SECOND QUARTER 2019 ANNUITY SALES

August 26, 2019 by Sheryl J. Moore

Deferred Annuity Sales

Total 2Q2019 deferred annuity sales were $58,271,065,521. Second quarter deferred annuity sales were up nearly 5% when compared with the previous quarter.

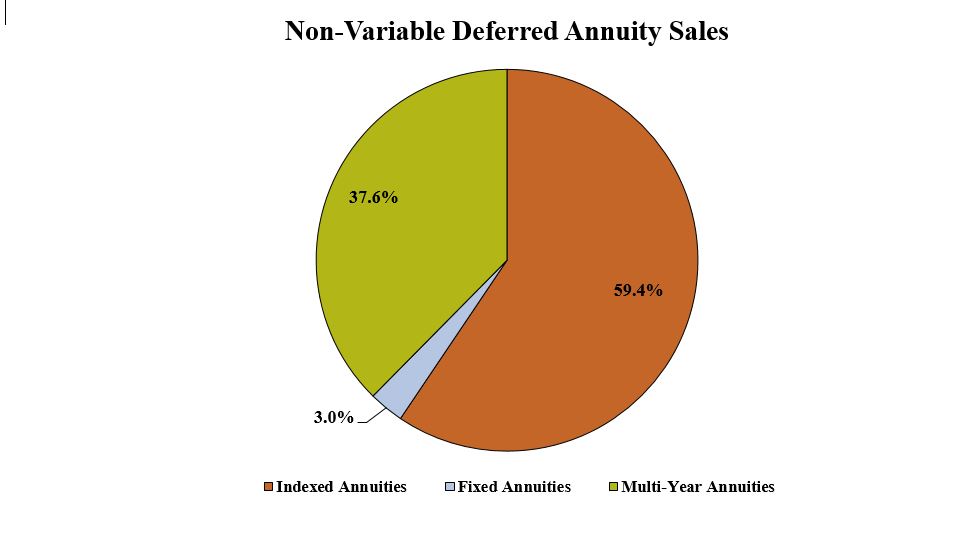

Non-Variable Deferred Annuity Sales

Total 2Q2019 non-variable deferred annuity sales were $33,141,918,594. Second quarter non-variable deferred annuity sales were down nearly 1% when compared with the previous quarter, and up more than 16% when compared to the same period last year.

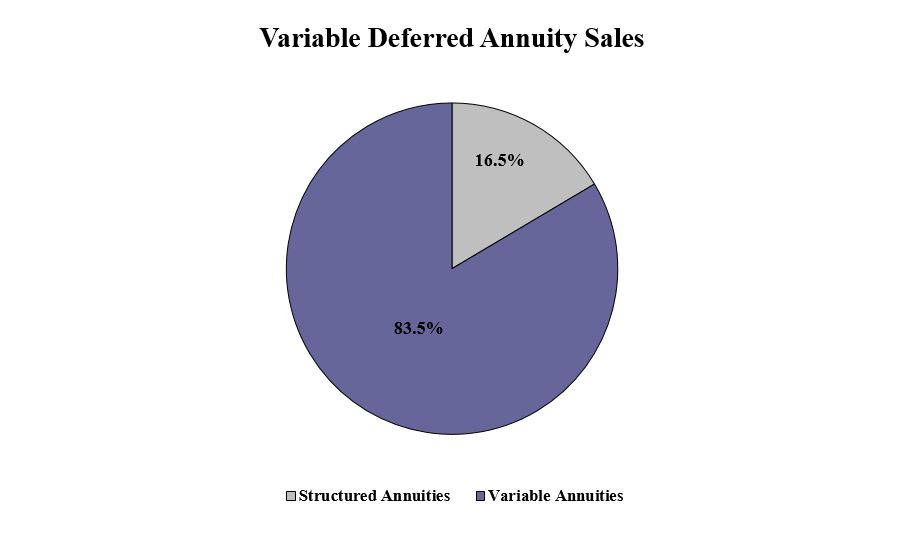

Variable Deferred Annuity Sales

Total 2Q2019 variable deferred annuity sales were $25,129,146,926. Second quarter variable deferred annuity sales were up nearly 14% when compared with the previous quarter.

Indexed Annuity

Sales for the second quarter of 2019 were $19,697 million, compared with sales of $17,344 million for the second quarter of 2018. Second quarter indexed annuity sales were up nearly 11% when compared to the previous quarter, and up nearly 14% when compared to the same period last year. This was a record-setting quarter for indexed annuity sales, topping the prior 4th quarter 2018 record by 2.58%.

Total 2Q2019 indexed annuity sales were $19,697,631,851.

THE TOP TEN INDEXED ANNUITY CARRIERS FOR THE SECOND QUARTER OF 2019:

1. Allianz Life

2. Athene USA

3. AIG

4. American Equity Companies

5. Nationwide

6. Global Atlantic Financial Group

7. Lincoln National Life

8. Pacific Life Companies

9. Jackson National Life

10. Great American Insurance Group

AVERAGE COMMISSION:

The indexed annuity commission received by the agent averaged 5.91% of premium for the second quarter of 2019; a trend that is down from the prior quarter.

LEADERS BY CHANNEL:

Bank- AIG

Career- CNO Companies

Direct Response- N/A

Independent Agent- Athene USA

Independent Broker Dealer- Allianz Life

National Broker Dealer- Global Atlantic Financial Group

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Allianz Life Allianz 222 Annuity

Bank- Forethought Life ForeAccumulation II FIA 5-Year

Career- C.M. Life Index Horizons

Direct Response- N/A

Independent Agent- Allianz Life Allianz 222 Annuity

Independent Broker Dealer- Allianz Life Allianz 222 Annuity

National Broker Dealer- Forethought Life ForeAccumulation II FIA 5-Year

Fee-Based Overall- Lincoln National Life Lincoln Core Capital

Fixed Annuity

Sales for the second quarter of 2019 were $983 million, compared to sales of $811 million for the second quarter of 2018. Second quarter fixed annuity sales were down nearly 10% when compared to the previous quarter, and up more than 21% when compared with the same period last year.

