Wink, Inc. Releases First Quarter, 2018 Life Sales Results

June 6, 2018 by Press Release

— FOR IMMEDIATE DISTRIBUTION — NEWS RELEASE

INDEXED LIFE SALES UP DOUBLE DIGITS

Wink, Inc. Releases First Quarter, 2018 Life Sales Results

Des Moines, Iowa. June 6, 2018– Wink, Inc. released first quarter, 2018 life sales results in its 83rd edition of Wink’s Sales & Market Report. Wink’s Sales & Market Report, the insurance industry’s #1 resource for indexed life insurance sales data since 1997, expanded in 2017 to include fixed universal life (UL) and whole life product lines.

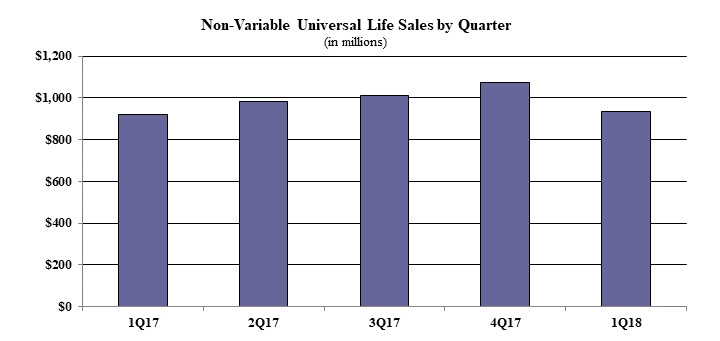

Non-variable universal life sales for the first quarter were over $936.3 million; down 12.7% when compared to the previous quarter and up 1.5% as compared to the same period last year. Non-variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the first quarter included Pacific Life Companies retaining their rank as the #1 company overall for non-variable universal life sales, with a market share of 8.7%. Great-West Financial’s Corporate Universal Life BOLI was the #1 selling product for non-variable universal life sales, for all channels combined, in the first quarter.

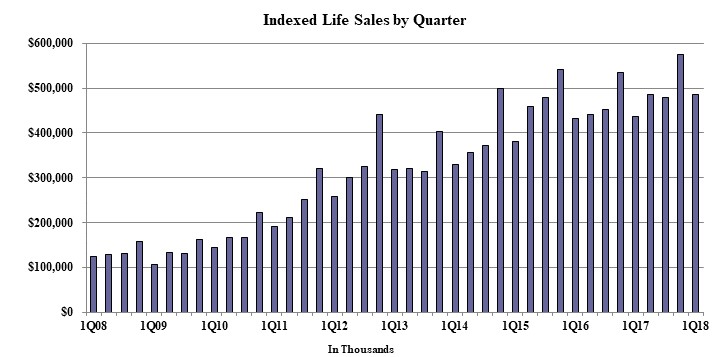

Indexed life sales for the first quarter were $486.2 million; down 15.5% when compared with the prior quarter, and up 11.5% as compared to the same period last year. “I don’t compare first quarter sales to the prior quarter, but to the same period the prior year,” explained Sheryl J. Moore, President and CEO of both Moore Market Intelligence and Wink, Inc. She continued, “The fourth quarter is always a big push for salespeople to qualify for trips and incentives, so that quarter’s sales are strong. It is a significant achievement to see that first quarter sales are up more than 11% from this time last year!”

Items of interest in the indexed life market included Pacific Life Companies retaining the #1 ranking in indexed life sales, with a 16.5% market share. National Life Group, Transamerica, Minnesota Life-Securian, and Nationwide concluded the top five sellers, respectively.

Pacific Life’s Pacific Discovery Xelerator IUL was the #1 selling indexed life insurance product, for all channels combined, for the quarter. The top pricing objective for sales this quarter was Cash Accumulation, capturing 83.1% of sales. The average indexed life target premium reported for the quarter was $9,221, an increase of nearly 2% as compared to the prior quarter.

