57% Of Americans Have Less Than $1,000 In Savings

September 21, 2017 by GoBankingRates

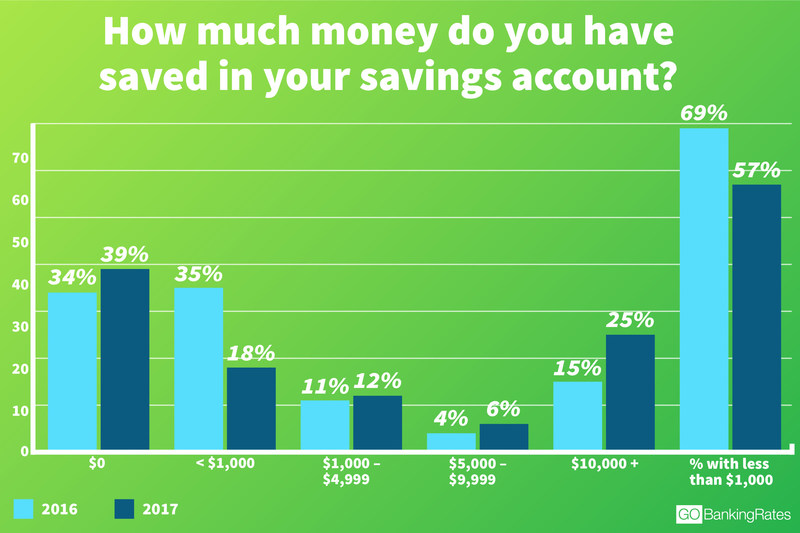

LOS ANGELES, Sept. 12, 2017 /PRNewswire/ — More than half of Americans have less than $1,000 in savings, a new survey found. In fact, 39 percent of survey respondents said they had no money set aside in savings at all.

For the second consecutive year, personal finance website GOBankingRates asked more than 8,000 Americans how much money they have in their savings accounts. The results revealed that 57 percent of Americans have less than $1,000 in savings — a significant improvement from a similar survey in 2016, which found that 69 percent of respondents had less than $1,000 set aside.

However, the percentage of people with $0 in savings has climbed to 39 percent from 34 percent in 2016. The data is broken down state by state to determine which states had the highest percentage of Americans with little to no savings.

Respondents could choose one of the following answers:

- $0

- Less than $1,000

- $1,000-$4,999

- $5,000-$9,999

- $10,000 or more

For full study results and more details on methodology, visit: More Than Half of Americans Have Less Than $1,000 in Savings in 2017.

States With the Highest Percentage of Residents With $0 in Savings

1. Washington, D.C.

- 48 percent of residents have $0 in savings

2. Massachusetts

- 48 percent of residents have $0 in savings

3. Hawaii

- 47 percent of residents have $0 in savings

4. Wyoming

- 47 percent of residents have $0 in savings

5. New Mexico

- 47 percent of residents have $0 in savings

States With the Highest Percentage of Residents With $10,000 or More in Savings

1. Kansas

- 38 percent of residents have $10,000 or more in savings

2. Washington

- 35 percent of residents have $10,000 or more in savings

3. New Jersey

- 34 percent of residents have $10,000 or more in savings

4. North Dakota

- 34 percent of residents have $10,000 or more in savings

5. Kentucky

- 32 percent of residents have $10,000 or more in savings

Additional Study Insights

- Sixty-seven percent of young millennials have less than $1,000 in savings — down from 72 percent in 2016. Sixty-one percent of older millennials now have less than $1,000 in savings, compared with 67 percent in 2016.

- The percentage of young Gen Xers with less than $1,000 saved fell 18 percentage points this year.

- Thirty-three percent of baby boomers say they have $0 saved.

- Men have more savings than women, overall. Sixty-two percent of women say they have less than $1,000 in savings versus 52 percent of men.

About GOBankingRates

GOBankingRates.com is a personal finance news and features website dedicated to helping visitors live a richer life. From tips on saving money, to investing for retirement or finding a good interest rate, GOBankingRates helps turn financial goals into milestones and money dreams into realities. Its content is regularly featured on top-tier media outlets, including MSN, MONEY, AOL Finance, CBS MoneyWatch, Business Insider and dozens of others. GOBankingRates specializes in connecting consumers with the financial institutions and products that best match their needs. Start your journey toward a rich mind and full wallet with us here.

Contact

Kim Dahlgren, Media Relations

GOBankingRates.com

kimd@consumertrack.com

310-297-9233 x138

SOURCE GOBankingRates

Related Links

http://www.gobankingrates.com