Allianz Posts 10.5% Rise in Net Profit

August 11, 2014 by Robert O'Connor

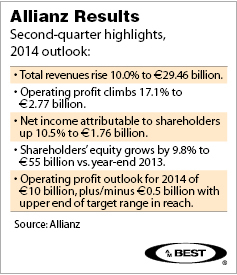

MUNICH – In what it described as a “strong second quarter” performance, Allianz SE reported a 10.5% increase in net profit to €1.76 billion (US$2.35 billion) from €1.59 billion in the same period in 2013.

Second-quarter revenues increased by 10% to €29.46 billion from €26.78 billion. Total revenues in the first six months of the year rose to €63.42 billion, up 7.8% from €58.82 billion in the first half of last year.

Operating profit in the first half of the year was up 6.4% to €5.49 billion from €5.16 billion. Net income attributable to shareholders rose 3% during the first half to €3.4 billion from €3.3 billion.

“The market environment continues to present challenges for customers and financial service providers,” Michael Diekmann, chairman of the board of management, said in a statement. “Our well-diversified business model as well as new solutions for customers enabled us to achieve already 55% of the midpoint of the outlook range in the first six months of 2014.”

Shareholders’ equity increased by 9.8% to €55 billion from €50.08 billion.

Allianz confirmed its expectations of a full-year 2014 operating profit of €10 billion, with a €500 million margin of error. The group also warned that the final results will be influenced by the level of natural catastrophes and the performance of the capital markets.

Allianz said about half its operating profit came from property/casualty, which benefited from a lower incidence of catastrophes.

Buoyed by sales in the United States, Germany and Italy, statutory premiums in life and health rose 20.1% in the second quarter to €16.96 billion from €14.13 billion. Fixed-indexed annuities sales supported an increase in premiums for Allianz Life in the U.S. to €3.35 billion from €1.79 billion.

“We see a continued momentum to buy life insurance products serving the need for old age provisions,” Dieter Wemmer, chief financial officer, said in a statement. “While life insurance still is burdened by increased regulation and the low interest environment, Allianz has reacted with innovative products reflecting the current challenges and these products are in high demand.”

Allianz said its property/casualty operating profit increased by 14.2% in the second quarter to €1.35 billion from €1.18 billion in the first quarter of 2013. Gross premiums written in property/casualty rose by 0.9% to €10.85 billion from €10.75 billion. The performance of the property/casualty account was hit by currency movements, Allianz said.

The property/casualty combined ratio was 94.6, an improvement from 96 in the second quarter of 2013. “Our property and casualty business has seen another successful quarter helped by a comparatively low impact from natural catastrophes and a strict underwriting discipline,” Wemmer said.

Allianz United Kingdom reported a 15.5% growth in premiums. Allianz Germany saw premiums increase by 6%, with contributions from motor and commercial non-motor business. The group also reported growth from Allianz Worldwide Partners and Allianz Global Corporate & Specialty. Allianz Global Corporate & Specialty provides commercial insurance into a global corporate market. Allianz Worldwide Partners seeks to create alliances with global companies that are in need of highly developed insurance expertise.

Allianz said it had encountered “challenges” in Brazil, Russia and Turkey.

Allianz Asset Management reported an 11.5% drop in second quarter operating revenues to €1.61 billion from €1.82 billion. Operating profit dropped 16% to €675 million from €804 million. Allianz cited the effects of the shift in some operations to other parts of the group and foreign exchange movements. “Without these effects, operating revenues would have declined by 5.8% while operating profit would have decreased by 9.7%.” Allianz said.

Allianz Asset Management said total assets under management increased by 4.4% during the second quarter to €1.81 from €1.73 billion. Third party assets under management rose by 3.3% to €1.37 billion from €1.32 billion.

Asset Management’s results were “within expectations,” Wemmer said. “The key for future results is the investment performance,” he added.

In a research note, London-based Bernstein Research said Allianz’s second quarter operating profit was “100% in line with our expectations.”

Allianz’s “robust” performance — and prospects — in property/casualty, life and Asset Management, suggested a a 3% boost to the share price, Bernstein said.

Allianz SE has a current Best’s Financial Strength Rating of A+ (Superior).

(By Robert O’Connor, London editor: Robert.OConnor@ambest.com)