Fixed Annuities Were ‘The’ Sales Story In 3Q

{November 27th, 2013} by Linda Koco

What a difference a quarter makes in annuity sales results. In third quarter, total fixed sales were up 31 percent over third quarter last year, according to LIMRA’s new estimated results. On a year-to-date basis, the year-over-year increase was not as dramatic but sales were still up. Total fixed sales increased by 6 percent compared […]

Insurance Groups Raise Concerns About NAIC Funding Reserve

{November 27th, 2013} by Thomas Harman

WASHINGTON – Insurance industry associations raised concerns to the National Association of Insurance Commissioners about the group’s increasing financial reserve and the need for greater transparency. The discussions came during a public hearing on the proposed 2014 NAIC budget, which has $93 million in revenues, a slight increase over 2013, along with new funding for […]

Dear ma, dear pa: Welcome back … watch your back

{November 27th, 2013} by Staff Writer

How easily we seem to forget the bad times. The market’s recent returns are giving older folks the impression that everything is back to the way it was. However, analysts and experts alike are quick to warn past performance does not indicate future results. Click here to read…

How to Talk About Insurance During the Holiday Season

{November 27th, 2013} by Alex Vandevere

Holiday get-togethers with friends and family are full of opportunities to discuss what you do for a living. Unfortunately for those of us in the insurance industry, these opportunities aren’t always easy ones. It seems to happen every year — Uncle Milton is just trying to make small talk, asking you how work is going, […]

Did Joseph Belth’s Insurance Forum get it wrong concerning Glenn Neasham?

{November 26th, 2013} by Nicholas Paleveda MBA J.D. LL.M

The Insurance Forum got it wrong I have been a follower of Joseph M. Belth’s The Insurance Forum since the Mutual Benefit Life and Executive life days. His calls concerning capitalization were correct; however theses were financial matters, not a legal matter. In his latest comments, he expressed surprise that the appeals court overturned the […]

Selling annuities to younger workers: A lesson in futility?

{November 26th, 2013} by Alanna Ritchie

Marketing annuities to younger workers may seem like a futile task. At first glance, annuities might not appear to be the most appealing or prudent investment for these consumers. However, standard retirement plan options are changing, allowing a platform for annuities to succeed as a valuable option for members of Gen X — those in […]

California AG asks for review of Neasham reversal

{November 26th, 2013} by Maria Wood

The California Attorney General office has requested the state’s Supreme Court review the Appellate Court’s decision overturning the conviction of Glenn Neasham on theft from an elder. The petition was filed earlier this month. In October, the Court of Appeal of the State of California, First Appellate District, Division Three, reversed the verdict handed down […]

Highland Capital Brokerage Announces New Branding

{November 25th, 2013} by Wilma Turner

Birmingham, AL — November 22, 2013 – Highland Capital Brokerage, Inc. (HCB) announced today that it has unveiled a new corporate identity. The new brand was created to distinguish the company from previous brand marks and to signalize its transformation to private ownership. “Our new visual identity is a reflection of our recent move to private ownership. […]

American General Named a Preferred Life Insurance Product Partner with Edward Jones

{November 25th, 2013} by Linda Malamut

American General Life Companies November 19, 2013 9:00 AM HOUSTON–(BUSINESS WIRE)– Individuals and businesses served in the United States by financial services firm Edward Jones now have access to a suite of life insurance products from member insurers of American General Life Companies (American General). American General’s affiliation as a preferred life insurance partner with […]

Consumers Retire Earlier than Planned and Underestimate Retirement Expenses

{November 25th, 2013} by Proquest LLC

Proquest LLC Consumers have unrealistic expectations about when they will retire, how much money they will need in retirement and where that income will come from, according to The Future of Retirement Income, a survey released by Genworth. According to a release, the Genworth study reveals that while nearly three-fourths (73 percent) of pre-retirees are […]

Will fixed-rate annuity assets stay or bolt from banks?

{November 25th, 2013} by Maria Wood

Since banks and career agents manage nearly two-thirds of fixed-rate annuity assets for clients, they have a great deal of input regarding the fate of those contracts once surrender charges expire. That was the thesis of a research brief written by Matthew Drinkwater and Jafor Iqbal, both associate managing directors with LIMRA’s Secure Retirement Institute […]

Sheryl J. Moore on the current success of indexed insurance products

{November 24th, 2013} by Paul Wilson

Despite a historically low interest rate environment and other challenging market conditions, indexed annuities recently reached record sales. In the interview below, indexed insurance product expert Sheryl Moore explains why, and exactly what it means to the insurance industry. Additionally, she talks about indexed life insurance sales, the challenges faced by those who sell IUL, […]

Wink CEO: US Sales of Indexed Annuities Gaining Traction in Banks

{November 24th, 2013} by Fran Lysiak

Best’s News Service – November 21, 2013 10:52 AM PLEASANT HILL, Iowa – Total third-quarter 2013 sales of indexed annuities in the United States increased to $10 billion, up 15% from the same period a year ago, according to Wink Inc. Sheryl J. Moore, president and chief executive officer of Moore Market Intelligence and Wink, […]

Former Aviva USA Companies Agree to $4 Million Settlement Over Use of Death Master File

{November 24th, 2013} by Fran Lysiak

CHICAGO – Aviva Life & Annuity Co. and Aviva Life & Annuity Company of New York, formerly part of Aviva USA, have agreed to pay $4 million to several states as part of a settlement regarding their use of the Social Security Administration’s Death Master File database, according to the Illinois Department of Insurance. The […]

