Americans Are Worried About Their Finances, New NAPFA Survey Shows

September 25, 2019 by NAPFA

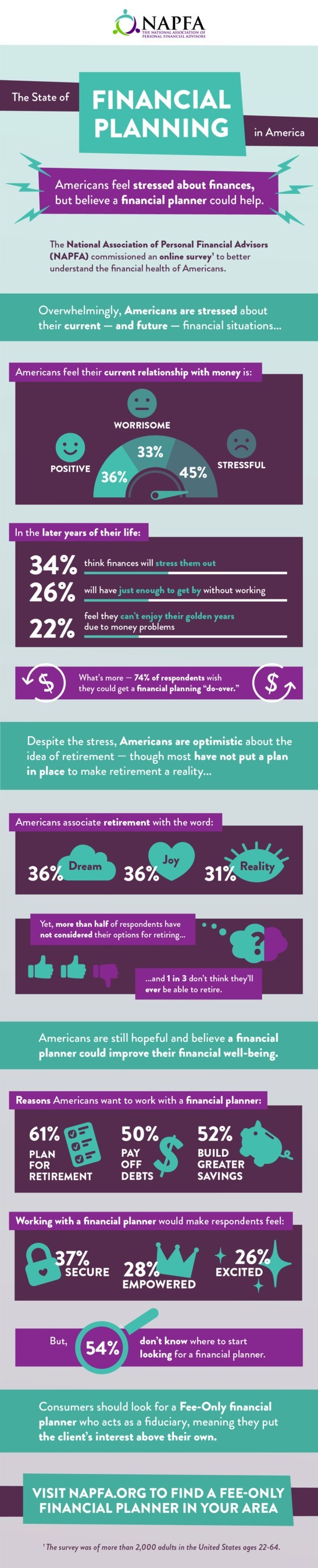

CHICAGO, Sept. 24, 2019 /PRNewswire/ — A new study released for October’s Financial Planning Month found the majority of Americans are stressed about their financial situations, with 3 out of 4 Americans wishing they could get a financial planning do-over. However, according to the survey by the National Association of Personal Financial Advisors (NAPFA), the outlook isn’t all grim: Americans are hopeful about their retirement options.

The other good news is that Americans believe a financial planner can help. In particular, respondents want guidance on planning for retirement (61%), building greater savings (52%) and paying off their debts (50%).

The study — which was commissioned to evaluate the financial health of Americans — also found that 34% of respondents believe finances will still remain a source of stress in their futures and 22% worry they will not enjoy their senior years due to money issues.

“With all the uncertainty in the economy right now, it is more important than ever for consumers to have their finances in order,” says Geoffrey Brown, NAPFA CEO. “While none of us can go back in time to change our financial situations, we always have the power to make positive changes for our future.”

Survey findings also indicate that more than half of respondents have not considered their options for retiring, and 1 in 3 do not think they’ll ever be able to retire. Despite feeling stressed, Americans still associate the idea of retirement with the words: dream (36%), joy (36%) and reality (31%).

Having a financial plan with specific goals can make a big difference in how consumers spend their time now and in the future. Survey results show that Americans believe working with a financial planner will make them feel secure (37%), empowered (28%) and excited (26%).

“The right guidance and professional advice can help make financial planning feel approachable,” explains Brown. “With 54% of Americans not knowing where to look for a financial planner, it is our job to make it easy for them. We encourage consumers to look for a Fee-Only financial planner who will consider all the aspects of their unique financial situation.”

Fee-Only financial planners work with clients on goal setting, cash management, tax planning, investing, estate planning, insurance needs, education funding and retirement planning. It is important to look for Fee-Only financial planners, who act as fiduciaries, meaning they put the client’s interest ahead of their own.

Visit the NAPFA website for a search tool to find Fee-Only financial planners in your area, as well as a variety of consumer resources, including: How to Find An Advisor, Financial Advisor Checklist, Financial Advisor Diagnostic and Questions to Ask Your Advisor. Additional survey findings are available here.

About NAPFA

Since 1983, The National Association of Personal Financial Advisors has provided Fee‐Only financial planners across the country with some of the highest standards possible for professional competency, comprehensive financial planning, and Fee‐Only compensation. With more than 3,700 members across the country, NAPFA is the leading professional association in the United States dedicated to the advancement of Fee‐Only financial planning. Learn more at www.napfa.org.

SOURCE NAPFA