What’s Better than a Paycheck for Life?

November 25, 2020 by Sheryl J. Moore

If your prospects have never heard of annuities, there are some great things you can share with them, in order to make them receptive.

Some people plan to invest in their home, fix it up, and eventually sell it when they are ready to retire- then live off the proceeds. Others may own a business, which they plan to sell in preparation for retirement. However, most average Joes, like us, use different instruments to save money, in preparation for retirement. The 401(k) is likely the most recognizable of these instruments. However, other instruments such as Certificates of Deposit (CDs), mutual funds, stocks, annuities, and even life insurance (crazy, right?!?) can be used to help one save their money for retirement.

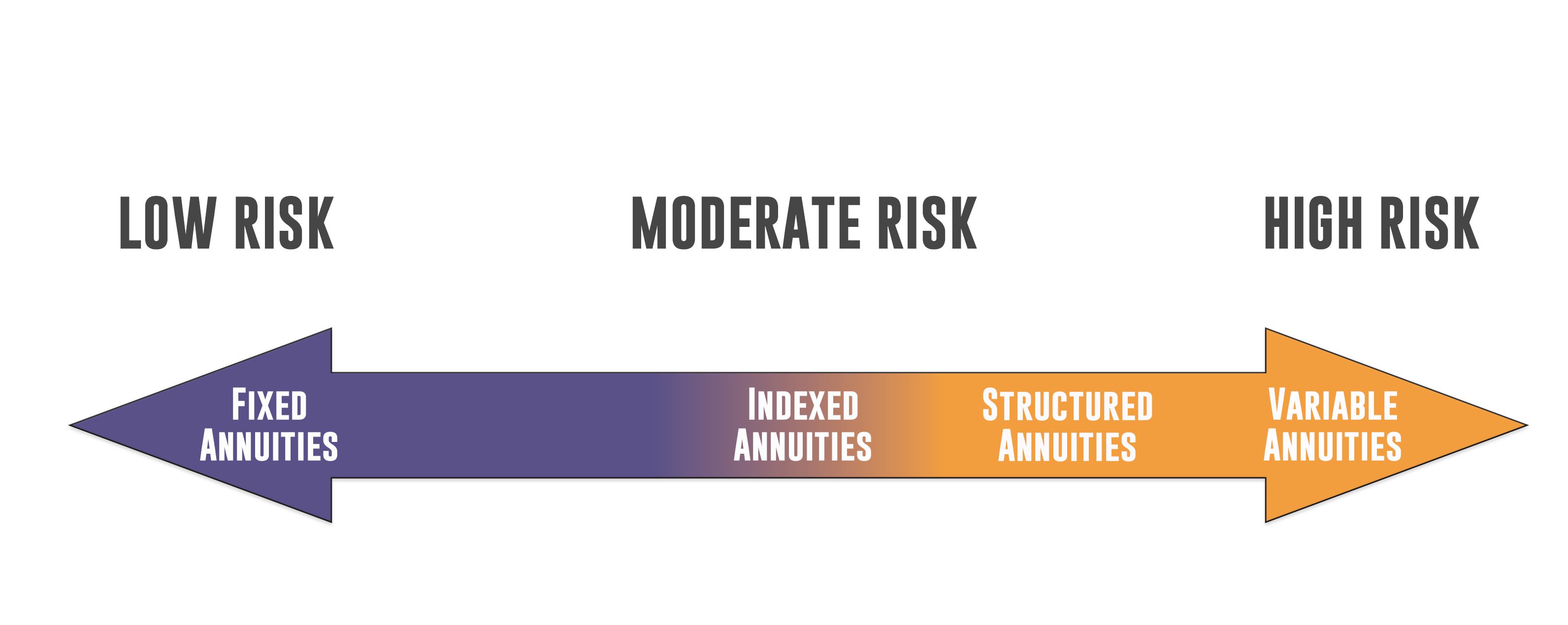

Each of these retirement vehicles is suited best for a different risk tolerance, or the amount of variability in returns that a purchaser is willing to withstand. The idea of risk tolerance is an important one to grasp.

Click HERE to read the full story via NAILBA Perspectives

Each of these instruments also has their respective costs and their benefits. Some are better than others for some people, and some just wouldn’t make sense for other people. Yet among these, one instrument has options to fit every risk tolerance and offers a single, unique feature that no other retirement savings instrument can:

A paycheck sent to you every month, for the rest of your life, no matter how long you live.

Even if you live to be 150 years old, or older, an annuity will send you a paycheck every month for the rest of your life. Even if you paid $150,000 into the annuity, and the insurance company has sent you $1,500 per month for 8.34 years (and you’ve essentially gotten-back what you paid-in), you will continue to receive the $1,500 per month.

While this example is merely that- an example, it helps drive home the most valuable feature that exists in every annuity: a guaranteed paycheck for life. And this is a feature that nearly everyone is interested in. Until, the mention the word “annuity.”

Let me help you understand what an annuity IS, as opposed to what you may have heard.

Technically, the definition of an annuity is a financial product that facilitates a sum of money being payable annually, or more frequent intervals.

If that sounds familiar, that is because it probably is. Social Security, winning the lottery, even those old pensions of yore are paid out as annuities! The difference is an annuity is a pension that you provide for yourself.

It also has a tax deferral feature that isn’t available through some retirement savings instruments. The IRS has provided favorable tax status to annuities, in order to provide an incentive for Americans to save for their own retirements. So, you don’t have to start paying taxes on the money that you put into an annuity, until you begin taking money out of the annuity.

If all of those things sound good, believe it or not, an annuity may just be right for your prospects!

Sheryl Moore is President and CEO of the life and annuity market research firm of Wink, Inc. Her company provides competitive intelligence, market research, product development, consulting services and insight to select financial services companies. She may be reached at sjm@intelrockstar.com.