Why indexed annuities are so hot now: NAILBA 32

{November 24th, 2013} by Paul Wilson

Despite a historically low interest rate environment and other challenging market conditions, indexed annuities recently reached record sales. In the interview below, indexed insurance product expert Sheryl J. Moore explains why, and exactly what it means to the insurance industry. Additionally, she talks about indexed life insurance sales, the challenges faced by those who sell […]

Digging into IUL at NAILBA 32

{November 23rd, 2013} by Emily Holbrook

Among the numerous sessions offered today at the annual NAILBA conference was one focusing on Indexed Universal Life (IUL). Speaking on the topic were Alan Grissom of S&P Dow Jones Indices and Dick Weber from The Ethical Edge Inc. Both are equally knowledgeable in the field. Click here to read…

Iowa annuity companies’ sales contribute to record $10 billion quarter

{November 23rd, 2013} by Joe Gardyasz

U.S. insurers sold $10 billion in indexed annuities in the third quarter, more than any previous quarter in the industry’s history, according to an analysis released Friday. More than 10 percent of that record sales total was attributable to West Des Moines-based American Equity Investment Life Holding Co., which topped $1 billion in sales for […]

Remove this word from your vocabulary

{November 23rd, 2013} by Emily Holbrook

“I can’t finish this report on time,” “I can’t find new clients,” “I can’t finish the last half mile of my workout,” “I can’t meet up with you, I’m just too busy.” I can’t (or should I say, can) believe what a hindrance “I can’t” really is. Sure, I’m guilty of using it, and probably […]

NAILBA 32: The valet and JFK

{November 23rd, 2013} by Daniel Williams

What brings you to our fine city?” the valet asked. He was the kind of man who never met a stranger. He wasn’t in a hurry to remove you from your car and keys. Click here to read…

S&P 500 ends above 1,800 for first time; healthcare leads

{November 22nd, 2013} by LUKE SWIDERSKI

Reuters) – Stocks rose on Friday, with the S&P 500 closing above 1,800 for the first time and healthcare names leading the way higher. The Dow industrials ended at another record high above 16,000. Both the Dow and the S&P 500 recorded their seventh straight week of gains in what has been a very strong year for stocks. The seven-week advance comes just ahead […]

Q3 indexed annuity sales hit $10 billion

{November 22nd, 2013} by Maria Wood

As the end of the year approaches, indexed annuity sales are rushing toward the finish life, hitting a record $10 billion in the third quarter, according to the most recent compilation from Wink’s Sales & Market Report, which tracks indexed annuity and life sales. That $10 billion figure represents a 9 percent jump from the […]

NAILBA 32: Out of chaos, opportunity

{November 22nd, 2013} by Daniel Williams

“As we’ve seen time and again, serendipity depends on the flow of ideas and the intermingling of unlikely people. Organizational silos are the enemy of serendipity: it’s hard to find serendipity in a cubicle.”—The Chaos Imperative, by Ori Brafman. Speaking at the annual NAILBA Conference, being held this week at the Gaylord Texan facility outside […]

The startup costs of advisers’ going solo

{November 22nd, 2013} by Tom Daley

When asked by financial advisers if it’s too expensive to go out on their own, set up shops and create unique brands, I tell them they will definitely incur costs but they aren’t necessarily prohibitive — especially for those with an entrepreneurial mindset. There are three initial factors advisers should cover in their startup estimates […]

Indexed Annuities See Jaw-Dropping Sales

{November 21st, 2013} by Linda Koco

Perhaps the biggest jaw-dropper in the past week was Wink, Inc.’s report that indexed annuity production broke yet another record, with sales hitting $10 billion for the quarter. It is one of many recent annuity developments that provide clues to fixed and variable annuity trends that advisors and carriers and are facing or soon will […]

Aging producer workforce on minds of “State of the Industry” panelists

{November 21st, 2013} by Brian Anderson

David Long looked like one of the youngest people in the room, but he knows he’s in an industry dominated by old, er, “experienced” professionals. Long, who is 43, was representing BGAs in a wide-ranging “State of the Industry” panel discussion in front of about 200 people during NAILBA 32 on Thursday afternoon at the […]

Allianz intros one annuity, sunsets another

{November 21st, 2013} by Maria Wood

Allianz Life launched a new fixed indexed annuity (FIA) while slumping sales forced it to discontinue another product. Its latest FIA, Allianz Signature 7, is targeted to the registered rep and broker-dealer community, according to Matt Gray, vice president of product innovation at Allianz. While those distributors are beginning to warm to FIAs, they have […]

How To Sell Annuities To Generation X

{November 21st, 2013} by Bill Fay

Nearly every story about annuities — or even the mention of annuities — includes a kicker to remind people that this product is for retirees or for those at the doorstep of retirement. That might be the case for many annuity products, but a void is being created as more companies turn their back on […]

Rollover contributions to hit $470B by 2018

{November 20th, 2013} by Warren S. Hersch

Individual retirement account rollover contributions are forecasted to increase at a compounded annual growth rate of 5.5 percent over the next five years, reaching nearly $470 billion in 2018, according to a new report. Cerulli Associates published this finding in “Evolution of the Retirement Investor 2013: Influencing and Addressing Retirement Savings.” The study analyzes the […]

