Annual Industry Checkup—Financial Institutions Battle DOLHeadwinds

March 23, 2017 by Kehrer Bielan Research & Consulting

Tim Kehrer and Ken Kehrer Kehrer Bielan Research & Consulting (KBR&C)

Sponsored by: Bank Insurance & Securities Association (BISA)

The 2016/2017 Annual Industry Checkup provides a yearly review of the health of the investment services industry in banks and credits unions. This year, the Annual Industry Checkup is sponsored by BISA. Below are key findings and highlights.

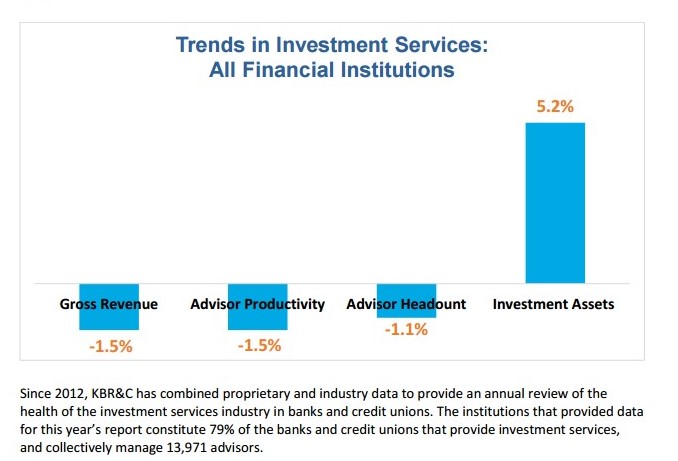

Fighting headwinds from the massive disruption of anticipating, understanding, and implementing the Department of Labor’s Fiduciary Standard for retirement accounts, financial institutions experienced small declines in gross investment services revenue and revenue per advisor during 2016.

Financial institutions increased investment assets under administration by more than 5%, but that was generally less than increases in market valuation of assets during the year. The S&P 500 Index was up 10%.

One bright spot in the Checkup—a growing number of US households can obtain investment services where they bank:

The share of banks and credit unions selling investments continues to climb.

The number of banks offering investments continues to shrink, but the banking industry is consolidating faster, so the banks in the investment services business are getting bigger and now account for 82% of core bank deposits. But financial institutions have had difficulty recruiting and keeping enough advisors to fully exploit this opportunity:

The number of advisors in financial institutions was down slightly, after a small increase during the previous year. Recruiting success is offset by a high attrition rate.