Millennials Not Buying Life Insurance

August 20, 2014 by Thomas Rockford

After a survey we conducted on our site regarding millennial life insurance purchasing habits, we at Life Ant have concluded that the millennial generation is largely avoiding purchasing life insurance. While historical purchase rates of life insurance by people in their 20′s are not available, after consulting with industry experts it appears that fewer people in their 20s are buying life insurance when compared with pre-financial crisis levels. This is leaving this generation deficient on coverage.

The consequences to millennials who do not purchase life insurance at a young age include an increased risk that they will not be insurable when they attempt to buy it for the first time later in life. This very real risk is due to the general tendency for people’s health to decline with age.

They will also almost certainly pay a higher price for their insurance coverage if they wait to buy, because generally speaking, the later in life someone purchases life insurance the more expensive the coverage will be. Most people seek life insurance coverage when they start a family. By delaying the purchase of life insurance, they are increasing the risk that they will not be able to afford the coverage they need, at a period of their lives when the coverage is most valuable to their families.

We think that millennials will be wise to consider purchasing some coverage earlier in life than they currently are on average, which will reduce the risk to their families later in life that they they will be left financially unprotected.

Our Survey

For our study we surveyed 240 self identified members of the millennial generation. Broken down by sex, 172 of the respondents were males, and 68 females were surveyed. All members reported that they are college graduates between the ages of 23 and 35. Survey respondents were not excluded for income or employment status, or marital status. All data was collected randomly through an online survey agency, and survey respondents did not know that they were taking a life insurance survey until they had already agreed to take it.

Our Results

Our results show that members of the millennial generation are not purchasing life insurance. Our findings show that only 21% of people aged 23-35 are life insurance owners. As may be expected, there appears to be a positive correlation with age, as older respondents age 30-35 were by far the most likely to own life insurance, and those 23-25 were by far the least likely to own insurance. Overall, a disturbing trend revealing a lack of life insurance ownership among members this generation was uncovered. For a reference, as a rule, almost every person between the ages of 22 and 65 should have some life insurance coverage on their lives.

This is the breakdown of life insurance ownership ownership by age group according to the results of the survey.

As you can see, the older the person is the more likely they are to own life insurance. The problem is that even among the most likely group to own, those 31-35 years old, only 28% of those surveyed were covered. This represents a dangerously low level of life insurance coverage, as this group is also most likely to be married and have children.

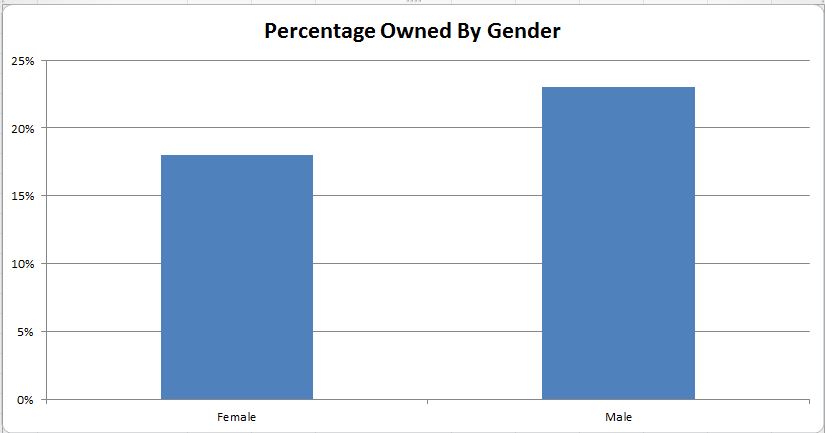

The survey also revealed a divide between the sexes, with women being the least likely sex to own life insurance of the two. This supports our earlier finding, that young mothers are among the least likely groups to own life insurance. Here is the divide between the sexes of the millennial generation, according to our survey.

Reasons For Low Ownership Rates

While we can only speculate at the causes, it would stand to reason that a poor job market with lower relative wages has lead this group to forgo spending on items viewed as superfluous to basic needs, including life insurance. A recent study by Generation Opportunity, a millennial think tank, found that over 15% of millennials are unemployed, which does not bode well for their ability to afford life insurance coverage.

Members of the millennial generation are also marrying and having children later than ever. According to a recent Washington Post article revealing finds from a study by The National Campaign to Prevent Teen and Unplanned Pregnancy, the National Marriage Project at the University of Virginia, and the RELATE Institute, the average age of marriage is now over 26 years old, and the average age that adults have their first child is now over 25 years old. Their findings show a rise in the average age of both over time, and a sharp rise after 2008.

We can speculate that less discretionary spending combined with the ever increasing age of marriage and childbirth have led to lower life insurance purchasing rates by this age group.

Dangers Of Low Ownership Rates

Whatever the reasons, the results represent a serious risk to this young generation. Those who are under insured with families put their families ability to support themselves in serious jeopardy should something happen to them. Those without families run the risk that they will not be able to obtain coverage when they need it.

Traditionally, people would purchase life insurance when they are very young. This ensures their ability to obtain coverage because they are most healthy at a young age. By pushing back the age at which they purchase insurance, they run the risk that health issues will prevent them from obtaining the coverage they require. For those that do remain insurable, coverage will almost certainly be costlier because coverage is more expensive when the insured person is issued a policy at an older age than if the same policy was issued at a younger age.