Are Independent Agents Meeting Customer Needs? New Study Identifies Potential Gaps

August 12, 2020 by Nationwide

COLUMBUS, Ohio, Aug. 6, 2020 /PRNewswire/ — The latest in Nationwide’s Agent Authority research found that economic uncertainty and unpredictable markets have forced business owners and consumers to reevaluate their finances and insurance needs. This requires insurance agents to navigate unique challenges when helping customers interpret their property and casualty policies. But even up against these new obstacles, agents have a compelling opportunity to serve as a knowledgeable resource for current and prospective customers to strengthen and grow their portfolio or business.

Nationwide uncovered four themes in this study:

- A perception gap: There are gaps between agents and customers when it comes to perception of service levels.

- Customers want more than just property and casualty support from agents.

- Understanding policy coverage and price are shared challenges across all audiences.

- The economy is a concern, and customers are looking to agents for guidance.

“Our latest research shows some emerging opportunities in the agent-customer relationship particularly when navigating this current environment and economy,” said Jeff Rommel, Senior Vice President of Property and Casualty Sales at Nationwide. “But while the data pinpointed gaps, agile agents will see ways to address their clients’ concerns, enhance retention and grow their business.”

These and other important insights came out of the summer survey of the Agent Authority research series conducted by Nationwide, which includes samples of independent insurance agents, consumers and business owners. The research was developed to uncover unique challenges property and casualty agents encounter and create subsequent guidance.

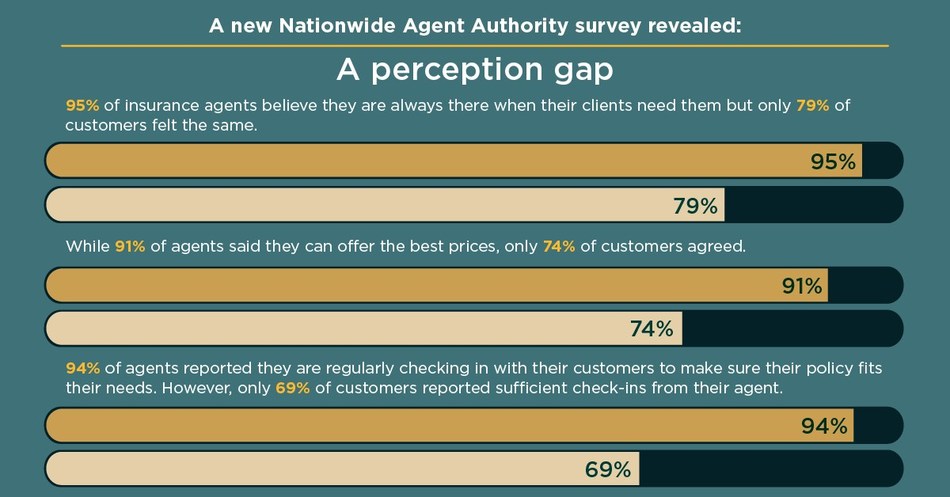

A Perception Gap

The Agent Authority research identified a perception gap in the value agents believe they are bringing to their customers. Agents are confident they are meeting the needs of their customers, yet some business owners and consumers have a different perspective on the services agents should provide. In areas where agents gave themselves higher marks than consumers and business owners, agents can lean in and proactively close gaps, effectively strengthening their relationships and improving their brand.

- 95% of insurance agents believe they are always there when their clients need them but only 79% of customers felt the same.

- While 91% of agents said they can offer the best prices, only 74% of customers agreed.

- 94% of agents reported they are regularly checking in with their customers to make sure their policy fits their needs. However, only 69% of customers reported sufficient check-ins from their agent.

Quick tip for agents:

- Set up regular calendar reminders to check in with your top commercial lines clients every six months to understand the challenges their business is facing and evaluate evolving insurance needs. Reach out to all personal lines customers at least once a year to do the same.

What Customers Want:

To support agents in closing this perception gap, the research identified areas where agents can go above and beyond traditional insurance guidance. While most customers seek counsel on conventional insurance, some business owners are looking for help on succession planning, disaster recovery and employee benefits. Additionally, general property and casualty customers are asking agents about retirement and banking advice.

- 57% of mid-market business owners are asking about employee benefits.