Fixed-rate deferred annuities fuel sales in Q3

{November 20th, 2013} by Maria Wood

Third-quarter statistics compiled from LIMRA’s Secure Retirement Institute (SRI) underscore the rising popularity of fixed-rate deferred annuities. Sales of that particular type of annuity – both book value and MVA (market value adjusted) – hit $9.5 billion, a 66 percent leap from a year ago. In total, Q3 annuity sales rose 9 percent to $59.4 […]

Why Social Media Matters in the Financial Services Industry

{November 20th, 2013} by Erik Johnson

Marketing your products and services effectively and maintaining your corporate image is vital to your ongoing success in the competitive marketplace. The social media environment offers new opportunities for your company to reach potential clients, build brand loyalty and gain insights into client needs and concerns. However, these same social networking venues can present serious […]

13 ways an annuity can benefit an estate plan

{November 19th, 2013} by John L. Olsen, Michael E. Kitces

A principal goal of many estate plans is to provide income to the estate owner’s heirs. This goal can often be achieved by using either immediate or deferred annuities. Where the goal is to provide heirs with an immediate income, an immediate annuity may be the ideal mechanism, especially if the income is to continue […]

How producers maximize personal development

{November 19th, 2013} by Jamie E. Green

A key contributor to the industry’s ability to recruit and retain talented sales professionals is the professional development available to producers. According to the study, the most commonly utilized forms of professional development are continuing education and insurance company sponsored training, followed by industry trade associations and wholesale brokerage agencies (Figure 4; click to enlarge). […]

Top Advisors Share Secrets Of Successful Client Relationships

{November 19th, 2013} by Cyril Tuohy

If there’s one goal that binds many financial advisors, it’s that they want to do well by their clients. This is not only because it assures the advisors’ financial and professional success, but also because it leads to their customers’ happiness. Some of the strategies used by successful financial advisors were on display last week […]

Help to family rivals retirement for many boomers

{November 19th, 2013} by Warren S. Hersch

Half of pre-retirees ages 50 and older say they would make major sacrifices that could impact their retirement to help family members, according to new research. Merrill Lynch Wealth Management discloses this finding in a new survey, “Family & Retirement: The Elephant in the Room.” Conducted in partnership with Age Wave, the survey polled 5,415 […]

3 time-saving tips for financial advisors using social media

{November 19th, 2013} by Amy Mcllwain

It’s happened to all of us. You were just going to check your Facebook for five minutes and the next thing you know, it’s been an hour. Social media has a reputation for being one big black hole. It sucks you in and makes you lose all sense of time and any chance for productivity. […]

IA Sales Break Second Consecutive Sales Record

{November 19th, 2013} by Press Release

Pleasant Hill, Iowa. November 15, 2013. Forty-two indexed annuity carriers participated in the 65th edition of Wink’s Sales & Market Report, representing 98.4% of indexed annuity production. Total third quarter sales were $10.0 billion. In reviewing third quarter indexed annuity sales, production was up more than 9.0% when compared to the previous quarter, and up […]

The Principal Introduces Indexed Universal Life Insurance

{November 19th, 2013} by BUSINESS WIRE

The specialized option offers greater cash accumulation potential with less risk November 18, 2013 03:00 PM Eastern Standard Time DES MOINES, Iowa, Nov 18, 2013 (BUSINESS WIRE) — In today’s economic environment, many individuals seek life insurance protection that can offer greater cash accumulation potential than traditional universal life products, but also have less risk than […]

Yellen: One-size-fits-all not a model for regulation

{November 18th, 2013} by Arthur D. Postal and Elizabeth D. Festa

The Federal Reserve Board recognizes there are “critical differences” between banks and insurance companies, Federal Reserve Board chairman-designate Janet Yellen told a Senate committee at her confirmation hearing Nov. 14. However, Yellen declined to be hemmed in on how the Fed will deal with that issue, saying only that the Fed is undertaking a study as […]

What is the fifth huge mistake advisors are making today?

{November 18th, 2013} by Lew Nason

So far, we have covered four huge mistakes that are keeping most advisors from reaching their full potential in this business. These huge mistakes are keeping most advisors from consistently earning a significant six-figure annual income. Have you really looked at what you are doing in your practice? Are you making any or all of […]

I hate annuities — and you should too

{November 18th, 2013} by Tony Walker

My wife and I are in the process of building a new home. It’s exciting stuff for sure, with lots of things to research and plenty of conflicting information about how one should construct and design a new home. Recently, while I was sitting at the kitchen table surfing the Web for ideas on decorative […]

10 tips advisors can use to boost their income during the holidays

{November 18th, 2013} by Sandy Schussel

With so little time left to go in 2013, I’ve put together a list of the most effective ideas for my financial and insurance friends to boost their holiday sales. I know you’ll find at least some of these ideas useful. 1. Keep your schedule filled with appointments.If your goal is eight appointments, don’t try […]

Wink, Inc. Releases Third Quarter, 2013 Indexed Sales Results

{November 16th, 2013} by Wink, Inc.