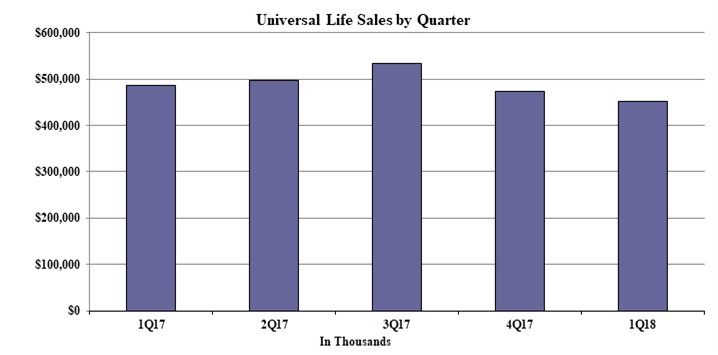

Fixed UL first quarter sales were $451.2 million. Noteworthy highlights for fixed universal life in the first quarter include the top pricing objective of No Lapse Guarantee, capturing 35.0% of sales. The average UL target premium reported for the quarter was $7,532, an increase of more than 48% from the prior quarter.

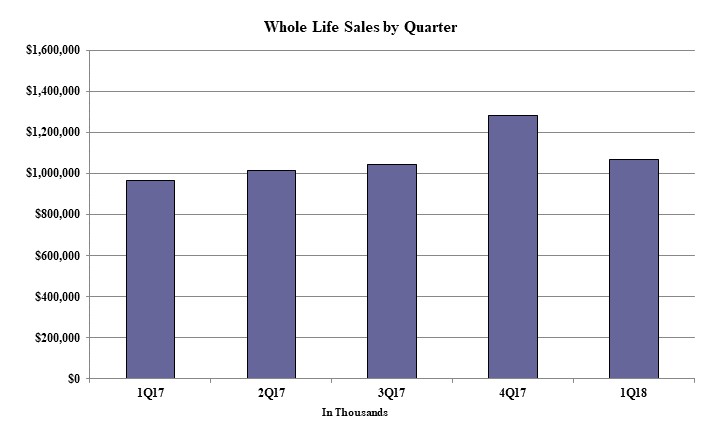

Whole life first quarter sales were $1.0 billion. Items of interest in the whole life market included the top pricing objective of Cash Accumulation capturing 74.3% of sales. The average annual premium per whole life policy reported for the quarter was $3,282, a decline of more than 16% from the prior quarter.

Wink is focusing on increasing participation with their current product lines of indexed universal life, traditional universal life, indexed whole life, and traditional whole life product sales. Additional product lines, such as term life insurance, will be added to Wink’s Sales & Market Report in upcoming quarters.

****

For more information, go to www.LookToWink.com.

The staff of Moore Market Intelligence has the combined experience of eight decades working with indexed insurance products. The firm provides services in speaking, research, training, product development, and marketing of indexed annuities and indexed life insurance. Their knowledge in product filing research and policy forms analysis, coupled with their unmatched resources in insurance distribution, give them the expertise to provide competitive intelligence that allows carriers to stay ahead of their competition.

Sheryl J. Moore is president and CEO of this specialized third-party market research firm and the guiding force behind the industry’s most comprehensive life insurance and annuity due diligence tools, AnnuitySpecs and LifeSpecs distributed by Wink, Inc. Ms. Moore previously worked as a market research analyst for top carriers in the life insurance and annuity industries. Her views on the direction of the market are frequently heard in seminars and quoted by industry trade journals.

Ms. Moore is the author of the quarterly Wink’s Sales & Market Report. Serving as the insurance industry’s #1 resource of indexed insurance product sales since 1997, this report provides sales by product, company, crediting method, index, distribution, surrender charge period, and more. Wink’s Sales & Market Report expanded to cover all fixed deferred annuity products in 2015 and all non-variable cash value life insurance products in 2017.

Wink, Inc. is the company that distributes resources such as this sales report, along with the competitive intelligence tools AnnuitySpecs and LifeSpecs at www.LookToWink.com.

June 6, 2018

Des Moines, IA

(855) ASK-WINK