U.S. life and health insurance industry direct premiums expect decline for the first time in four years

July 25, 2017 by S&P Global Market Intelligence

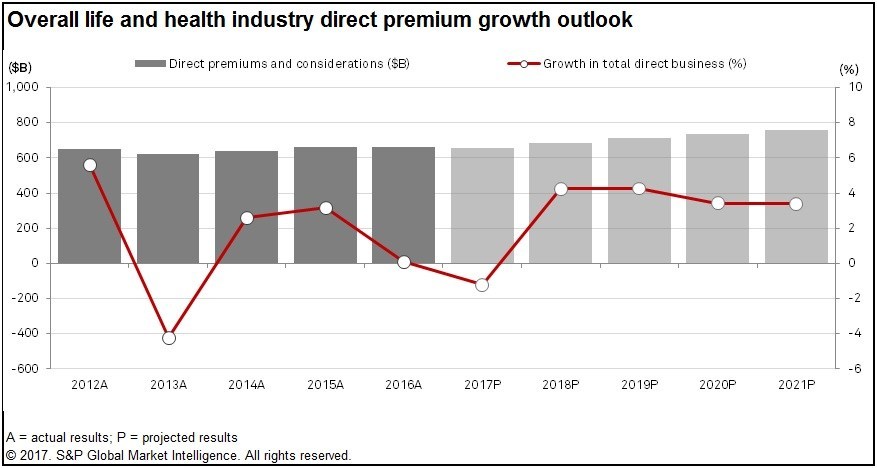

NEW YORK, July 25, 2017 /PRNewswire/ — U.S. life and health insurance industry direct premiums and considerations will decline for the first time in four years in 2017 as regulatory uncertainty stymies sales of certain types of individual annuities, a new S&P Global Market Intelligence report projects. The 2017 U.S. Life and Health Insurance Market Report, which is the first forward-looking life and health insurance analysis of its kind for S&P Global Market Intelligence, provides a comprehensive five-year outlook on U.S. life, annuity and accident and health premium volumes.

Tim Zawacki, senior insurance research analyst of S&P Global Market Intelligence said, “Though key demographic trends bode well for the continued expansion of products such as life insurance and annuities over the longer term, a lack of clarity from Washington, D.C. on certain regulatory matters is putting significant pressure on sales of certain types of products in the near term.”

Direct premiums and considerations across the life, annuity and accident and health business lines were approximately $654.6 billion in 2017, down 1.2% from 2016’s record result of $662.6 billion. In subsequent years, S&P Global Market Intelligence projects low- to mid-single digit percentage growth in direct premiums and considerations in reflection of an expected rebound in annuity sales. Moreover, as a result of slumping sales stemming from a lack of clarity regarding the Trump administration’s plans for the Labor Department’s fiduciary rule, the report projected a decline in ordinary individual annuity considerations of 11.5%.

Additional findings in the 2017 U.S. Life and Health Insurance Market Report include:

- Low-single-digit growth in direct life insurance premiums, including 2.2% in 2017.

- First-year and single-premium direct premiums and considerations are projected to fall by 6.3% – faster than overall direct premiums and considerations – reflecting S&P Global Market Intelligence’s view of the effect of lower sales of indexed and variable annuities.

- The aging of the American population and the challenges associated with saving for retirement will continue to drive demand for many of the industry’s products.

- The supply of solutions the industry offers will continue to be constrained by profitability concerns in a low interest rate environment as demonstrated by plunging sales of individual long-term care policies.

For an executive summary of the report with additional analysis and charts, please click here. To learn more about S&P Global Market Intelligence in-depth sector coverage of the insurance industry, please click here.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. Accurate, deep and insightful. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence a division of S&P Global (NYSE: SPGI), provides essential intelligence for individuals, companies and governments to make decisions with confidence. For more information, visit www.spglobal.com/marketintelligence.

SOURCE S&P Global Market Intelligence