Indexed Annuity Sales Break Second Consecutive Sales Record Wink, Inc. Releases Third Quarter, 2013 Indexed Sales Results Pleasant Hill, Iowa. November 15, 2013- Forty-two indexed annuity carriers participated in the 65th edition of Wink’s Sales & Market Report, representing 98.4% of indexed annuity production. Total third quarter sales were $10.0 billion. In reviewing third quarter indexed annuity sales, […]

Third Quarter 2013 Indexed Insurance Sales

{November 15th, 2013} by Sheryl J. Moore

Indexed Annuity Wink’s Sales & Market Report, 3rd Quarter 2013 shows third quarter 2013 indexed annuity sales were $10,053 million, compared with sales of $8,738 million for the third quarter of 2012. Third quarter indexed annuity sales were up more than 9% when compared to the previous quarter, and up more than 15% when compared […]

Look to Wink at NAILBA 32!

{November 15th, 2013} by Jamie Johnson

Look to Wink at NAILBA 32! Sheryl J. Moore’s Wink rockstars will be at NAILBA 32 on November 21st-23rd and we’ve got the intel you need *wink*! You won’t want to miss our Booth #305. Our mission is to provide the best darned competitive intelligence to the life insurance and annuity industries. Period. We don’t do […]

Vt’s National Life Group celebrates 165th birthday

{November 15th, 2013} by Texas News

MONTPELIER, Vt. (AP) — Vermont’s largest insurance company is celebrating its 165th birthday. In 1848, the Vermont Legislature chartered the National Life Insurance Company, based in Montpelier. Since then the company grew into National Life Group, which includes a number of insurance and financial services companies. The group, with primary offices in Montpelier and Addison, […]

Advisors want fiduciary definition left alone

{November 15th, 2013} by Dan Berman

By Dan Berman More than 90 percent of independent financial advisors said the Department of Labor should not redefine the meaning of fiduciary to ban the giving of IRA advice for a fee, a poll released Thursday by the Financial Services Institute found. The number against the change (91 percent) was unchanged from last year. […]

IRA charitable deduction, 56 other tax goodies set to expire Dec. 31

{November 15th, 2013} by Mark Schoeff Jr.

Federal deductions for individuals for state and local taxes, as well as R&D credits for businesses also on list New Year’s Eve this year won’t be nearly as dramatic for tax policy as last year, but dozens of deductions — including a client favorite for charitable donations — are set to expire when the ball […]

A BRIGHT NEW DAY FOR FIXED ANNUITIES

{November 15th, 2013} by Kim O'Brien

by Kim O’Brien MESSAGE FROM THE NAFA PRESIDENT As we close out another year at NAFA and reflect on the activities and challenges of 2013, we can’t help but be amazed that this marked the end of NAFA’s 15th year. And what a year it was! 2013 was very good for fixed annuities and for […]

CEO compensation: The sky is the limit

{November 15th, 2013} by Warren S. Hersch

Pay packages for life insurers’ corporate chiefs have rebounded since the recession with no slowdown in sight. Click here to read…

Pacific Life Kicks Off Social Media Pilot To Connect Advisors

{November 15th, 2013} by Cyril Tuohy

Looking to strengthen advisors’ social media network to generate prospects, retain customers and sell more, the Retirement Solutions Division of Pacific Life has announced the launch of a pilot program using technology from Hearsay Social. The initiative would expand Pacific Life’s social media program currently made up of company wholesalers who share information with financial […]

Boston Fed gearing up for top tier regulation of Pru

{November 15th, 2013} by Elizabeth Festa

Do you want to help develop creative approaches to evaluating Prudential Financial’s financial condition, relative to peer companies? Or take on an “exciting role that offers the opportunity to contribute to the development and execution of a new set of responsibilities for the Federal Reserve System?” The Boston Federal Reserve bank is now attempting to […]

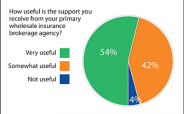

Reader Insights – What Matters Most to You and Your Business

{November 15th, 2013} by Annuity Outlook

We recently asked our Annuity Outlook readers for their insight into the industry, their business and what works best for their practice. The results provide a meaningful reflection of the views and habits of our most committed readers. By Annuity Outlook The Product Portfolio Annuities are a large portion of our reader’s business, being over […]

Facebook’s five-star ratings: The end of business pages for advisers?

{November 15th, 2013} by Kristen Luke

Should you be nervous about a new rating system that allows users to evaluate your business? You bet. If you have looked at your Facebook business page in the past week, you may have noticed something very concerning at the top of your page — a Morningstar-style star rating. The world’s most popular social-media site […]

A.M. Best Affirms Ratings of NLV Financial Corporation and Its Subsidiaries

{November 14th, 2013} by A.M. Best

OLDWICK, N.J. – A.M. Best Co. has affirmed the financial strength rating of A (Excellent) and the issuer credit ratings (ICR) of “a+” of National Life Insurance Company (NLIC) (Montpelier, VT) and its wholly owned subsidiary, Life Insurance Company of the Southwest (Dallas, TX) (together known as National Life). These companies are the insurance subsidiaries […]

Zurich’s Third-Quarter Net Rises 64% on Underwriting Improvement

{November 14th, 2013} by David Pilla, international editor, BestWeek: David.Pilla@ambest.com

ZURICH – Higher catastrophe losses and lower investment income failed to deter Zurich Insurance Group Ltd. from posting a 64% rise in third-quarter net income as the group reported improved underwriting performances across all lines. “We delivered a solid operating profit in all core segments for the first nine months of 2013,” said Chief Executive […]

Insurance Sector Holds Prominent Place In Conn. Economy

{November 14th, 2013} by Luther Turmelle, New Haven Register, Conn

By Luther Turmelle, New Haven Register, Conn. McClatchy-Tribune Information Services Nov. 14–HARTFORD — A new report released this week by an industry trade group shows thatConnecticut’s insurance industry retains a prominent place in the state’s economy. The report — which was released this week by theConnecticut Insurance and Financial Services (IFS) Cluster, the state’sEconomic Resource […]

