Symetra Financial SVP: We’re Looking to Gain Scale in Individual Life

June 3, 2014 by Marie Suszynski

WEST DES MOINES, Iowa – As Symetra Financial Corp. embarks on its move to become legally domiciled in Iowa in late summer, the company is ramping up efforts to grow its individual life business at a faster clip than its annuities business.

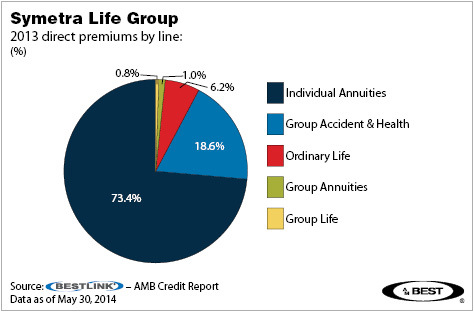

Symetra’s overall mix of business is half retirement and annuities, and Symetra recognizes that annuities are correlated with interest rates, Jim Pirak, senior vice president, corporate marketing and investor relations, said during the 2014 Des Moines Insurance Conference.

The company has been looking to become more diversified for the past four years, and that means growing its presence in the individual and group life space, Pirak said.

Meanwhile, the company is looking at leveraging its market position with financial institutions, which have helped Symetra design a fixed-indexed annuity product. Symetra was one of the first players to enter the space through banks and broker dealers, he said. The company has a long-standing relationship with 30 large financial institutions.

Part of how Symetra is working to grow its businesses is by increasing brand recognition. “Symetra is now 10 years old and is still an unknown brand in the marketplace,” Pirak said. Distributors know the company well and the products sell on their merits, but it can sometimes be a difficult sell for advisers and customers.

Over the past few years, Symetra has been increasing brand awareness through sponsorships, including one for Sports Illustrated. “We’re being prudent about the spending, making sure it’s aligned with revenues, but we know brand awareness is important in the marketplace,” Pirak said.

Another area for significant growth is medical stop-loss insurance, which is catastrophic coverage for companies that choose to self-insure their medical coverage, Pirak said. The company is seeing more midsized to large companies, those with 500 to 5,000 employee, that are currently covered with a traditional health plan looking into self-insured plans. As that grows, medical stop-loss grows, he said.

“We have a market leadership position,” he said. “We’re consistently in the top five from a premium standpoint.” Symetra’s “sweet spot” among businesses are those with employees in the range of 500 to 1,500. Although it’s not a market with tremendous growth rates, it’s compelling that early indications show companies looking into alternatives to fully insured plans, he said.

Symetra is also targeting other products for private health insurance exchanges.

In the first quarter of this year, Symetra posted a 20.1% jump in profit that was helped in part by a low loss ratio in its medical stop-loss business. The loss ratio improved to 57.1% from 68.5% a year ago, according to Barclays equity analysts (Best’s News Service, April 24, 2014).

“For a company of our size, we like to say we use our relatively smaller size to our advantage,” Pirak said. “We can be nimble and flexible.” Because Symetra can react faster, it benefits the company in the marketplace.

In January, Symetra said it had applied to change the legal domicile of its principal life insurance subsidiary Symetra Life Insurance Co. from Washington to Iowa, saying it was looking for a level playing field to compete with other life insurers. Emerging industry standards that deal with reserve financing, accounting and reinsurance rules were at the heart of the decision (Best’s News Service, Jan. 15, 2014).

Pirak said Symetra already has an office in West Des Moines and that the redomestication should be completed in late summer.

On the afternoon of May 30, shares of Symetra Financial (NYSE: SYA) were trading at $20.79, up 0.05% from the previous close.

Symetra’s rated companies have a current Best’s Financial Strength Rating of A (Excellent).

(By Marie Suszynski, Best’s News Service correspondent)

BN-NJ-5-30-2014 1542 ET #