What Insurance Industry Can Learn from Amazon About Customer Satisfaction

June 8, 2016 by Gregory Hoeg

Amazon.com scored its sixth annual victory in the 24/7 Wall Street Customer Service Hall of Fame last year, with 59 percent of customers reporting that they received excellent customer service from the e-commerce giant. That score surpassed the number two company on the list, Chick-fil-A, by 12 percentage points.

Why should that matter to the insurance industry? Because it’s the new benchmark for what customers have come to expect in a hyper-connected, global economy, whether they are trying to return a pair of shoes or have to report an insurance claim.

Customer expectations and satisfaction relative to responsiveness are not necessarily set by a company’s competitors in their industry. A customer calling into the contact center of an insurance company will expect the excellent responsiveness they just experienced in their call to Amazon. In many cases the delivery capabilities of all industries are now being measured by standards set by the best performer in that delivery discipline and not the best in that delivery discipline in the same industry.

For the insurance industry this is a particularly critical issue in that the real product from an insurer is service. The relationship between the insurer and the insured, in general, is a promise for the provision of services by the insurer at a time of critical need to the insured. The expectation of timeliness in the provision of that service is not only logical, but supported by the evidence. This is a phenomenon that has shown up at several points in the J.D. Power our 2015 U.S. Auto Claims Satisfaction Study. It found several areas in which responsiveness to the customer were key to their satisfaction. For example, “First Notice of Loss” satisfaction is much higher when claim reports are completed within 15 minutes, satisfaction drops by a significant 54 points when a claim takes more than 15 minutes to report.

Responsiveness is important throughout the entire claim process, including the responsiveness of an insurer related to the first communication of the claim.

In cases where additional contacts are required, claimants are most highly satisfied when a representative is immediately available to assist them with any questions or concerns they may have about their claim, with satisfaction declining by 109 points when the claimant is required to wait.

If the claimant’s concern cannot be handled by the representative and they have to wait while their issue is escalated to a manager, satisfaction declines further (107 points compared with claimants that don’t have to have their issue escalated). Further we found that claims professionals should contact claimants within one day after the First Notice of Loss to ensure highest satisfaction. When claimants have to wait three days or more, satisfaction plummets by over 100 points.

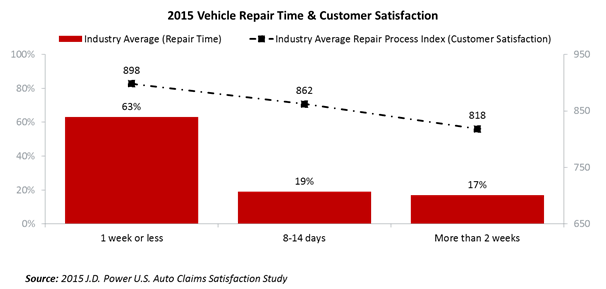

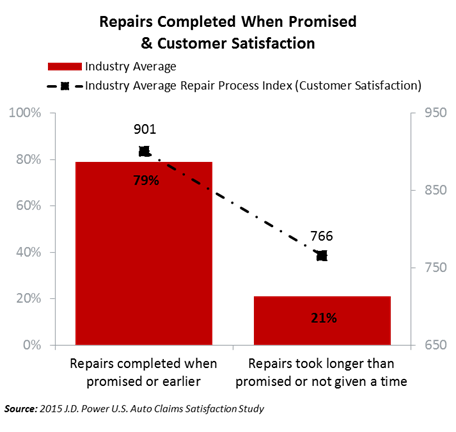

Providing accurate estimates of how long each step in the claim process will be is also critical to customer satisfaction. Overall satisfaction scores were 135 index points higher when repairs were completed in the estimated window given at the onset of the claim versus those that took longer than promised. The same is true for the overall claim process.

The importance of responsiveness in the insurance claims experience to customers cannot be overestimated. Not only does common sense tell us that customers prefer to have their claims handled and completed quickly, but the data bears this out.

Gregory Hoeg

JD Power

The challenge for insurers is how to manage the process in such a way as to maintain quality while providing service at a pace that will favorably impress customers who are used to instant responses and services in many of their daily interactions with various businesses. Insurers must identify how they can leverage developing technologies to improve customer service delivery and workload management. Also, because insurers must rely on outside service vendors in much of the claim process for auto and homeowners insurance, such as repair shops and building contractors, they need to align themselves with partners that also will recognize the value of responsiveness.

If a customer believes you are wasting their time or not responding to their needs promptly enough you stand a good chance you will lose them as a customer.

Hoeg is vice president, J.D. Power Insurance Practice