Retirees’ Social Security COLA raise in 2017: $3 a month?

October 18, 2016 by Jennifer Oppenshaw

It’s surprising that even though this year’s presidential candidates are over 65 — making them the oldest major party nominees in our nation’s history — we haven’t heard more about Social Security in the debates.

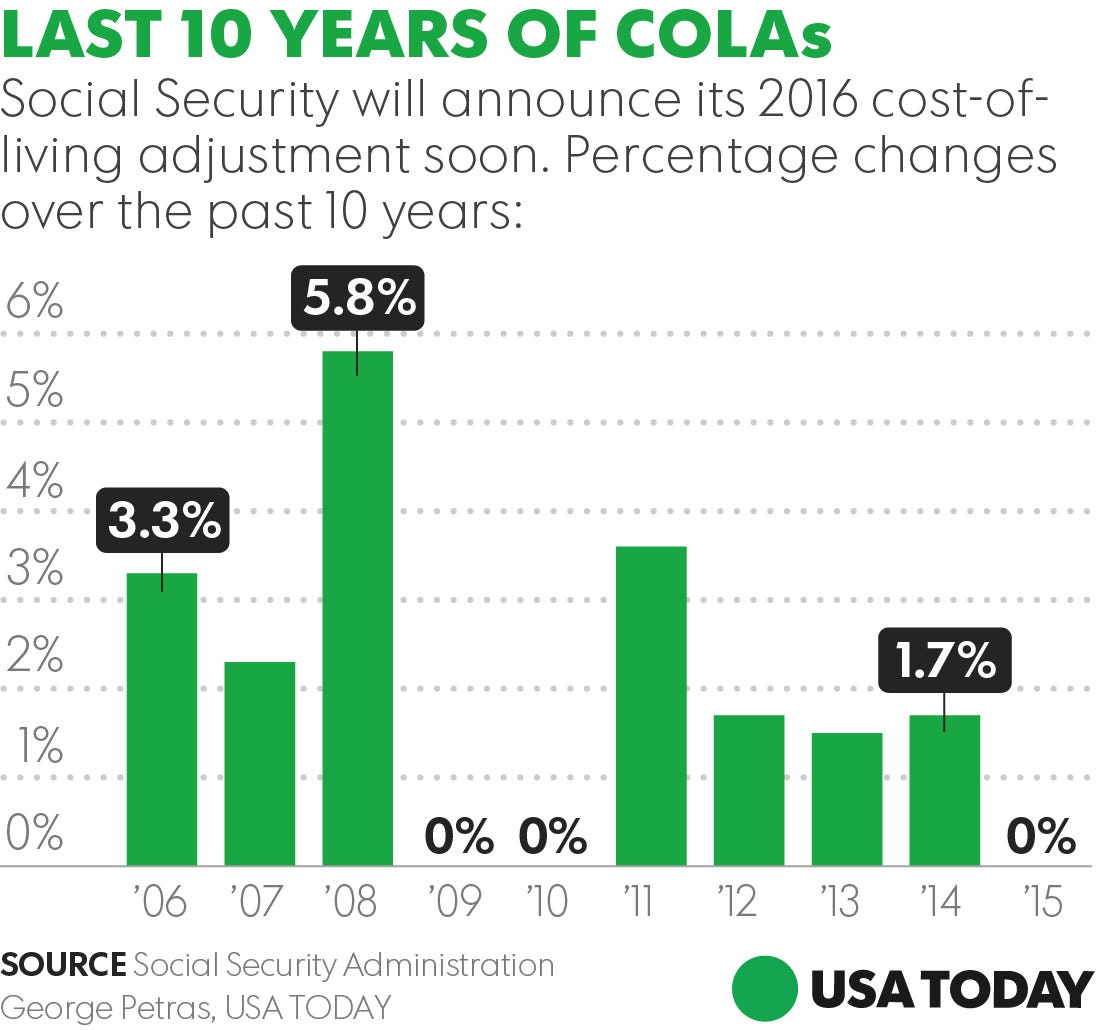

Americans, like my own 74-year-old mother, are wondering exactly what Donald Trump and Hillary Clinton’s plans are. In the meantime, they’re anxiously awaiting word on the Social Security Cost of Living Adjustment for 2017, which could come as soon as Tuesday. Early projections peg it at 0.2%, among the smallest increases in the program’s history.

