WINK AIDS IN DETERMINING “REASONABLE COMPENSATION”

October 7, 2016 by Wink's RockStars

Wink, Inc.’s AnnuitySpecs Tool

is Strategically Positioned to Aid with DOL Rule Implementation

Pleasant Hill, Iowa. October 6, 2016– How can one determine what is “reasonable compensation” on an annuity?

The Department of Labor issued its final fiduciary rule on April 6, 2016. Among the products that the regulation affects are annuity sales that are funded with qualified monies. Indexed annuities, as a product class, are in the crosshairs of this regulation. This is due to the fact that they were transferred from the 84-24 exemption to the more onerous Best Interest Contract Exemption of the regulation, in the final hour. Interestingly, Wink’s Sales & Market Report indicates that 64% of indexed annuity sales will be affected by the fiduciary rule. As a result, insurance companies have been struggling to interpret the vague regulation for the past six months.

One of the most ambiguous portions of this regulation indicates that “firms and advisers will be required to…charge only reasonable compensation…” This brings us back to our original question of how firms can determine what qualifies as “reasonable compensation.”

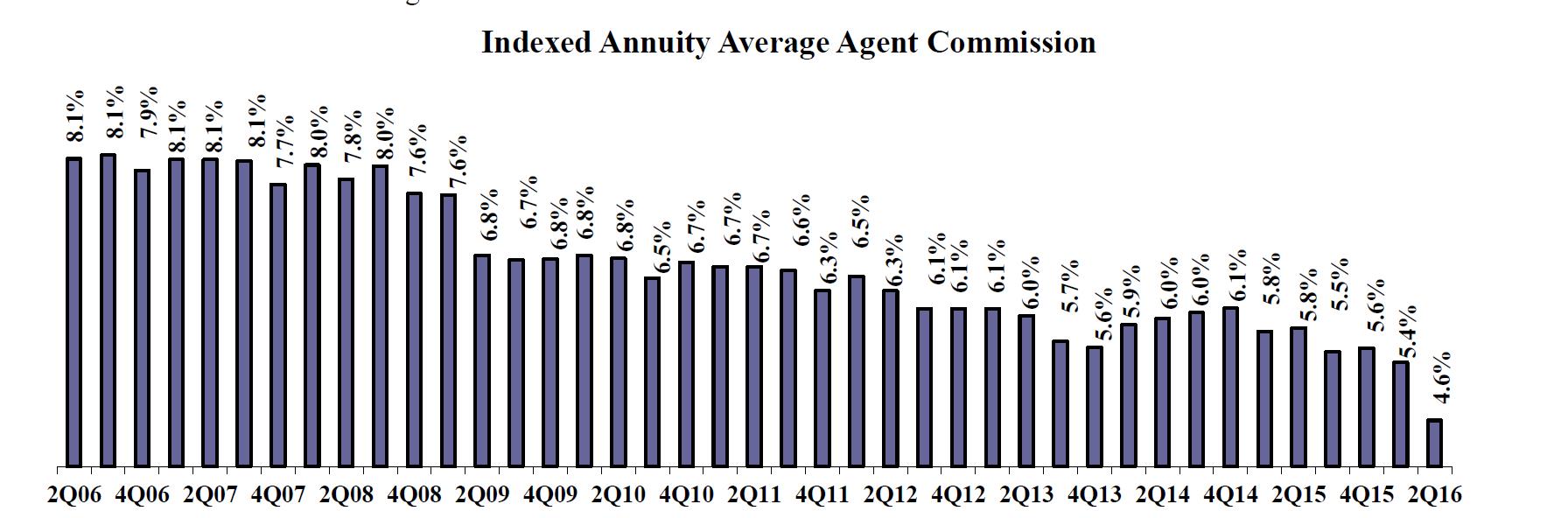

According to Wink’s Sales & Market Report, the average street level compensation for indexed annuities as of 2Q2016 was 4.60%. This is the lowest this figure has been in over a decade.

