What insurers expect in 2016, according to A.M. Best survey

April 4, 2016 by Phil Gusman

Insurers across all sectors — Property & Casualty, Life/Annuity and Health — shared their views on a range of topics from the economy to competition in the industry in A.M. Best’s Winter 2015/2016 Insurance Industry Survey.

The survey comes as Oldwick, N.J.-based ratings agency A.M. Best maintains negative outlooks on the Commercial Lines, Reinsurance and Health segments, and stable outlooks on Personal Lines, Life/Annuity and Life Reinsurance.

Michelle Baurkot, assistant vice president at A.M. Best, says the outlook for Commercial Lines has been negative for some time, and while A.M. Best expects most ratings actions to be affirmations, rates are under pressure and concerns remain regarding the industry’s reserve levels.

For Reinsurance, despite no large catastrophes in recent years, Baurkot says the combined ratio has been creeping up, and challenging conditions in the marketplace are putting pressure on margins. Health insurers, meanwhile, face challenges associated with earnings pressure and the Affordable Care Act (ACA).

The majority of the survey’s respondents themselves, though, anticipate conditions across all segments to be stable, except for Health, where nearly 55% view conditions as negative.

Asked about the leading disruptors over the next five years, the most common responses were economic events (22.6%), capital markets (14.5%) and political events (13.4%).

Related: Trump most favorable to insurance industry, according to A.M. Best survey

A.M. Best says its survey is based on several hundred responses from P&C (70.4%), Life/Annuity (22.2%) and Health insurers (5.3%). The remaining 2.1% identified as Surety, Reinsurance, Credit and Term, or Title Insurance.

Keep reading to see what insurers are talking about most, what they expect for 2016 and how they plan to succeed.

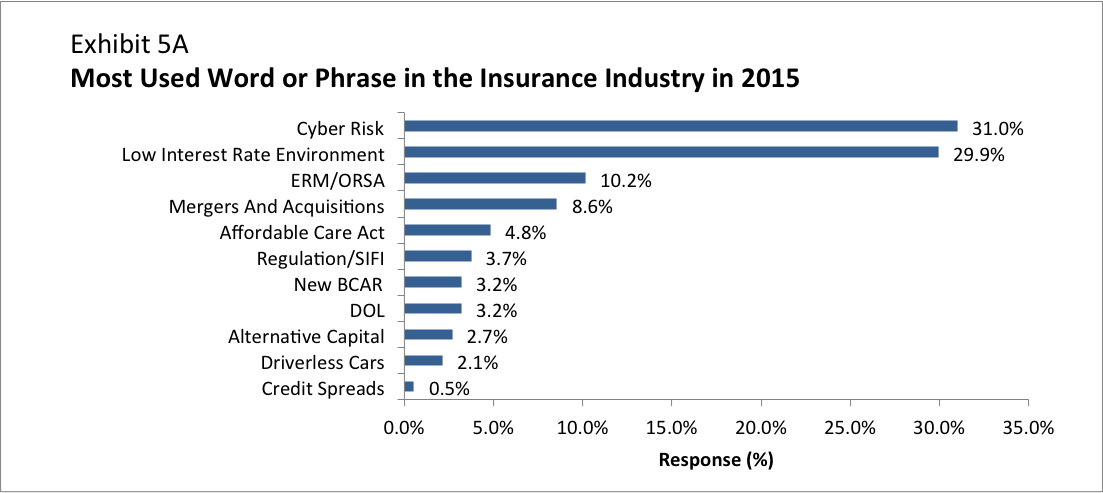

Thirty-one percent of respondents cited “cyber risk” as the most-used word or phrase for 2016.

What’s the industry talking about?

Cyber risk was top of mind for the insurance industry in 2015, with 31% of respondents citing it as the most-used word or phrase for the year. Baurkot says that has been the biggest change since last year. “Cyber risk shot right up,” she says.

While there has been no major change in the Cyber landscape over the last year — there are large-scale breaches in the news just as there have been for the last several years — Baurkot says perhaps being exposed to this rapidly evolving risk for one more year has companies thinking about the insurance implications.