The issue of succession planning

{November 14th, 2013} by Jamie E. Green

An important issue the industry is facing is the aging of the producer population. Less than one quarter (24 percent) of producers are in their forties or younger, leaving the large majority of producers facing the prospect of retirement in the near or immediate future (Figure 6; click to enlarge). That means the issue of […]

3 ways survivorship life can help younger clients

{November 13th, 2013} by Celeste Moya

Survivorship life insurance, also referred to as second-to-die life insurance, has been primarily used for estate planning needs. With proper design and planning, a survivorship life insurance policy utilized for estate preservation can ensure estate taxes are covered and the estate’s assets are preserved for heirs. For many years, the ideal survivorship life insurance product […]

10 of the best-paid CEOs in the life insurance industry

{November 13th, 2013} by Warren S. Hersch, Mary Shaub

By any account, comparing compensation across the life insurance industry is a tricky business. Institutional Shareholders Services Inc (ISS) cites 20-plus long-term benchmarks and nearly 40 short-term ones that may contribute to an executive’s realizable pay. The one existing standard, Summary Compensation Tables (STC) pay, is a combination of actual pay (salary and annual incentives) […]

NAIC to eye guidelines on unclaimed property

{November 13th, 2013} by Arthur D. Postal

A key National Association of Insurance Commissioners (NAIC) committee agreed late Friday to determine whether guidelines should be developed to provide consistency in the handling of unclaimed death benefits. The decision was made after considerable debate by the NAIC’s Life Insurance and Annuity Committee. It was made at the urging of NAIC President Tom Donelon and Nebraska […]

Dodd-Frank requirements could lower insurers’ exposures

{November 13th, 2013} by Standard & Poor's

According to an S&P report DALLAS Nov. 11, 2013–In response to the financial crisis of 2008, the U.S. Congress passed the Dodd-Frank Act (DFA), officially known as the Wall Street Reform and Consumer Protection Act of 2010, with provisions targeting a wide variety of financial markets. Among the law’s many provisions is Title VII, also […]

Annuity Firms Eye Rising Interest Rates

{November 12th, 2013} by Linda Koco

The interest rate environment may no longer be the source of acute pain it once was in the annuity industry. It’s still a tender issue because the rates are still pretty low, but a few annuity carriers actually said something good about interest rates in their third quarter reports — namely, that the slowly rising […]

Life insurers to benefit from rising interest rates

{November 12th, 2013} by Elliott Gue

Only a handful of industries stand to benefit directly from a steady uptick in interest rates and rising equity prices. Life insurance companies, which offer financial products aimed at providing for retirement and protecting income, will be one of the biggest winners in this environment. While there are a number of different types of life […]

Life Carriers Reporting Strong 3Q Net Income

{November 12th, 2013} by Cyril Tuohy

Major life insurers are delivering windfalls in the third quarter as companies rejiggered their product lineup and capitalized on the sale of fee-income products. Analysts with Moody’s Investors Services are looking for the industry to deliver earnings growth in the “low single-digit range.” Here is a wrap up of what some of the largest carriers […]

Sun Life posts loss

{November 12th, 2013} by Paula Aven Gladych

Cites sale of US annuities business Toronto-based Sun Life Financial took a third-quarter loss of $804.8 million because of the sale of its U.S. annuities business in August, but operating profit was higher than expected, the company reported. Canada’s third-largest life insurer sold off its annuities business in August in an attempt to reduce its exposure to […]

NAFA Membership Elects 2014 Board of Directors at its Annual Meeting

{November 12th, 2013} by Scott Hinds – 414-332-9306, ext.2, or scott@nafa.com

Milwaukee, WI (November 12, 2013) – The National Association for Fixed Annuities (NAFA) elected its 2014 board of directors at the association’s annual meeting held recently in Aspen, Colorado. Five new members are joining the board: Dominic Cursio of Collabrix, Rod Mims of Athene Annuity & Life, John E. Orrell of Brokers International, Harry N. […]

The boomer woman’s guide to annuities

{November 11th, 2013} by Melody Juge

Annuities are all the rage right now, especially for the risk-averse boomer women planning for their retirement. There are many reasons someone may require, or simply feel more comfortable with, an annuity in their retirement portfolio. But the annuity sales process can be unforgiving if you are not prepared. Annuities are complicated and usually have […]

Why life insurance is a rockstar retirement income generator

{November 11th, 2013} by Brandon Roberts

Life insurance for income generation works, and it works well, because we can eliminate so many other risks that you probably haven’t even considered. Life insurance used to generate retirement income is a slightly more advanced subject within the world of life insurance and financial planning. The stock jockeys hate it and the life insurance […]

Veterans Day discounts offered at restaurants across nation

{November 10th, 2013} by Army News Service

By Army News Service Federal Information & News Dispatch, Inc. November 6, 2013 WASHINGTON (Army News Service,Nov. 6, 2013) — OnNov. 11, 2013, America will pay tribute to the men and women who served the nation. ForVeterans Day, as a way to say thanks, many restaurants will be giving discounts and running promotions for veterans. […]

