Wink, Inc. Releases 3rd Quarter, 2018 Deferred Non-Variable and Structured Annuity Sales Results

November 22, 2018 by Press Release

— FOR IMMEDIATE DISTRIBUTION —

NEWS RELEASE

INDEXED ANNUITY SALES CONTINUE TO RAISE THE BAR!

Wink, Inc. Releases 3rd Quarter, 2018 Deferred Non-Variable and Structured Annuity Sales Results

Des Moines, Iowa. November 21, 2018– Wink’s Sales & Market Report, the insurance industry’s #1 resource for indexed annuity sales data since 1997, is in its third year of reporting on all deferred non-variable annuities which include indexed annuity, traditional fixed annuity, and multi-year guaranteed annuity (MYGA) product lines. This is the first year for Wink to report on structured annuities, (a.k.a. indexed-variable annuities, collared annuities, or buffered annuities).

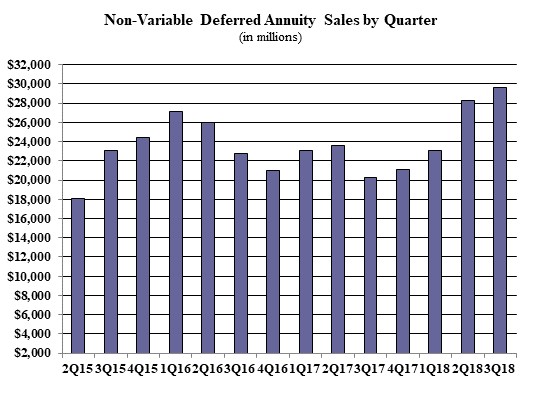

Sixty indexed annuity providers, 53 fixed annuity providers, 65 MYGA providers, and ten structured annuity companies participated in the 85th edition of Wink’s Sales & Market Report for 3rd Quarter, 2018. Total third quarter non-variable deferred annuity sales were $29.6 billion; up nearly 5.0% when compared to the previous quarter and up more than 46.2% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the third quarter include Allianz Life ranking as the #1 carrier overall for non-variable deferred annuity sales, with a market share of 9.2%. AIG took the second-place position, while New York Life, Athene USA, and Global Atlantic Financial Group rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz 222 Annuity, an indexed annuity, was the #1 selling non-variable deferred annuity, for all channels combined, in overall sales.

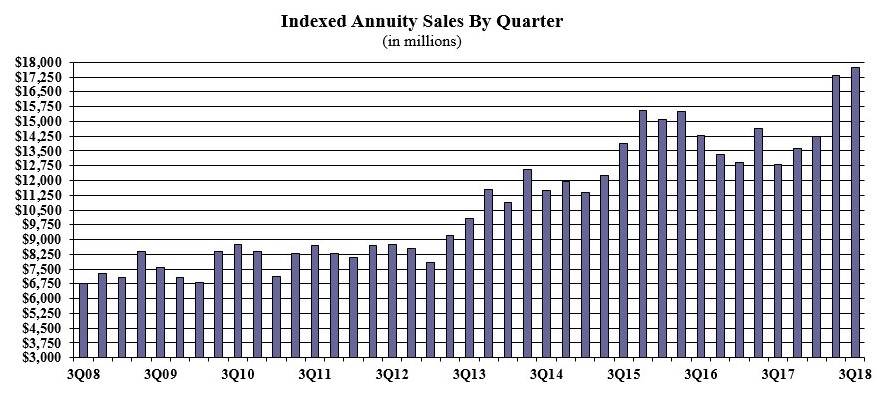

Indexed annuity sales for the third quarter were $17.7 billion; up nearly 2.2% when compared to the previous quarter, and up more than 38.4% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500®.

“I am not surprised to see yet another record-setting quarter for indexed annuities!” exclaimed Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc. She continued, “I want to prepare everyone, and just say that you can count on another go-round for fourth quarter, 2018; we are going to make it a three-peat!”

Noteworthy highlights for indexed annuities in the third quarter include Allianz Life retaining their #1 ranking in indexed annuities, with a market share of 15.4%. Athene USA held the second-ranked position while AIG, Nationwide, and Great American Insurance Group rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz 222 Annuity was the #1 selling indexed annuity, for all channels combined, for the seventeenth consecutive quarter.

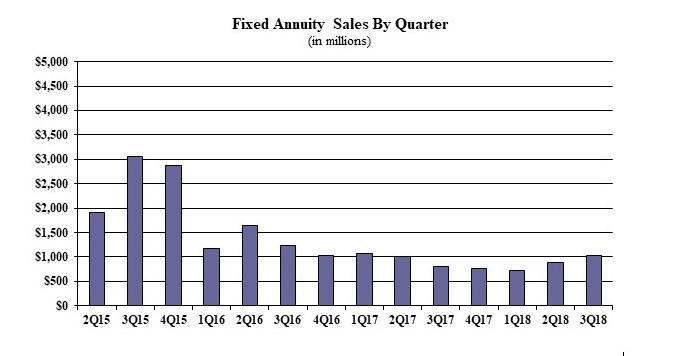

Traditional fixed annuity sales in the third quarter were $1.02 billion; up more than 16.7% when compared to the previous quarter, and up 28.7% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the third quarter include AIG ranking as the #1 carrier in fixed annuities, with a market share of over 12.3%. Jackson National Life moved into the second-ranked position and Modern Woodmen of America, Global Atlantic Financial Group, and Great American Insurance Group rounded-out the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the #1 selling fixed annuity for the quarter, for all channels combined, for the tenth consecutive quarter.