For P&C insurers, Baurkot says Cyber is likely top-of-mind as they look into developing products to sell. And P&C insurers were most likely to mention Cyber as the top buzzword of 2015 (34.6%). But many Life/Annuity (28.6%) and Health insurers (10%) also cited Cyber as the most-discussed word. Baurkot says the survey did not get into what in particular each company discussed with respect to the most-used buzzwords, but she says for Life/Annuity and Health insurers, discussions around Cyber probably involved protecting their own information and data as breaches become more common and extensive.

The low interest rate environment placed second behind Cyber as the most-used phrase in the insurance industry, at 29.9%, down only slightly from last year, according to Baurkot. It ranked first (40%) for Life/Annuity and Health insurers (30% — tied with the ACA), and second (25.4%) for P&C insurers.

Baurkot says other topics of discussion that ranked high last year, such as Enterprise Risk Management/Owned Risk and Solvency Assessment and the ACA, were not as prominent this year, although, the ACA was top-of-mind for health insurers (30%) even if it was far lower down on the list for the insurance industry overall (4.8%).

Regarding the ACA, Baurkot says much of the discussion last year was likely over the uncertainty. “This year,” she says, “it looks like it’s playing out — maybe not ideally — but I think people can see what the expectation is, so that may have been why it dropped off a little bit from last year.”

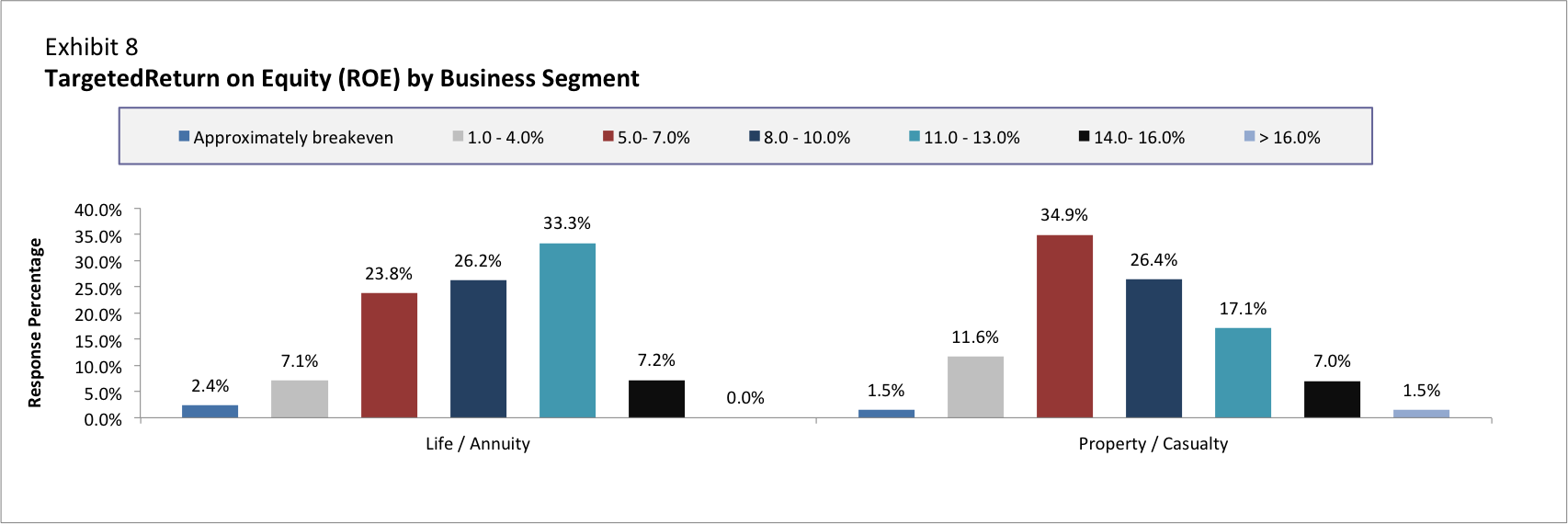

Forty-eight percent of P&C carriers expect returns on equity of 7% or less.

