Boomers most likely to use an online source for life insurance info; Millennials more likely to work with financial pro

February 2, 2018 by Insurance Forums Staff

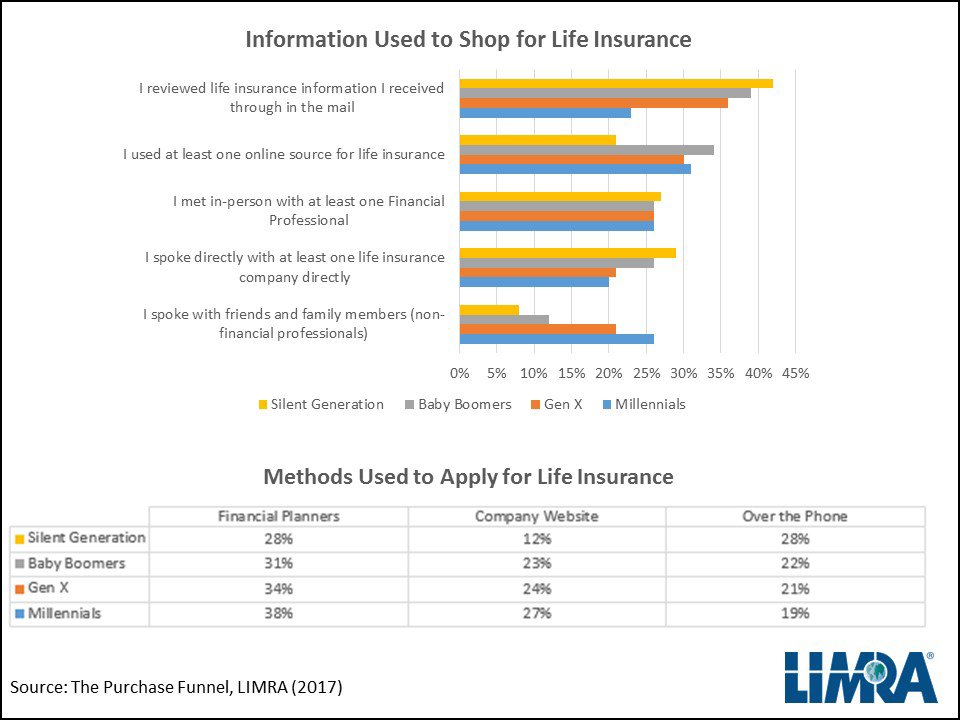

Despite not growing up with the Internet, LIMRA research finds Baby Boomers are most likely to say they used at least one online information source when shopping for life insurance. Sixty-one percent say they found the information online to be very useful, compared with 58% of Millennials and 54% of Generation X (Gen X).

Conversely, Millennial and Gen X consumers are far more likely to consult with friends and family to learn about life insurance (26% and 21% respectively). Researchers suggest younger consumers may have less familiarity with life insurance products and therefore, may feel more comfortable relying on people they trust rather than online sources. The study found 21% of Millennials said the information they received from friends and family was the strongest influence on why they thought they needed life insurance.

LIMRA’s study, The Purchase Funnel, explores why people buy and how they purchase life insurance. This report finds Millennials are more likely to work with a financial professional than older generations (38% of Millennials versus 34% of Gen X, 31% of Baby Boomers and 28% of Silent Generation). While this may be contrary to what most people would think, it is a trend in the life insurance industry. The younger generations don’t always have as much knowledge in this area and often start out having more questions and working with a financial professional is the best way for them to learn and understand. The trend shows as the buyers age, they feel more comfortable using other purchasing methods.

Overall, the study finds all consumers – except the Silent Generation – are most likely to purchase term life insurance. Younger generations were more likely to purchase term, compared with older generations. For those who bought permanent products, 7 in 10 Boomers and Gen X consumers purchase whole life products. While more Millennials are most likely to purchase whole life products (46%), one quarter say they purchased universal life products (compared with 15% of Gen X and 17% of Boomers).

The study also looks at why consumers choose not to buy life insurance. LIMRA finds more than half of Millennials say they have other financial priorities or they simply can’t afford life insurance and 43% of Gen X consumers say the same. It’s important to note that prior LIMRA research found most consumers overestimate the cost of insurance, with Millennials overestimating the costs by as much as five times the actual cost. Whereas 4 in 10 Boomers already own life insurance with only a quarter citing other financial priorities or believe they can’t afford it.

LIMRA, a worldwide research, learning and development organization, is the trusted source of industry knowledge, helping more than 850 insurance and financial services companies in 64 countries. Follow at @LIMRA and @LIMRANewsCenter.