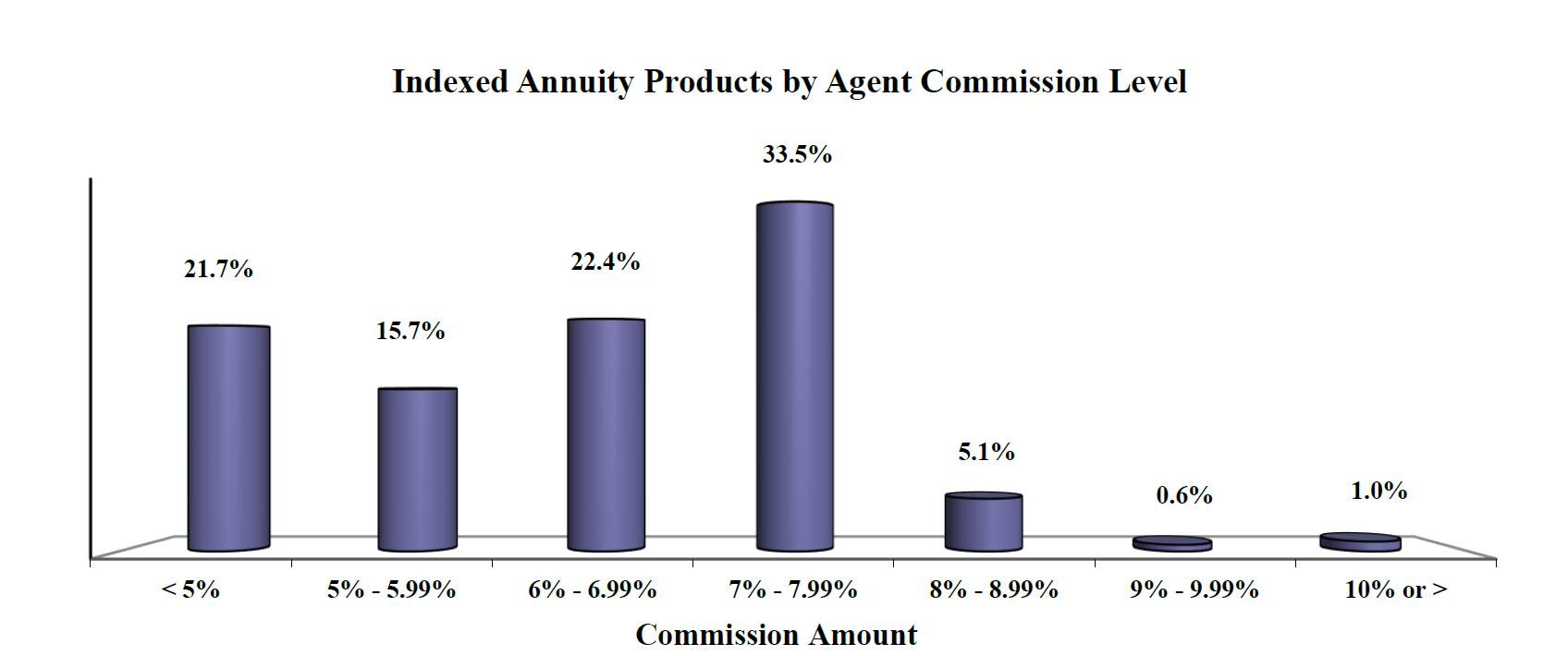

Moore Market Intelligence, a firm that consults on indexed insurance products, tracks product features for every indexed annuity available in the country. According to the firm’s research, commissions on indexed annuities range from 2.00% to 12.00%, but the majority of products pay a commission in the 7.00% – 7.99% range. This commission is generally 50% lower for older-aged annuitants.

The staff of both Wink and Moore Market Intelligence have received reports that insurance companies are engaging expensive consulting and actuarial firms, in order to obtain compensation information on indexed annuities, so that they can perform their due diligence in regards to “reasonable compensation.” Wink wants insurance company personnel to know that their employer is likely already paying for a resource that houses detailed commission information on thousands of annuities. Wink’s AnnuitySpecs tool can be found at www.LookToWink.com, and breaks down annuity commissions by commission option, age, and whether the money is qualified or non-qualified.

Sheryl J. Moore, president of the market research and the consulting firm, had this to say, “Insurance companies have already paid for an inexpensive tool that can aid their efforts with the fiduciary rule. This may be the best news they’ve received all year!”

…………………………………………………………………………….

For more information, go to www.LookToWink.com

The staff of Moore Market Intelligence has combined experience of nearly four decades working with indexed insurance products. The firm provides services in speaking, research, training, product development, and marketing of indexed annuities and indexed life insurance. Their knowledge in product filing research and policy forms analysis, coupled with their unmatched resources in insurance distribution, give them the expertise to provide competitive intelligence that allows carriers to stay ahead of their competition.

Sheryl J. Moore is president and CEO of this specialized third-party market research firm and the guiding force behind the industry’s most comprehensive life insurance and annuity due diligence tools, AnnuitySpecs and LifeSpecs distributed by Wink, Inc. Ms. Moore previously worked as market research analyst for top carriers in the life insurance industry. Her views on the direction of the life insurance and annuity markets are frequently heard in seminars and quoted by industry trade journals.

Ms. Moore is the author of the quarterly Wink’s Sales & Market Report. Serving as the insurance industry’s #1 resource of indexed insurance product sales since 1997, this report provides sales by product, company, crediting method, index, distribution, surrender charge period, and more. Wink’s Sales & Market Report expanded to cover all fixed deferred annuity products in 2015.

Wink, Inc. is the company that distributes resources such as this sales report, along with the competitive intelligence tools AnnuitySpecs and LifeSpecs at www.LookToWink.com.

October 6, 2016

Pleasant Hill, IA

(855) ASK-WINK