Fidelity & Guaranty Life Insurance moving HQ to Des Moines

{November 8th, 2013} by Victor Epstein

Fidelity & Guaranty Life Insurance Company announced Friday that it intends to move its headquarters from Baltimore to downtown Des Moines and legally relocate to Iowa to take advantage of its lower cost of living, business-friendly regulatory climate and ready supply of insurance professionals. The mid-sized annuities and life insurance company already has a temporary […]

NAFA Annuity Outlook Magazine Presents Insurance Sales and Marketing Expo 2014

{November 8th, 2013} by Annuity Outlook

November 6, 2013 – NAFA Annuity Outlook magazine will present the Insurance Sales and Marketing Expo (ISMX) April 23-25, 2014, at Rio All Suites in Las Vegas, Nevada. ISMX 2014 will provide a platform for hundreds of the top insurance sales professionals to learn inspiring insights and proven strategies for the 50+ age insurance marketplace. […]

Longer Lifespans Fuel Insurers’ Concerns

{November 8th, 2013} by Cyril Tuohy

Big changes are afoot in the life insurance industry even if the tectonic shifts are not immediately apparent to U.S. policyholders or advisors who sell to them. With Moody’s, among other observers, downgrading the industry some experts are even questioning whether the sector will bear much resemblance to its present appearance. In a recent webinar […]

Agents to BGAs: What have you done for me lately?

{November 8th, 2013} by Jamie E. Green

Most independent agents write business through a wholesale brokerage entity, such as a brokerage general agency (BGA). After all, an effective BGA partner can add much-needed resources to agents in the areas of administrative support, underwriting assistance, large case design – even leads and training – so that agents can focus more of their attention […]

Former Marine Captain, Adam Brochetti, of Lincoln Financial Group Says Military Training Helps Veterans Become Valuable Assets to Any Work Environment

{November 8th, 2013} by PRNewswire

Marine Captain Brochetti Invited by NYSE to Underscore Amazing Potential of Vets as Job Candidates RADNOR, Pa., Nov. 7, 2013 /PRNewswire/ — “Veterans are trained to adapt to their settings, work together to achieve a common goal, and complete the task at hand in the most efficient manner possible making them valuable assets to any […]

Kansas City Life Earnings Jump 72 Percent

{November 8th, 2013} by Mark Davis, The Kansas City Star

By Mark Davis, The Kansas City Star McClatchy-Tribune Information Services Nov. 08–Kansas City Life Insurance Co. earned $7.1 million, or 65 cents a share, in the third quarter. Its profits were up 72 percent from a year ago when the company earned $4.1 million, or 38 cents a share. The company’s Thursday announcement said its […]

Aviva Sees Steady Gains In New Business

{November 8th, 2013} by Robert O'Connor

In a low-key assessment of its performance over the first nine months of 2013,U.K.-based multiline insurer Aviva plc cited steady gains after a 14% increase in value of new business, along with good performances in international markets. “Progress is in line with our expectations, “Mark Wilson, group chief executive officer, said in a statement. “And […]

Delaware Life debuts fixed annuity

{November 8th, 2013} by Maria Wood

Also: Personnel moves at AXA Equitable, news from New York Life Delaware Life recently introduced Pinnacle MYGA, a multiyear guaranteed fixed annuity. The single-premium deferred annuity offers guaranteed periods of three, five, seven or 10 years. Click here to read…

Don’t fear annuities

{November 8th, 2013} by Eric Taylor

The key takeaway from Genworth’s recently released study, The Future of Retirement Income Study, can be summed up by the concept of perception versus reality: Consumers perceive annuities more positively than financial professionals give them credit for. The study was the culmination of in-depth interviews, focus groups and quantitative surveys of 400 financial professionals and […]

Congress Told: Don’t Mess With Tax Deferral

{November 8th, 2013} by Linda Koco

Don’t mess with tax deferral in retirement savings products. Do preserve tax deferral in annuities. Don’t take tax deferral for granted, and don’t take it away. In view of expected budget changes coming up, retirement industry leaders are working to get those messages out to Congress, the industry and the public in different ways. For […]

A “Back to the Future” look at insurance marketing data analytics

{November 7th, 2013} by Mark Chai

One of my favorite movies while growing up in the 1980s was “Back to Future.” Marty McFly’s and Doc Brown’s adventures traveling in time provided a timeless tale of how small changes could have a substantial impact on one’s future. In one of my favorite moments, Marty purchases a future copy of a sports almanac, […]

New York Life Has the Largest Market Share of Both Immediate and Deferred Income Annuities

{November 7th, 2013} by N/A

NEW YORK — New York Life announced today that it is the largest seller of income annuities through the second quarter of 2013, with an impressive 33 percent market share in fixed immediate annuities and 44 percent market share in the deferred income annuity category, according to an industry source.* New York Life’s income annuity […]

Prudential swings to profit, but revenue dips

{November 7th, 2013} by Christina Rexrode

Prudential Financial Inc. [s:pru] swung to a third-quarter profit. Net income for the financial services business was $981 million, or $2.07 a share, compared to a net loss of $627 million, or $1.34 a share, a year earlier. Revenue fell 18 percent to $10.8 billion, from $13.2 billion a year earlier, the insurance company said Wednesday. […]

Old Mutual Reports 14% Increase In Funds Under Management

{November 7th, 2013} by A.M. Best

Emphasizing its “continued shift from traditional insurance to modern investment products, “London-based financial services group Old Mutual plc reported a 14% increase in funds under management to 287.5 billion pounds ($US460.2 billion) since the beginning of 2013. In releasing results for the third quarter, Old Mutual also said gross sales rose to 6.5 billion pounds […]