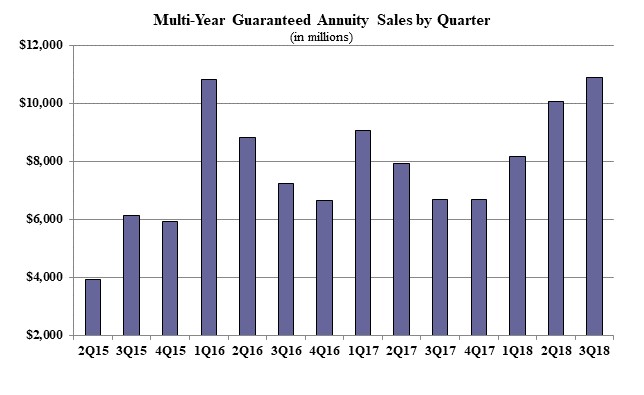

Multi-year guaranteed annuity (MYGA) sales in the third quarter were $10.8 billion; up over 8.0% when compared to the previous quarter, and up more than 63.3 % when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the third quarter include New York Life ranked as the #1 carrier, with a market share of 20.8%. Global Atlantic Financial Group continued in the second-ranked position, while AIG, Colorado Bankers Life Insurance Company, and Massachusetts Mutual Life Companies rounded-out the top five carriers in the market, respectively. Forethought’s SecureFore 5 Fixed Annuity was the #1 selling multi-year guaranteed annuity for the quarter, for all channels combined, for the third consecutive quarter.

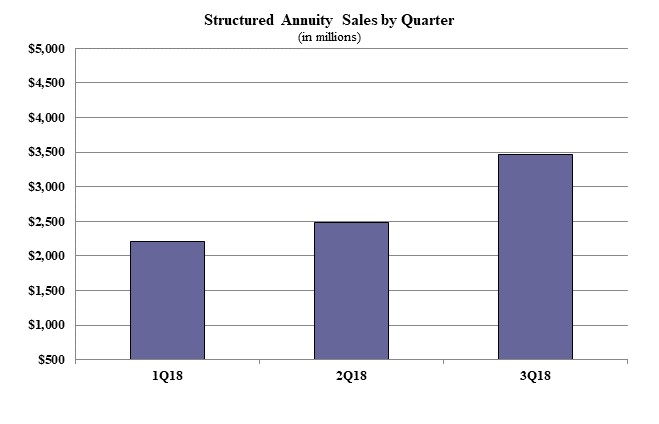

Structured annuity sales in the third quarter were $3.4 billion; up more than 39.4% as compared to the previous quarter. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

“It is amazing to see the amount of increased sales in this new market segment! Consumers definitely see value in these products.,” exclaimed Moore.

Noteworthy highlights for structured annuities in the third quarter include AXA US ranking as the #1 carrier in structured annuities, with a market share of 44.6%. Brighthouse Life Shield Level Select 6-Year was the #1 selling structured annuity for the quarter, for all channels combined.

While Wink currently reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, and multiple life insurance lines’ product sales, the firm looks forward to reporting on variable annuity sales at the beginning of the new year, and other product lines in the future.

****

For more information, contact the Wink team at http://www.LookToWink.com/.

Wink, Inc. is the company behind the most comprehensive life insurance and annuity due-diligence tools, AnnuitySpecs and LifeSpecs at www.LookToWink.com. Wink, Inc. is the distributor of the quarterly Wink’s Sales & Market Report. Serving as the insurance industry’s #1 resource of indexed insurance product sales since 1997, this report provides sales by product, company, crediting method, index, distribution, surrender charge period, and more. Wink’s Sales & Market Report expanded to cover all fixed deferred annuity products in 2015 and all non-variable cash value life insurance products in 2017.

The staff of Wink, Inc. has the combined experience of more than a century working with insurance products. Based in Des Moines, Iowa, the firm offers competitive intelligence and market research in the life insurance and annuity industries; serving financial services professionals, distributors, manufacturers, regulators, and consultants on both a domestic and global basis.

Sheryl J. Moore is president and CEO is the guiding force behind Wink, Inc. Ms. Moore previously worked as a market research analyst for top carriers in the life insurance and annuity industries. Her views on the direction of the market are frequently heard in seminars and quoted by industry trade journals.

November 21, 2018

Des Moines, IA

(855) ASK-WINK