“Last year, we didn’t have an increase,” she told me recently. It was only the third time since COLA’s inception in 1975 that has happened. “But it’s important every year because things like my rent go up, no matter what.”

The adjustment — based on a formula tied to the consumer price index — is designed to help benefit checks for retirees, widows and the disabled keep pace with the rising costs of goods and services. TheSocial Security Trustees report in June projected the 0.2% increase for 2017, but there’s a chance it might be more than double that. Based on updated calculations that take the July and August CPI-W figures into consideration, it may be about 0.5%.

“People feel a bigger COLA is better, obviously,” said David Certner, legislative policy director for AARP. “But if you’re getting a bigger COLA and prices are rising faster, you’re not necessarily better off.”

Impact on retirees, women & workers

Millions of Americans — from retirees to those working full-time — will be affected by the likely adjustment. Here’s how:

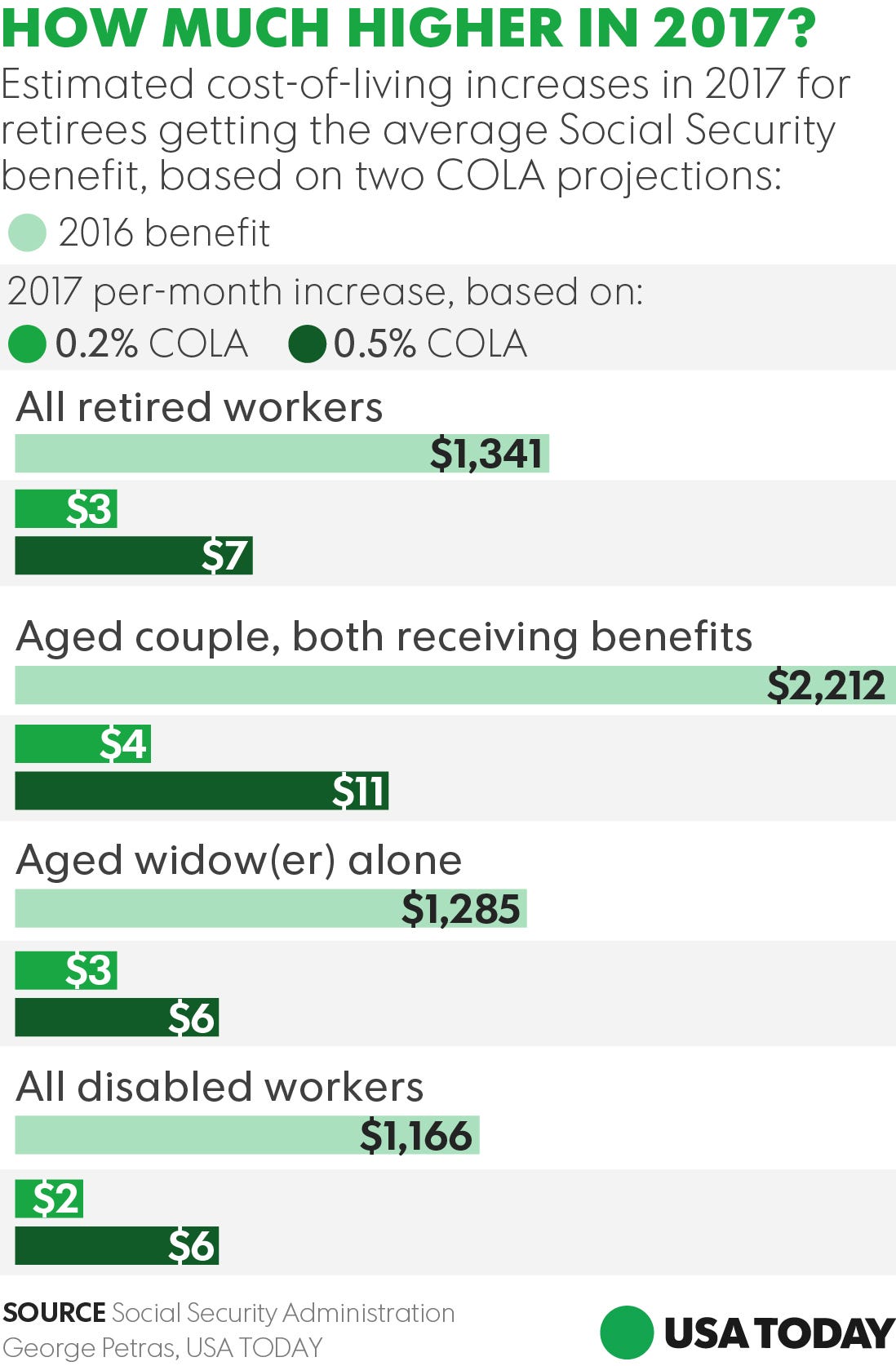

- Social Security & Disability benefit checks. Those people counting on their Social Security checks are likely to see them rise by just a few dollars per month — $3 if there’s a 0.2% increase and $7 at 0.5% — for retired workers getting an average benefit of $1,341.

- Working retirees. Also likely to be affected are those working to generate income while receiving Social Security benefits. Those who are working but haven’t yet reached their full retirement age (currently 66) can still receive full Social Security benefits so long as their income does not exceed $15,720. But that cap would also increase with any Social Security adjustment, enabling retirees to earn more before they see a reduction in their benefits.

- Payroll taxes paid by employees. Any adjustment will also affect the millions of working Americans who contribute to Social Security through payroll deductions. That’s now 6.2% on earnings up to $118,500 for 2016, but a higher COLA could raise this income cap.

Women bearing the brunt

Because they represent 57% of all Social Security beneficiaries 62 and older, women are likely to take the brunt of only a small increase.

“Women tend to have lower Social Security benefits and are less likely to have pensions or other sources of income,” Certner said. “So, for them, the COLA is a lot more important.”

