Interesting industry facts and figures from new NAIC report

August 2, 2018 by Brian Anderson

How many licensed producers are there in the U.S.? How many domestic insurers are there, and how does that number compare to recent years? What states levy the most fines and suspend or revoke the most producer licenses?

The answers to all these questions and many more facts and figures can be found in the first volume of the 31st edition of the Insurance Department Resources Report (IDRR), recently released by the National Association of Insurance Commissioners (NAIC).

It contains key statistics on the resources and regulatory activities of the members of the NAIC, which include the 50 states, the District of Columbia, American Samoa, Guam, Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands.

Developed through an extensive survey of the NAIC member states, the report is intended to provide state insurance departments with information to compare their resources with other insurance departments. The report details how state insurance departments manage available resources to regulate a complex and competitive industry.

Volume One of the IDRR is organized into five sections: staffing; budget and funding; examination and oversight; insurance producers; and consumer services and antifraud.

An overview of the findings in Volume One includes:

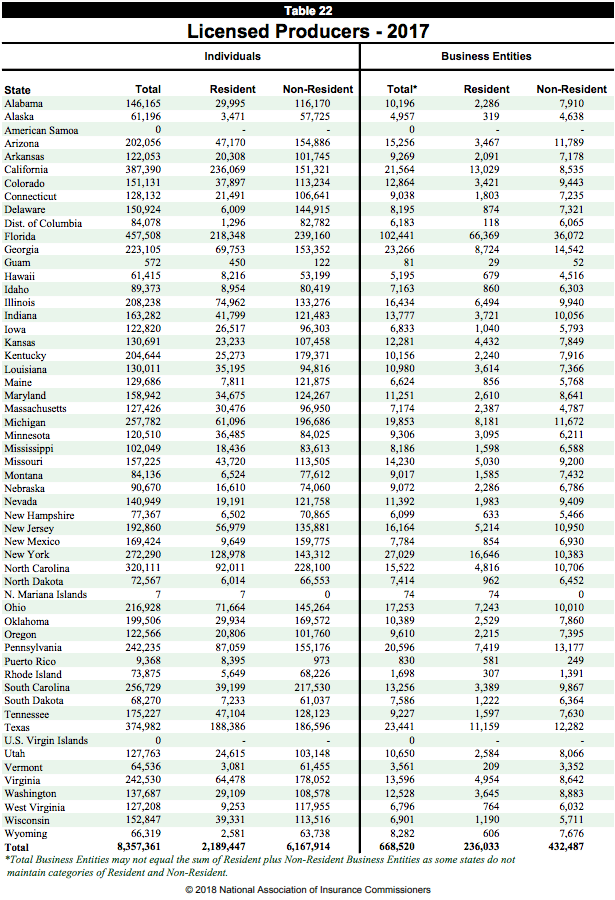

- Licensed resident producers numbered nearly 2.2 million individuals and 236,033 entities. Non-resident producers consisted of nearly 6.2 million individuals and 432,487 entities (see chart below).

- California reported the largest state insurance department 2019 budget ($216,627,000), which is $58.8 million greater than the second-largest 2019 budget (New York). 28 states reported increased 2019 budget amounts. Wyoming has the smallest 2019 budget of any state ($3,113,960).

- The top five departments based on staffing levels were Texas, California, Florida, New York and North Carolina.

- Total taxes collected by state insurance departments increased by 3.3%.

- There were 5,954 domestic U.S. insurers in 2017, down from 5,977 in 2016 and 6,708 back in 2009.

- 7,211 fines and 577 restitutions were levied against insurance producers by state insurance departments; 30,700 licenses were suspended; and 2,397 licenses were revoked.

- Texas levied only 250 fines against producers (3rd most), but the amount of the fines was by far the largest of any state: $9,021,632. Delaware levied the most fines (4,292) but the total amount of the fines only amounted to $1,009,100. By contrast, California levied just 178 fines against producers but collected $6,128,450.

- Virginia revoked the most producer licenses of any state by far at 735 (while suspending only 1 license). California was second with 278 revocations. West Virginia suspended the most producer licenses by far at 969, but revoked only 19 licenses. Florida suspended the second-most licenses (136).

- State insurance departments received nearly 300,000 official complaints and more than 1.7 million inquiries. Not surprisingly, California led the way with 42,878 consumer complaints, followed by New York (39,641) and Texas (24,566).

The IDRR is a key assessment tool for state insurance departments. It is also a reference for state legislators, other financial regulators and public policymakers. The second volume, which will be released in August, will include information on premium volume by type and by state.

Free access to the complete Volume 1 report is available at this link:

https://www.naic.org/prod_serv/STA-BB-18-01.pdf

About the NAIC: The National Association of Insurance Commissioners (NAIC) is the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer review, and coordinate their regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally. NAIC members, together with the central resources of the NAIC, form the national system of state-based insurance regulation in the U.S. For more information, visit www.naic.org.