Targeted returns for 2016

Forty-six percent of insurers expect returns on equity between 8% and 13%, while just 9.2% expect returns over 14%. Life/Annuity insurers were more optimistic than P&C carriers. For P&C, 48% expect returns of 7% or less, compared to 33.3% of Life/Annuity companies. Meanwhile, 40.5% of Life/Annuity companies expect returns on equity of 11% or more compared to 25.5% of P&C companies.

Baurkot says expectations have fallen “quite a bit” in recent years, with a significant downward trend since 2014. This year, she says there was a lot more focus on what the Fed would, or would not, do on interest rates, “and that could have an impact on thoughts on interest rates and likewise targeted returns on equity.”

Mergers and acquisitions activity hit record highs in 2015, and is expected to continue to be strong this year.

Mergers and acquisitions

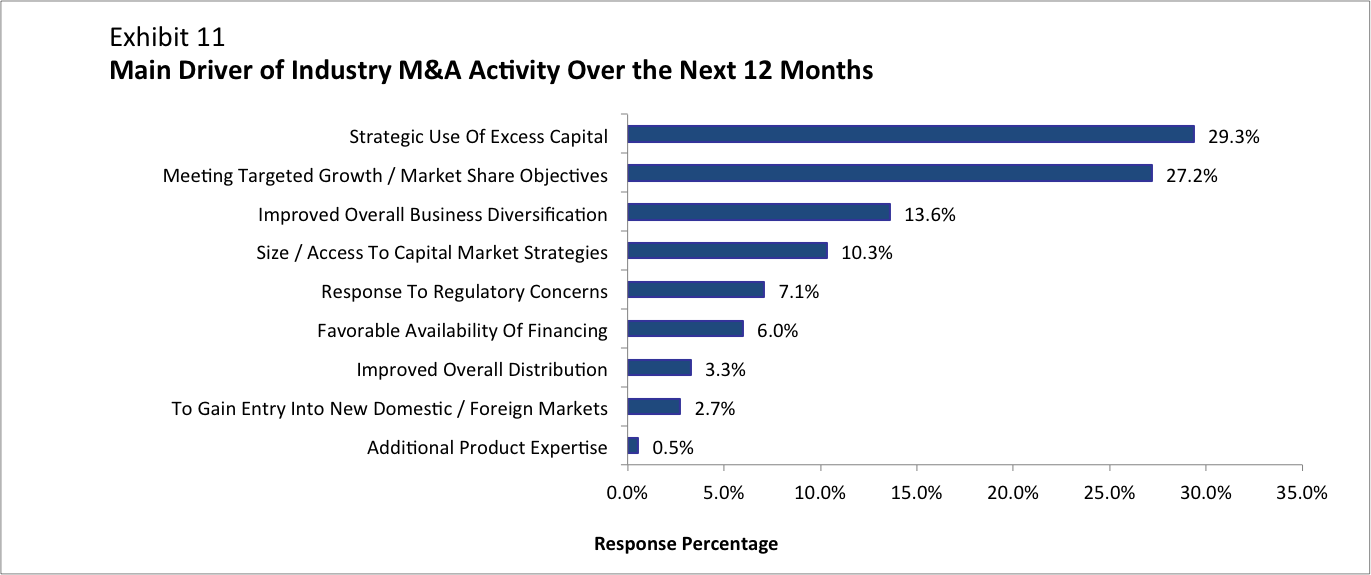

While mergers and acquisitions (M&A) interest is higher for larger insurance companies, A.M. Best notes that companies of all sizes are expressing some interest. According to the survey, 66.3% of respondents are considering M&A for various strategic reasons tied to expansion of the business, while 32.6% say they do not plan to participate in any type of M&A this year.

A.M. Best says, “While very few cite regulatory pressures as a driver of M&A interest, we note MetLife’s recently announced sale of its domestic retail advisor force to MassMutual, coming on the heels of MetLife’s challenge of its designation as a non-bank systemically important financial institution by the Financial Stability Oversight Council.”