Sun Life Financial Reports Third Quarter Results

{November 7th, 2013} by PR Newswire Association LLC

The information contained in this document concerning the third quarter of 2013 is based on our unaudited interim financial results for the period endedSeptember 30, 2013. Unless otherwise noted, all amounts are in Canadian dollars. Third Quarter 2013 Financial Highlights Operating net income(1) from Continuing Operations(2) of $422 million, compared to $459 million in the third […]

4 reasons seminars are back

{November 7th, 2013} by Jonathan Musgrave

We all fondly remember the Golden Age of seminars. All you had to do was litter mailboxes with cheap yellow postcards advertising a free dinner at a local buffet, and BAM, You had a room of eager attendees ready to eat up what you had to say (along with a fair amount of all-you-can-eat prime […]

Older Workers Finding It Difficult To Retire

{November 6th, 2013} by Ron Devlin, Reading Eagle, Pa.

By Ron Devlin, Reading Eagle, Pa. McClatchy-Tribune Information Services Nov. 03–David J. Cocuzza knows exactly what he would do in retirement: perfect his mandolin playing and tend the garden of his Muhlenberg Township home. Indeed, at 63, Cocuzza thought by now he’d be retired from managing the Bern Township office of Philadelphia Ball and Roller […]

Delaware Life Receives A- Rating Confirmation from A.M. Best

{November 6th, 2013} by Delaware Life

WELLESLEY, Mass. (Oct. 17, 2013) – Delaware Life today received confirmation of an A- (Excellent) financial strength rating, along with a negative future outlook, from A.M. Best as part of a review of Sun Life Assurance Company of Canada (U.S.). In a statement, A.M. Best explained that the confirmed ratings reflect Delaware Life’s “more than […]

Delaware Life Debuts Its First Annuity

{November 6th, 2013} by Linda Koco

The wondering is over. Delaware Life has debuted its first annuity, a multi-year guaranteed fixed annuity called Pinnacle MYGA. The debut brings to end speculation about whether the newbie would or would not become an active player in the annuity marketplace this year. The questions have been circulating ever since the company was established as […]

A.M. Best Affirms Ratings of Fidelity & Guaranty Life Holdings, Inc. and Its Key Life/Health Subsidiaries

{November 6th, 2013} by A.M. Best

CONTACTS: Robert Adams Managing Senior Financial Analyst (908) 439-2200, ext. 5225 robert.adams@ambest.com Thomas Rosendale Assistant Vice President (908) 439-2200, ext. 5201 thomas.rosendale@ambest.com Rachelle Morrow Senior Manager, Public Relations (908) 439-2200, ext. 5378 rachelle.morrow@ambest.com Jim Peavy Assistant Vice President, Public Relations (908) 439-2200, ext. 5644 james.peavy@ambest.com FOR IMMEDIATE RELEASE OLDWICK, N.J., NOVEMBER 06, 2013 A.M. […]

A.M. Best Assigns Issuer Credit Rating to Global Atlantic Financial Group

{November 5th, 2013} by BUSINESS WIRE

OLDWICK, N.J.–(BUSINESS WIRE)– A.M. Best Co. has assigned an issuer credit rating (ICR) of “bbb-” to Global Atlantic Financial Group (Global Atlantic) (headquartered in Bermuda). The outlook assigned is stable. The financial strength rating of A- (Excellent) and the ICRs of “a-” of the insurance operating entities of Global Atlantic are unchanged. Global Atlantic is […]

CEO compensation: The sky is the limit

{November 5th, 2013} by Warren S. Hersch

The numbers are eye-popping. Last year, the 25 highest paid chief executive officers of U.S. publicly held life insurers earned more than $310 million in compensation. Of these, the top 10 pay packages account for nearly 60 percent of the total. Click here to read…

Fed formally applies to IAIS for membership

{November 5th, 2013} by Elizabeth Festa

As anticipated, the Federal Reserve Board formally applied to the International Association of Insurance Supervisors (IAIS) Oct. 25 in an application that lays out the full scope of its powers and breadth as a central bank. Although the Federal Reserve has had oversight of various insurance companies that owned banks and thrifts, and as such were […]

‘I hate annuities’

{November 5th, 2013} by Adam Cufr

It’s a wonderful headline if your goal is to attract the attention of people who are seeking to learn more about annuities. Why? We’re all inherently skeptical and looking for reasons that affirm our fears. After all, that financial advisor who just recommended an annuity can’t possibly be acting in his client’s best interest, can […]

Insurance broker sentenced for scamming Tom Hanks

{November 5th, 2013} by AP Staff Writer

LOS ANGELES (AP) — A Southern California insurance broker who overcharged Tom Hanks and his wife, Rita Wilson, hundreds of thousands of dollars has been sentenced to more than two years in federal prison. City News Service says Jerry Goldman received a 27-month sentence Monday. He also was ordered to pay about $840,000 in restitution. […]

Benmosche comments on AIG earnings

{November 5th, 2013} by Arthur D. Postal

American International Group (AIG) officials said Friday that its life and retirement business achieved its highest level of sales in the company’s history. AIG Life and Health CEO Jay Wintrob said the unit “continues to experience strong sales momentum, and that all product lines “contributed to this favorable trend.” Wintrob said the majority of the […]