Total 2Q2019 fixed annuity sales were $983,225,484.

THE TOP TEN FIXED ANNUITY CARRIERS FOR THE SECOND QUARTER OF 2019:

1. Great American Insurance Group

2. Modern Woodmen of America

3. Jackson National Life

4. Global Atlantic Financial Group

5. OneAmerica

6. EquiTrust

7. American National

8. Reliance Standard

9. Brighthouse Financial

10. National Life Group

AVERAGE COMMISSION:

The fixed annuity commission received by the agent averaged 4.42% of premium for the second quarter of 2019; up slightly when compared to last quarter.

LEADERS BY CHANNEL:

Bank- Great American Insurance Group

Career- Modern Woodmen of America

Direct Response- Amica

Independent Agent- Jackson National Life Group

Independent Broker Dealer- Jackson National Life

National Broker Dealer- Global Atlantic Financial Group

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Forethought Life ForeCare Fixed Annuity

Bank- Great American American Freedom Aspire 5

Career- Kansas City Life Growth Track

Direct Response- Amica Flexible Premium Deferred Annuity

Independent Agent- EquiTrust ChoiceFour

Independent Broker Dealer- Forethought Life ForeCare Fixed Annuity

National Broker Dealer- Forethought Life ForeCare Fixed Annuity

Multi-Year Guaranteed Annuity

Sales for the second quarter of 2019 were $12,461 million, compared with sales of $10,341 million for the second quarter of 2018. Second quarter MYGA sales were down more than 15% when compared to the previous quarter, and up nearly 21% when compared to the same period last year.

Total 2Q2019 MYGA sales were $12,461,061,260.

THE TOP TEN MYGA CARRIERS FOR THE SeCOND QUARTER OF 2019:

1. AIG

2. Global Atlantic Financial Group

3. New York Life

4. Massachusetts Mutual Life Companies

5. Delaware Life

6. Pacific Life Companies

7. Security Benefit Life

8. Protective Life Companies

9. Symetra Financial

10. Equitable Life & Casualty

AVERAGE COMMISSION:

The multi-year guaranteed annuity commission received by the agent averaged 2.31% of premium for the second quarter of 2019; a decline from last quarter.

LEADERS BY CHANNEL:

Bank- Global Atlantic Financial Group

Career- New York Life

Direct Response- N/A

Independent Agent- Delaware Life

Independent Broker Dealer- Global Atlantic Financial Group

National Broker Dealer- New York Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Forethought Life SecureFore 5 Fixed Annuity

Bank- Forethought Life SecureFore 5 Fixed Annuity

Career- Thrivent Financial Security One

Direct Response- N/A

Independent Agent- Equitable Life & Casualty Secure Savings 5

Independent Broker Dealer- Forethought Life SecureFore 5 Fixed Annuity

National Broker Dealer- Massachusetts Mutual Life Stable Voyage 3-Year

Structured Annuity

Sales for the second quarter of 2019 were $4,139 million compared with sales of $2,484 million for the second quarter of 2018. Second quarter structured sales were up more than 17% when compared to the previous quarter, and up nearly 67% when compared to the same period last year.

Total 2Q2019 structured annuity sales were $4,139,144,244.

THE TOP STRUCTURED ANNUITY CARRIER FOR THE SECOND QUARTER OF 2019:

AXA US

LEADERS BY CHANNEL:

Bank- AXA US

Career- AXA US

Independent Broker Dealer- Brighthouse Financial

National Broker Dealer- Allianz Life

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Brighthouse Life Shield Level Select 6-Year

Bank- AXA Equitable Structured Capital Strategies Plus

Career- AXA Equitable Structured Capital Strategies Plus

Independent Broker Dealer- Brighthouse Life Shield Level Select 6-Year

National Broker Dealer- Allianz Life Allianz Index Advantage

Variable Annuity

Sales for the second quarter of 2019 were $20,990 million. Second quarter variable annuity sales were up nearly 14% when compared to the previous quarter. Given that this is the second quarter that Wink has collected data on sales of variable annuities, additional comparisons will be available in future quarters.

Total 2Q2019 variable annuity sales were $20,990,002,682.

THE TOP TEN VARIABLE CARRIERS FOR THE SECOND QUARTER OF 2019:

1. Jackson National Life

2. Prudential

3. Lincoln National Life

4. AXA US

5. Nationwide

6. RiverSource Life

7. Transamerica

8. Pacific Life Companies

9. New York Life

10. AIG

LEADERS BY CHANNEL:

Bank- Jackson National Life

Career- AXA US

Independent Broker Dealer- Jackson National Life

National Broker Dealer- Jackson National Life

Registered Investment Advisor- Transamerica

TOP SELLING PRODUCTS BY CHANNEL:

Overall- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Bank- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Career- RiverSource Life RAVA5 Advantage VA 10-Year

Independent Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

National Broker Dealer- Jackson National Perspective II Flexible Premium Variable & Fixed Deferred Annuity

Registered Investment Advisor- Ameritas No Load Variable Annuity

Fee-Based Overall- Jackson National Perspective Advisory II Flexible Premium Variable & Fixed Deferred Annuity

Wink anticipates compiling third quarter, 2019’s sales with a release date of November 2019.