Asked about the main drivers of industry M&A activity in 2016, 29.3% of insurers cite strategic use of excess capital, and this is certainly the case for P&C insurers, where alternative capital has been flooding into the marketplace.

For primary P&C insurers, Baurkot says they now have much more flexibility when buying reinsurance, “which is making it an expense savings to some extent. If they have savings from shopping around for reinsurance, do they have more capital to use elsewhere?” she asks, noting that looking into a merger or acquisition could be one area to deploy that capital.

For health insurers, Baurkot says the past year was active for M&A, but it was more related to trying to increase scale and diversify products. Meanwhile, Life/Annuity companies, Baurkot says, have been heavily impacted by interest rates, and because interest rates have remained so low for so long, companies have had to decide if they can continue to manage through that environment, or if they should look at combining with other companies.

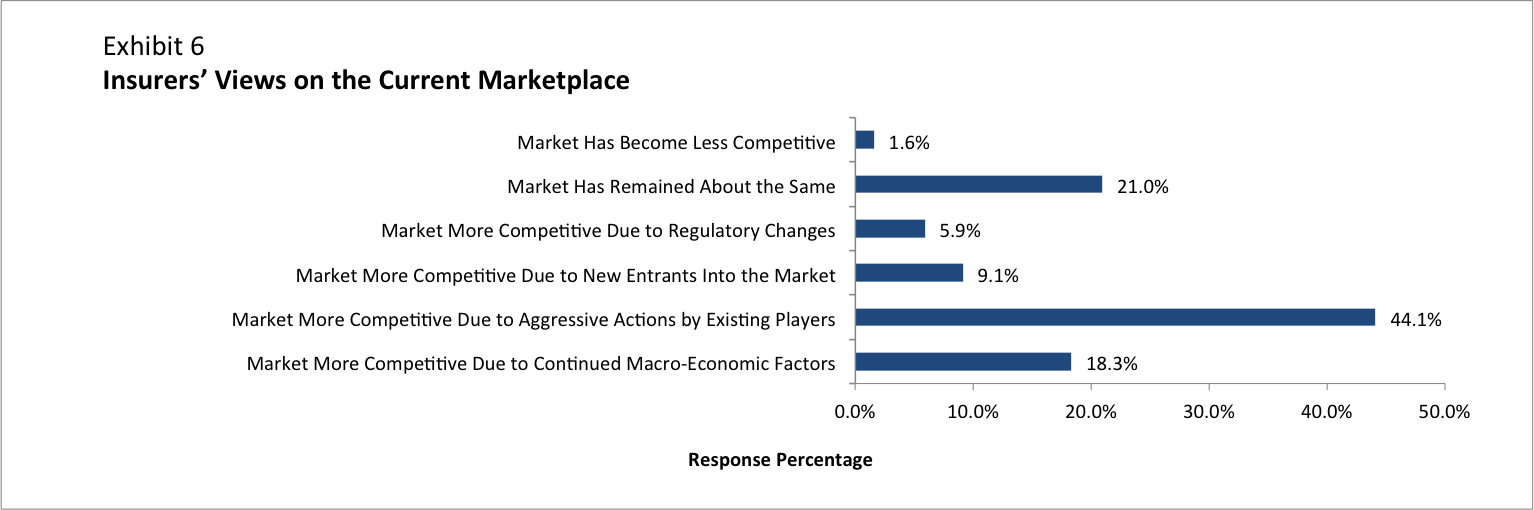

Overwhelmingly, respondents felt that competition in the insurance marketplace is growing more intense.

Competition and the economy

Competition from regulatory changes and from new market entrants decreased in this survey compared to Fall 2015 (from 8.1% to 5.9% and from 11.7% to 9.1% respectively). Meanwhile, competition from existing players jumped from 36% in the fall to 44.1% in the current survey.