Cindy Hounsell, president of Women’s Institute for a Secure Retirement, points out that too many women are taking benefits early out of necessity but that any increase is better than nothing.

“Women often don’t have choices,” Hounsell said. “They have these shocks, like divorce, widowhood and loss of a job. So the minute they turn 62, they jump on it. But by the time they’re in their 70s or 80s, they’re really hurting to pay for medications. Obviously, anything helps, but it won’t be enough for the majority who don’t have enough to begin with.”

Seniors losing buying power

Retirees have different spending patterns than the population as a whole. Health care costs have risen two to three times the rate of inflation and impact seniors disproportionally.

The Senior Citizens League, a non-partisan advocacy group, estimates that seniors have lost 23% of their buying power since 2000. They recommend a COLA formula based on what seniors actually spend their money on. That would more than triple the increase expected for 2017. The effort to change how the COLA is calculated isn’t gaining much headway, though. Three bills were introduced in 2015 and are sitting in committee.

Without some help, more aging Americans, like my mother, are being caught between their fixed incomes and rising costs for housing and medications.

“Even a small Social Security boost would help,” she said. “That seems only fair. I worked my whole life paying into the system.”

While neither presidential candidate, win or lose, will have to worry about paying their rent, we hope once in office they’ll think about those retirees who do.

3 steps to make the most of Social Security:

- Review your Social Security statement.

- Use the Social Security Retirement Estimator to estimate your benefit check in the future.

- Consider delaying your benefits until full retirement age (FRA). This is age 67 for those born in 1960 or after. At this time you’re entitled to full benefits. And if you wait until up to age 70, your benefit will continue to grow – 8% per year for each full year (prorated for months).

Jennifer Openshaw is a nationally known personal finance expert, author, and commentator. Reach her at jennifer@familyfn.com or Twitter: @jopenshaw.