New Data Reveals Millennials Upending Traditional Retirement Saving Strategies

July 29, 2015 by Jamie Johnson

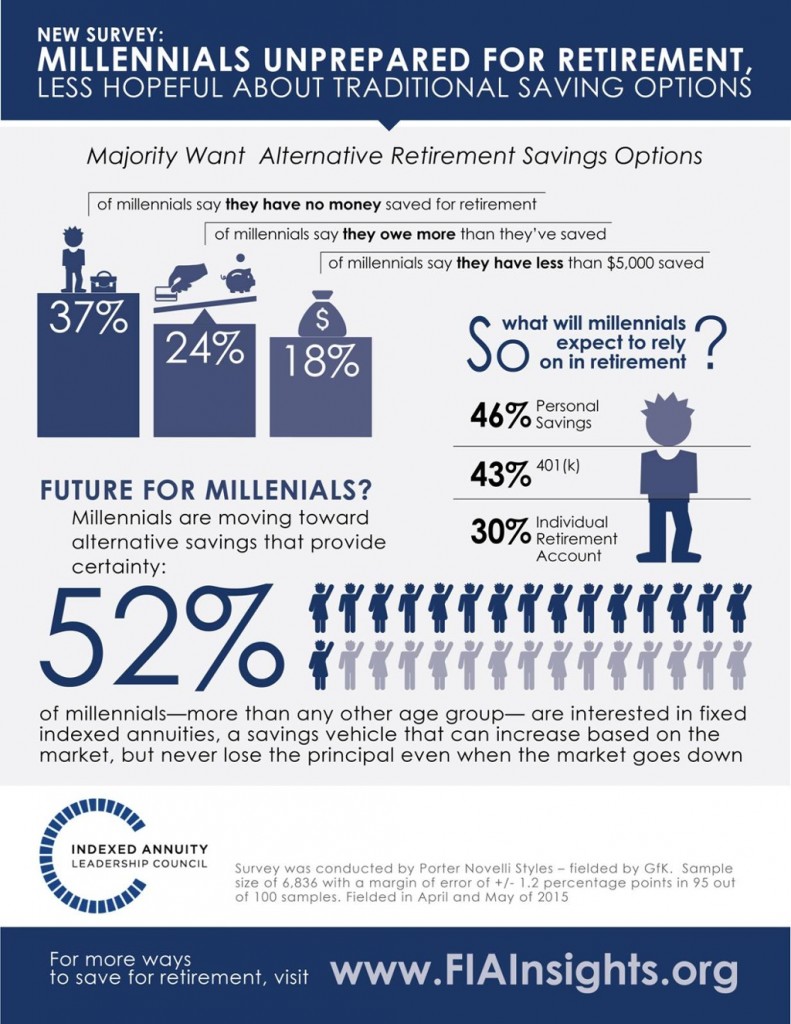

DES MOINES, Iowa–(BUSINESS WIRE)–Newly released, independent research uncovers that millennials are less hopeful about traditional retirement savings products. The study found that a surprisingly large number of millennials, 52 percent, are very or somewhat interested in annuities, indicating that those just starting to save for retirement are planning to depend on alternative retirement savings products.

“It’s no surprise that millennials, who entered the workforce after the tumultuous 2008 economic recession, are interested in products that can provide certainty against the unpredictability of the stock market”

In addition to millennials, the survey, conducted by the Indexed Annuity Leadership Council (IALC), found that people of all age groups are interested in annuities because of the retirement nest egg they can help grow and the long-term financial security they provide. Forty-three percent of all respondents expressed interest in annuities.

“It’s no surprise that millennials, who entered the workforce after the tumultuous 2008 economic recession, are interested in products that can provide certainty against the unpredictability of the stock market,” said Jim Poolman, executive director of the Indexed Annuity Leadership Council. “And, as other demographics are also showing interest in annuities, it is clear that traditional retirement savings vehicles are not meeting the needs of today’s consumers, and they are looking for a product, like a fixed indexed annuity, which can offer confidence and security in this new pay-for-yourself retirement era.”

Other top findings from the IALC survey include:

- Millennials are the least prepared for retirement, with one in three saying they have no money saved for retirement;

- A quarter of 18-34 year olds say they owe more than they have saved;

- While net worth increases with age, the survey found that nearly 10 percent of seniors aged 70+ have less than $5,000 in savings.

The sentiment expressed in the survey results are reflected in annuity sales. Sales of fixed indexed annuities have increased over the past two years. They were up nearly 5 percent in the first quarter of 2015; with total first quarter sales topping $11.3 billion.

The new study complements recent polling for a program called “The Changing Face of Retirement,” which discovered that nearly two-thirds of those 55 and older said they plan to work past 67 for financial reasons.

The IALC survey was conducted using GfK’s KnowledgePanel and was sent to a nationally representative sample of 6,836, and data was collected between April and May of 2015. To view full findings, click here.

For more information about fixed indexed annuities, visit the IALC’s educational website or media center, or follow on Twitter@IALCouncil.

About the Indexed Annuity Leadership Council

The Indexed Annuity Leadership Council (IALC) brings together a consortium of life insurance companies with a commitment to providing consumers, the media, regulators and industry professionals complete and factual information about the use of indexed annuities. Namely, that these products provide a source of guaranteed income, principal protection, and interest rate stability in retirement as well as balance to any long-term financial plan.

Contacts

The Indexed Annuity Leadership Council (IALC)

Tina Beaty, 202-973-2940

tina.beaty@porternovelli.com