For P&C insurers, Baurkot says access to capital may well be playing a role in the increase in competition from existing players, in addition to the current pricing cycle. Rates are low in most lines, fueling competition, she says.

Competition because of macro economic factors also increased from the fall, from 14.3% to 18.3%, and insurers reporting stable conditions dropped from 28.9% to 21%.

On the economy, just 5.4% of insurers say economic conditions will improve this year, while 30.4% expect conditions to deteriorate. Another 46% expect conditions to remain stable. About 80% say GDP growth will be 2% or lower, with 50% saying GDP would grow at 1.5% or less. Just 2.8% say GDP increases would exceed 2.5%.

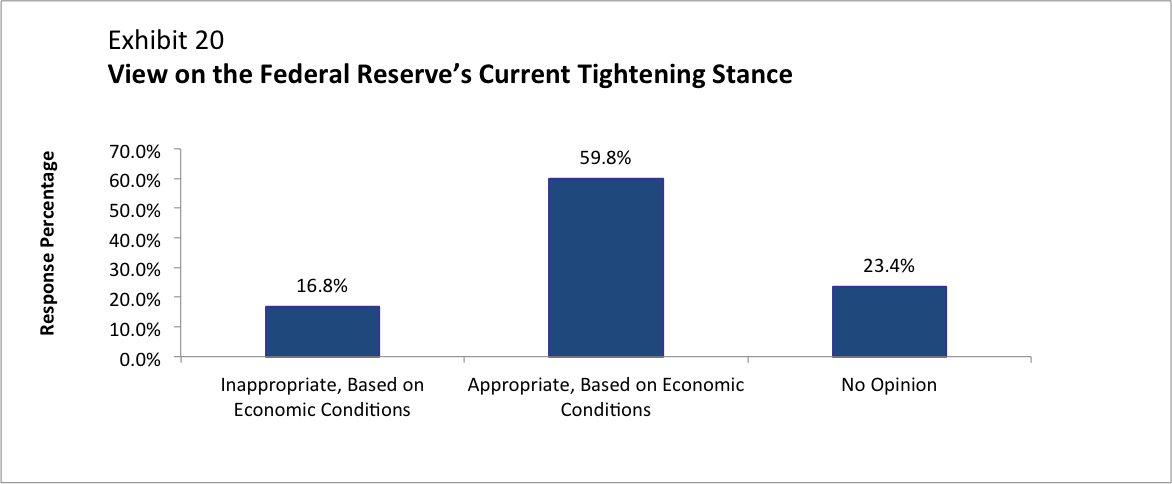

Asked about the Federal Reserve’s current policy based on economic conditions, almost 60% of respondents indicated that the policies were appropriate while 16.8% felt they were not. Most insurers felt that the Fed would tighten interest rates one or two more times this year, with slightly more expecting two hikes than one.

