Wink, Inc. Releases First Quarter, 2017 Life Sales Results

June 13, 2017 by Press Release

— FOR IMMEDIATE DISTRIBUTION —

NEWS RELEASE

A Record-Setting First Quarter for Indexed Life Sales!

Wink, Inc. Releases First Quarter, 2017 Life Sales Results

Pleasant Hill, Iowa. June 12, 2017– One hundred life insurance carriers participated in the 79th edition of Wink’s Sales & Market Report. Wink’s Sales & Market Report, the insurance industry’s #1 resource for indexed life insurance sales data since 1997, recently expanded to include fixed universal life (UL) and whole life product lines.

Total first quarter non-variable universal life sales were over $930.3 million. Non-Variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for non-variable universal life sales in the first quarter included Prudential Companies ranking as the #1 carrier overall for non-variable universal life sales, with a market share of 6.0%. Transamerica took the second position while Pacific Life Companies, National Life Group, and Protective Life Companies rounded out the top five carriers in the market, respectively. Transamerica’s Transamerica Financial Foundation IUL was the #1 selling product for non-variable universal life sales, for all channels combined, in the first quarter.

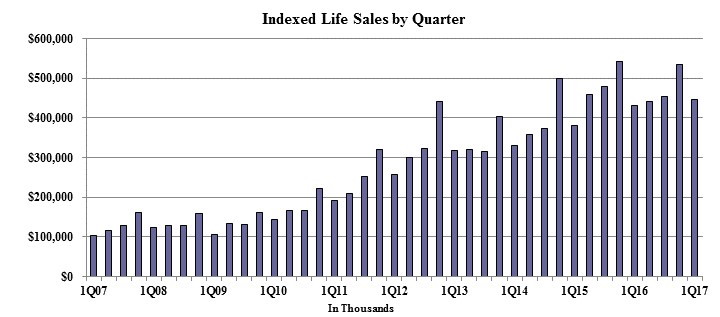

First quarter indexed life sales were $446.5 million; a figure that was down more than 16.4% when compared with the previous quarter, and up over 3.4% as compared to the same period last year. “This quarter, indexed life insurance sales were greater than they have ever been in any first quarter, since their introduction 20 years ago!” exclaimed Sheryl J. Moore, President and CEO of both Moore Market Intelligence and Wink, Inc. She added, “I don’t find the sales decline from last quarter remarkable; that is just a cyclical trend in sales of life insurance products.”

Items of interest in the indexed life market this quarter included Transamerica retaining the #1 ranking in indexed life sales, with an 11.2% market share. Pacific Life Companies, National Life Group, Minnesota Life-Securian, and Nationwide completed the top five sellers, respectively.

Transamerica Premier Financial Foundation IUL was the #1 selling indexed life insurance product for the thirteenth consecutive quarter. The top pricing objective for sales this quarter was Cash Accumulation, capturing 78.7% of sales. The average indexed life target premium reported for the quarter was $8,865, an increase of more than 2.0% from the prior quarter.

First quarter fixed UL sales were $484.6 million. Noteworthy highlights for fixed universal life in the first quarter included Prudential Companies ranking as the #1 carrier overall for UL sales, with a market share of 8.4%. Protective Life Companies came in at #2 followed by Symetra Financial, Lincoln National Life, and AIG, completing the top five carriers in the market, respectively.

Pruco Life’s PruLife Universal Protector was the #1 selling product for fixed universal life sales, for all channels combined, in the first quarter. The top pricing objective for sales this quarter was No Lapse Guarantee, capturing 71.1% of sales. The average UL target premium reported for the quarter was $11,557.

First quarter whole life sales were $933.1 million. Items of interest in the whole life market included Massachusetts Mutual Life taking the #1 ranking in whole life sales with a 15.2% market share. Mutual of Omaha, Transamerica, Penn Mutual and Americo rounded out the top five companies for whole life sales, respectively.

Penn Mutual’s Guaranteed Choice Whole Life was the #1 selling whole life product for whole life sales, for all channels combined, in the first quarter. The top pricing objective for sales this quarter was Cash Accumulation, capturing 66.0% of sales. The average annual premium per whole life policy reported for the quarter was $3,305.

Additional product lines will be added to Wink’s Sales & Market Report, via their quarterly sales survey in upcoming quarters. Immediately, the firm will focus on increasing participation with their current product lines of indexed universal life, traditional universal life, indexed whole life, and traditional whole life product sales. Looking-forward, Wink anticipates reporting on sales of term life insurance as well as variable life and variable UL.

****

For more information, go to www.LookToWink.com

The staff of Moore Market Intelligence has the combined experience of nearly four decades working with indexed insurance products. The firm provides services in speaking, research, training, product development, and marketing of indexed annuities and indexed life insurance. Their knowledge in product filing research and policy forms analysis, coupled with their unmatched resources in insurance distribution, give them the expertise to provide competitive intelligence that allows carriers to stay ahead of their competition.

Sheryl J. Moore is president and CEO of this specialized third-party market research firm and the guiding force behind the industry’s most comprehensive life insurance and annuity due diligence tools, AnnuitySpecs and LifeSpecs distributed by Wink, Inc. Ms. Moore previously worked as a market research analyst for top carriers in the indexed life and annuity industries. Her views on the direction of the market are frequently heard in seminars and quoted by industry trade journals.

Ms. Moore is the author of the quarterly Wink’s Sales & Market Report. Serving as the insurance industry’s #1 resource of indexed insurance product sales since 1997, this report provides sales by product, company, crediting method, index, distribution, surrender charge period, and more. Wink’s Sales & Market Report expanded to cover all fixed deferred annuity products in 2015 and all non-variable cash value life insurance products in 2017.

Wink, Inc. is the company that distributes resources such as this sales report, along with the competitive intelligence tools AnnuitySpecs and LifeSpecs at www.LookToWink.com.

June 12, 2017

Pleasant Hill, IA

(855) ASK-WINK

updated 7/6/2017