Women’s Retirement Insecurity Is a Global Concern

February 19, 2020 by Transamerica Center for Retirement Studies

LOS ANGELES, Feb. 19, 2020 /PRNewswire/ — Globally, only 21 percent of women workers (25 percent U.S.) believe they are on course to achieve their retirement income needs, according to a new report released today, The New Social Contract: Achieving retirement equality for women, based on an annual survey of 15 countries spanning Europe, the Americas, Asia, and Australia. It is a collaboration between Aegon Center for Longevity and Retirement (ACLR), and nonprofits Transamerica Center for Retirement Studies® (TCRS) and Instituto de Longevidade Mongeral Aegon.

“Women’s workforce participation and access to career opportunities have soared in recent decades,” said Catherine Collinson, CEO and president of nonprofit Transamerica Institute and TCRS, and executive director of ACLR. “However, the gender pay gap persists. Combined with women taking time out of the workforce for parenting and caregiving, it undermines their ability to achieve a financially secure retirement and increases the risk of living in poverty.”

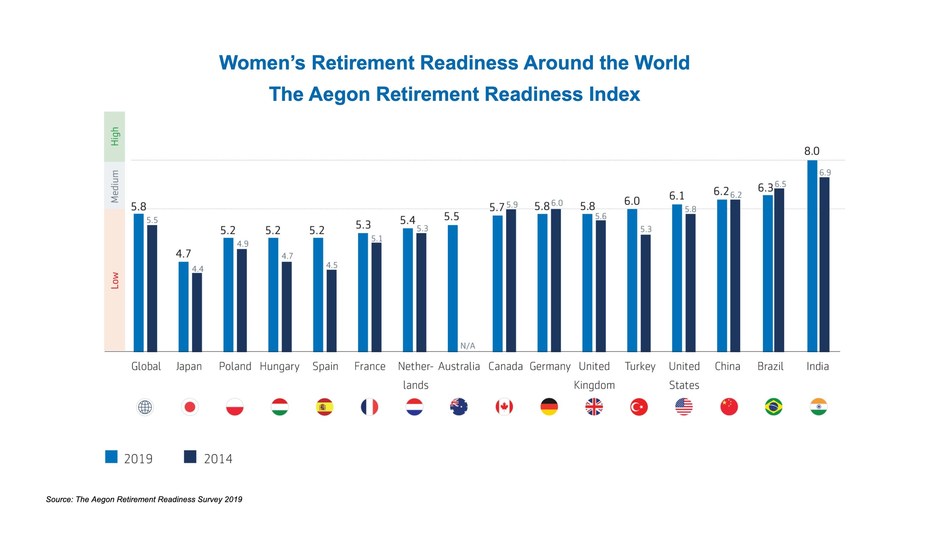

Women’s Retirement Readiness Is Stubbornly Low

Only 26 percent of working women across the globe (26 percent U.S.) are extremely or very confident they will be able to retire with a comfortable lifestyle. The Aegon Retirement Readiness Index (ARRI) measures preparedness on a scale of 0 to 10. In 2019, women globally had an ARRI score of 5.8, up from 5.5 in 2014. In the U.S., the ARRI among women increased from 5.8 in 2014 to 6.1 in 2019. **

“While this slight increase in retirement readiness in general is encouraging, much more can and should be done from a societal perspective,” Collinson said. “Women also have an opportunity to take individual action and improve their prospects.”

The Five Fundamentals for Women’s Retirement Readiness

The report illustrates specific opportunities for women and outlines a holistic approach to retirement planning based on these five fundamentals for retirement readiness:

- Start saving early and save habitually: The best route to retirement readiness is starting to save as early as possible and becoming a “habitual saver” who always saves for retirement. Only 38 percent of women workers globally say they are habitual savers (50 percent U.S.).

- Develop a written retirement strategy: Only 15 percent of women workers globally have a written plan for retirement (19 percent U.S.). Promisingly, 38 percent have a plan that is not written down (42 percent U.S.).

- Create a backup plan for unforeseen events: Consider the possibility of professional setbacks, such as being forced into retirement sooner than expected, and prepare accordingly. Globally, 32 percent of women workers have a backup plan to provide an income if they are unable to work before they reach their planned retirement age (31 percent U.S.).

- Adopt a healthy lifestyle: People who stay healthy and fit are in a better position to be able to continue working, earning income, and saving— and delay taking withdrawals from retirement savings. When asked which healthy behaviors apply to them, women most often cite avoiding harmful behaviors (62 percent global, 65 percent U.S.), eating healthily (62 percent global, 56 percent U.S.), and exercising regularly (50 percent global, 50 percent U.S.).

- Embrace lifelong learning: A commitment to continuing education is vital for keeping job skills relevant and gaining knowledge to make informed decisions in a world of fast-paced change. Financial literacy is a compelling example of where improvement is urgently needed. The survey found that only 23 percent of women globally (23 percent U.S.) could correctly answer all of the “Big Three” financial literacy questions developed by Drs. Annamaria Lusardi and Olivia Mitchell that test knowledge of compounding interest, inflation, and risk diversification.

“It is imperative that women take greater control over their financial situation, but it must be recognized that they face formidable headwinds that can limit their ability to save, such as lower incomes and less access to employer-sponsored retirement benefits,” Collinson said. “In order to achieve success, these structural inequalities must be addressed by a new social contract and the modernization of retirement systems around the world.”

The New Social Contract: Achieving retirement equality for women builds on The New Social Contract: Empowering individuals in a transitioning world (2019) and Women: Balancing family, career & financial security (2014). It provides comparisons with men and a detailed set of recommendations for policymakers, industry, employers, and women. It is based on findings from the 8th Annual Aegon Retirement Readiness survey of 14,400 workers and 1,600 retired people across 15 countries: Australia, Brazil, Canada, China, France, Germany, Hungary, India, Japan, the Netherlands, Poland, Spain, Turkey, the United Kingdom, and the United States. The survey was conducted online between Jan. 22 and Feb. 14, 2019.

Please visit www.transamericacenter.org for the report and other information about the research. Follow TCRS on Twitter @TCRStudies.

Transamerica Center for Retirement Studies®

Transamerica Center for Retirement Studies® (TCRS) is a division of Transamerica Institute®, a nonprofit, private foundation. TCRS is dedicated to conducting research and educating the American public on trends, issues, and opportunities related to saving, planning for, and achieving financial security in retirement. Transamerica Institute is funded by contributions from Transamerica Life Insurance Company and its affiliates and may receive funds from unaffiliated third parties. TCRS and its representatives cannot give ERISA, tax, investment or legal advice. www.transamericacenter.org

Aegon Center for Longevity and Retirement

Aegon Center for Longevity and Retirement (ACLR) is a collaboration of experts assembled by Aegon with representation from Europe, the Americas, and Asia. ACLR’s mission is to conduct research, educate the public, and inform a global dialogue on trends, issues, and opportunities surrounding longevity, population aging, and retirement security. www.aegon.com/thecenter

Instituto de Longevidade Mongeral Aegon

A champion in the theme of longevity and its social economic impacts in Brazil. With its initiatives, the non-profit organization tackles the challenges of living longer by integrating governments, companies, schools and people through activities towards income, work, health, and behavior. The Instituto is part of the Mongeral Aegon Group and provides complimentary services to create opportunities for individuals of all ages.

www.institutomongeralaegon.org

250860

Contact: Kristin Elia

kelia@webershandwick.com

206-576-5502

SOURCE Transamerica Center for Retirement Studies