- 45% of mid-market business owners and 35% of small business owners are asking about safety and loss control.

- 26% of consumer customers want guidance on retirement planning.

- Physical location is something customers value. While there is a desire for digital platforms –Small business owners (68%), and consumers (51%) still prefer to have an insurance agent where they are physically located.

Quick tips for agents:

- Ask your carrier partners for tools to talk to your clients about employee benefits, loss control, retirement planning.

- Nationwide’s My Loss Control Services provides a variety of loss control resources.

- The Nationwide Retirement Institute offers a wide range or retirement planning resources.

- Adjust your social media marketing efforts to reflect more than what you sell. It should reflect you and the hometown community you support. Nationwide’s Hearsay program helps independent agents reach clients via social media in new and innovative ways.

A Shared Challenge:

The research identified two consistent challenges across all audiences surveyed – understanding policy coverage and finding the best price.

- 46% of small business owners, 71% of mid-market business owners and 47% of consumers said it is a challenge to understand what is and what is not covered in their policy.

- 44% of small business owners, 69% of mid-market business owners and 45% of consumers said it is a challenge to find the best price for protection needs.

- Similarly, 55% of agents say they struggle educating clients on the coverage they need and 46% of agents say providing the level of service customers demand is a challenge.

Many customers also wrestle with understanding different types of coverage, the time it takes to settle a claim, insurance terminology and understanding how much coverage they need.

Agents reported it particularly challenging to:

- Adopt new technology to keep up with the industry (55%)

- Understand the nuances between different industries (53%)

- Help clients with disaster prep or mitigation practices (51%)

Quick tips for agents:

- When you touch base with clients, brainstorm insurance scenarios together to identify potential gaps and where business continuity and disaster planning may help.

- Help your clients understand that price is only one of several important considerations when evaluating insurance. While sometimes there is a better price out there, it is important to weigh the financial commitment against the best protection option.

- Look to your carrier partners to share technical expertise and resources to help you advocate for your clients and provide safety resources that mitigate their risks.

- Nationwide’s Commercial Insight Center offers quick, specialized and actionable information to help elevate agents’ expertise and success with mid-market businesses.

An Economic Outlook:

Over half of agents think their clients feel uncomfortable talking about economic uncertainty. However, more than half of business owners and consumers feel like their agent was prepared to have these discussions.

- 47% of agents are optimistic the economy will recover in the next year but 66% are concerned about making it through this economic climate.

- 81% of agents say their customers are unsure how the current economy will impact their business and their insurance needs.

Quick tips for agents:

- Nationwide offers regular economic updates from the office of our chief economist to help agents have informed conversations about the future of the economy.

- Some personal lines clients may be able to reduce auto insurance cost with a telematics policy. Discuss whether a safety-based or pay-by-mile telematics solution is the best option.

- Agents can also deliver bottom line impacts and operational insights to commercial clients with telematics and fleet management solutions. Discuss whether your clients’ businesses would benefit from leveraging its vehicle data.

Methodology:

Nationwide commissioned Edelman Intelligence to conduct a 20-minute quantitative online survey among a sample of 2,600 U.S. independent insurance agents, small business owners, mid-market business owners, mid-market business owners with fleet vehicles, African American business owners, Hispanic business owners and general consumers between June 9 – June 25 to understand what business owners and consumers value when buying or renewing insurance policies, explore the different challenges each audience faces around insurance, gauge perceptions of the economy and how each audience is managing uncertainty, and find out the actions business owners and consumer have taken as a result of COVID-19 and the conversations they’re having with agents. As a member of CASRO in good standing, Edelman Intelligence conducts all research in accordance with Market Research Standards and Guidelines.

About Nationwide

Nationwide, a Fortune 100 company based in Columbus, Ohio, is one of the largest and strongest diversified insurance and financial services organizations in the U.S. and is rated A+ by both A.M. Best and Standard & Poor’s. The company provides a full range of insurance and financial services, including auto, commercial, homeowners, farm and life insurance; public and private sector retirement plans, annuities and mutual funds; banking and mortgages; excess & surplus, specialty and surety; pet, motorcycle and boat insurance. For more information, visit www.nationwide.com.

Contact:

Mike Switzer

(614) 249-6349

SWITZEM1@nationwide.com

SOURCE Nationwide