Continue reading …

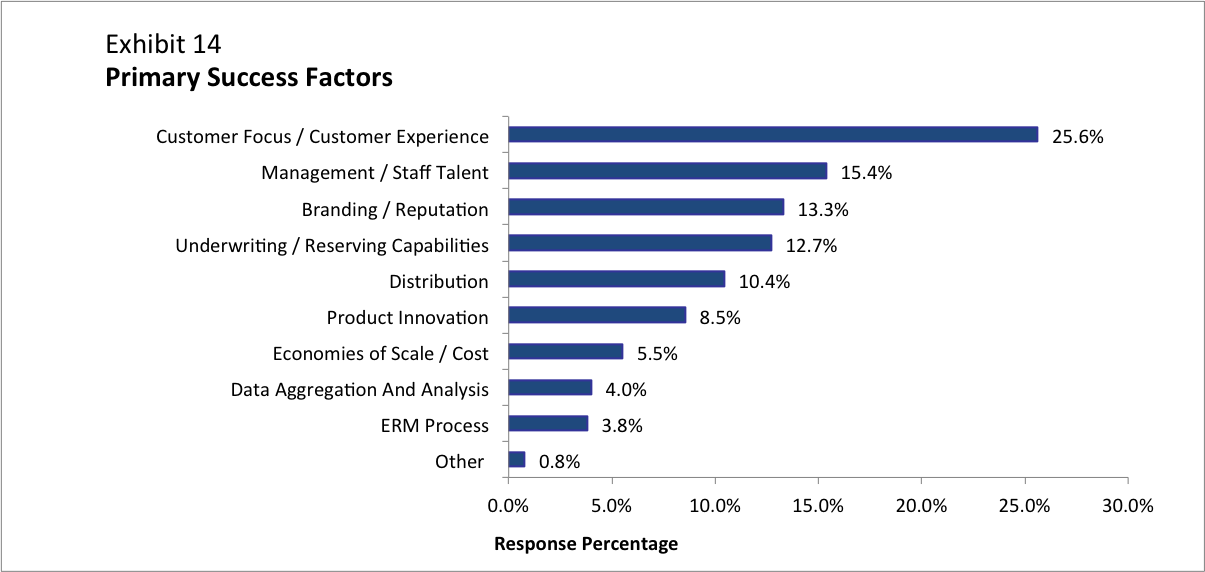

Across the insurance industry, delivering a good customer experience is seen as increasingly paramount to success.

Success factors

Insurers overwhelmingly attribute their success to focusing on customers (25.6%). A.M. Best notes, “As is widely reported, insurers are focusing on their customers through technology. Many recognize that customers increasingly turn to online and mobile platforms to shop for insurance products and carriers are developing seamless, easy-to-use interfaces for those individuals.”

Baurkot says success is all about getting to the customer “no matter where they are and how they want access” — be it through apps on a phone or on a computer. Insurers are working on building out their platforms, apps and tech abilities to meet this demand, she adds.

Other factors insurers cite for their success: talent of management and their staff (15.4%), branding/reputation (13.3%), and underwriting/reserving capabilities (12.7%).

A.M. Best says, “Of note, economies of scale, data aggregation and analysis, as well as a robust ERM process did not appear to be significant.

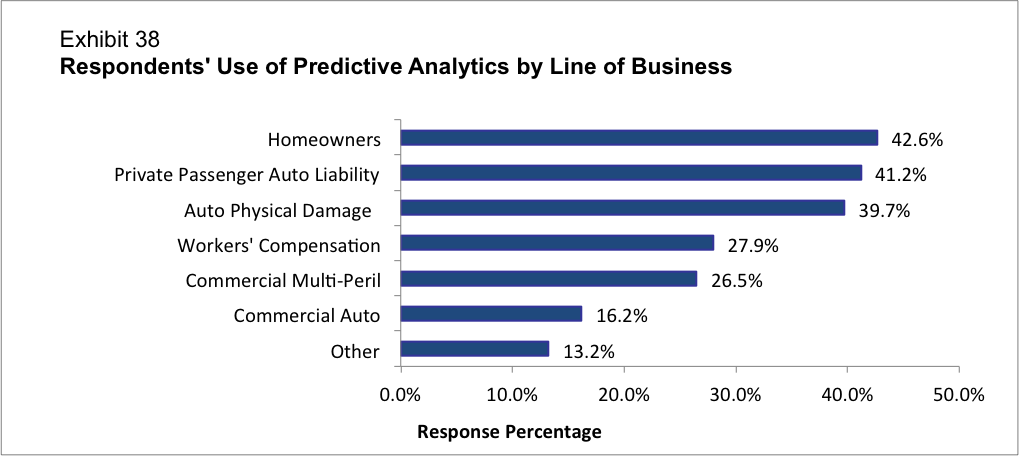

Predictive analytics

Less than half (48.9%) of insurers say they use predictive analytics. For those that do, underwriting was by far the most significant area of focus (82.2%), followed by claims (39.7%).

By line of business, predictive analytics is used most frequently in Homeowners (42.6%) followed by Private Passenger Auto Liability (41.2%) and Physical Damage (39.7%). There is a noticeable drop off to use in Commercial Lines coverages, with Workers’ Comp leading the way (27.9%).