Indexed life sales include both indexed UL and indexed whole life. “Sure- IUL sales are up double-digits, but this is nothing to celebrate about. Last quarters’ sales are our benchmark here, and IUL sales have not been that low in nearly three years,” explained Sheryl J. Moore, President & CEO of both Wink, Inc. and Moore Market Intelligence.

Items of interest in the indexed life market included Pacific Life Companies gaining the #1 ranking in indexed life sales, with a 14.5% market share. National Life Group, John Hancock, Transamerica, and Nationwide rounded out the top five, respectively.

Transamerica’s Transamerica Financial Foundation IUL was the #1 selling indexed life insurance product, for all channels combined. The top pricing objective for sales this quarter was Cash Accumulation, capturing 71.1% of sales. The average indexed life target premium for the quarter was $12,551, an increase of nearly 15.0% from the prior quarter.

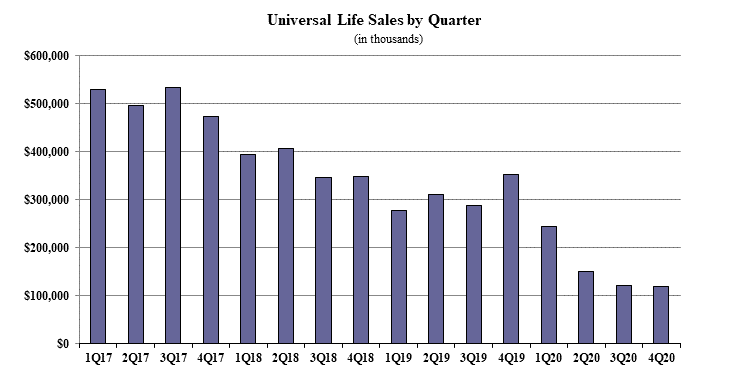

Fixed UL fourth quarter sales were $118.9 million, down 2.2% when compared with the previous quarter and down 66.1% as compared to the same period last year. Total 2020 fixed UL sales were $636.1 million. Noteworthy highlights for fixed universal life in the fourth quarter included the top pricing objective of No Lapse Guarantee capturing 45.0% of sales. The average UL target premium for the quarter $5,359, an increase of nearly 6% from the prior quarter. Moore commented, “It is terribly sad to see UL sales as low as they are. I helped develop the most successful GUL in the market, before starting my own business. Now, the combination of GUL reserving requirements and low interest rates have echoed a death knell on Universal Life sales.”

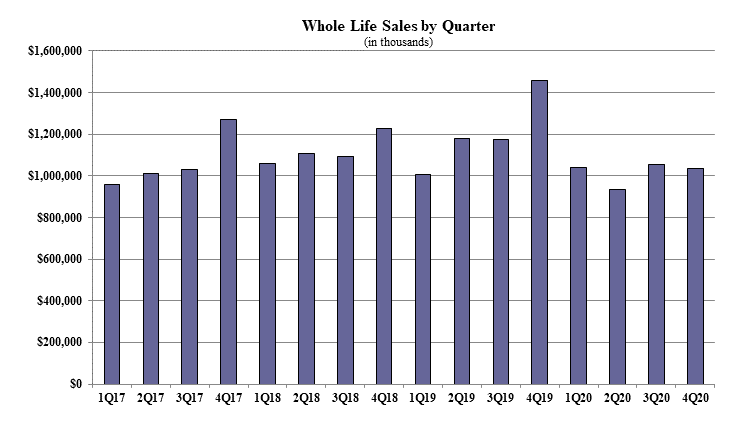

Whole life fourth quarter sales were $1.0 billion, down 1.7% when compared with the previous quarter, and down 28.8% as compared to the same period last year. Total 2020 whole life sales were $4.0 billion. Items of interest in the whole life market included the top pricing objective of Final Expense capturing 50.2% of sales. The average premium per whole life policy for the quarter was $3,571, a decline of more than 3.0% from the prior quarter. “Whole life sales will continue to be strong for the foreseeable future; products with guarantees become more valuable during periods of sustained low interest rates,” commented Moore.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future.

****

For more information, go to www.WinkIntel.com

Wink, Inc. is the company behind the most comprehensive life insurance and annuity due-diligence tools, AnnuitySpecs and LifeSpecs at www.WinkIntel.com. Wink, Inc. is the distributor of the quarterly Wink’s Sales & Market Report. Serving as the insurance industry’s #1 resource of indexed insurance product sales since 1997, this report provides sales by product, company, crediting method, index, distribution, surrender charge period, and more. Wink’s Sales & Market Report expanded to cover all deferred annuity products in 2015, all deferred variable annuity products in 2019 and all non-variable cash value life insurance products in 2017.

The staff of Wink, Inc. has a combined experience of more than 175 years working with insurance products, more than a decade of which is specific to competitive intelligence. Based in Des Moines, Iowa, the firm offers competitive intelligence and market research in the life insurance and annuity industries; serving financial services professionals, distributors, manufacturers, regulators, and consultants on both a domestic and global basis.

Sheryl J. Moore is president and CEO is the guiding force behind Wink, Inc. Ms. Moore previously worked as a market research analyst for top carriers in the life insurance and annuity industries. Her views on the direction of the market are frequently heard in seminars and quoted by industry trade journals.

May 20, 2021

Des Moines, IA

(855) ASK-WINK