Annuity regulation: NAFA’s Kim O’Brien on the coming storm

{November 5th, 2013} by Paul Wilson

When it comes to state and federal annuity regulation, 2013 has been relatively quiet. But the industry shouldn’t be lulled into a false sense of security, because things are about to change, according to Kim O’Brien, president and CEO of the National Association for Fixed Annuities (NAFA). As most insurance professionals know, NAFA plays a […]

5 Money Management Tips Every Woman Should Know

{November 5th, 2013} by Luna Jaffe

A Call to Empowerment While women are earning bigger paychecks and many consider themselves their family’s Chief Financial Officer, nearly half fear they’ll end up broke and homeless and 54 percent feel alienated by a financial industry they say is male oriented. The Great Recession prompted more women to get involved in financial matters, but […]

North Dakota Leads U.S. In Life And Annuity Premium Growth

{November 5th, 2013} by Cyril Tuohy

Advisors looking to grow their life and annuity books of business might want to consider North Dakota. It is the only state to make the top five on two separate lists tracking premium growth over the past four years. The top states for individual life insurance direct premium growth were Minnesota, North Dakota, Wyoming, Utah […]

Baltimore insurer plans to relocate to Des Moines

{November 4th, 2013} by Victor Epstein

Fidelity & Guaranty looks to hire 50 people locally in 3 years. The Des Moines area’s status as a national insurance hub got a lift Friday with the news that Baltimore-based Fidelity & Guaranty Life Insurance Co. has legally moved to Iowa and intends to move its headquarters here. Fidelity & Guaranty specializes in the […]

ING U.S. Ends New York City Marathon Sponsorship After 2013

{November 4th, 2013} by Maud van Gaal

ING U.S. Inc. (VOYA), the insurer that had an initial public offering in May, will stop sponsoring the New York City Marathon after 2013 as it moves away from Dutch owner ING Groep NV. (INGA) The firm reviewed its sponsorship strategy as it will start re-branding to Voya Financial Inc. in 2014, Raymond Vermeulen, a […]

Advisors and Alzheimer’s

{November 4th, 2013} by Daniel Williams

In the November issue of Senior Market Advisor, we take an in-depth look at the damage Alzheimer’s causes individuals, families, caregivers and even our entire health-care-related economy. As I think about this debilitating, cognitive disease, the question that continues to stare back at me from the page is this — what is the role financial […]

10 reasons why this is the best time ever to be an advisor

{November 4th, 2013} by Van Mueller

This is the greatest time ever to be in our business, but most insurance and financial professionals have not realized it yet. Many have not achieved the success they desire. Please remember, the biggest sale you will ever make in your career is to yourself. Click here to read…

Fidelity & Guaranty Life Insurance Company Announces Redomestication from Maryland to Iowa

{November 1st, 2013} by BUSINESS WIRE

DES MOINES, Iowa–(BUSINESS WIRE)– Fidelity & Guaranty Life Insurance Company (Fidelity & Guaranty Life) announced today that it is redomesticating from Maryland to Iowa effective November 1, 2013. This past week the company received approvals from the Iowa Insurance Division and Maryland Insurance Administration to move forward with the redomestication and the company’s board adopted […]

Lifetime income benefits propel indexed annuity sales

{November 1st, 2013} by Maria Wood

When it comes to the feature that’s helped seal the deal most often in the past year, an overwhelming majority of fixed indexed annuity (FIA) sales pros cite guaranteed lifetime withdrawal benefits (GLWBs). Yet, looking toward the future, those same specialists say fixed indexed annuities that offer a combination of benefits will see a rise […]

Adapt or die: Attracting Gen X and Gen Y clients

{November 1st, 2013} by Robert Sofia

Generations X and Y are about to accumulate millions of dollars on their own and inherit trillions from their parents. These families will need advisers. Are you prepared to serve them? Having been born in 1981, I belong to Gen Y. I’m also an investment adviser representative and a consultant to 950 financial professionals. Because […]

Lincoln Financial Group Reports Third Quarter 2013 Results

{November 1st, 2013} by PR Newswire Association LLC

PR Newswire Association LLC RADNOR, Pa., Oct. 30, 2013 /PRNewswire/ — Lincoln Financial Group (NYSE: LNC) today reported net income for the third quarter of 2013 of $337 million, or $1.23 per diluted share, compared to net income in the third quarter of 2012 of $428 million, or $1.51 per diluted share. Net income in the […]

Emergence of “nonstop customer” offers opportunity for life insurers

{November 1st, 2013} by Patrick M. Lyons

As life insurers know, customers have changed considerably over the past few years. They are more empowered, have higher expectations, are more prone to switching providers, are more connected — to companies and to each other — and are more diverse, both regionally and globally. Yet, many life insurers still operate within a “one size […]

MetLife, bracing for SIFI-hood, considering options

{November 1st, 2013} by Elizabeth Festa

MetLife’s CEO Steve Kandarian said on an earnings conference call today that the company is possibly considering action to contest a potential designation by federal authorities to name it as a systemically important financial institution (SIFI). Kandarian was speaking to investors and analysts after third quarter results were released Oct. 30, a transcript of which was […]

Workers getting more help prepping for retirement

{November 1st, 2013} by Dan Berman

Employers are expanding the scope of their 401(k) plans with increased matching contributions, relaxed eligibility rules and access to expert advice, an Aon Hewitt survey released Wednesday said. Three-quarters (77 percent) of the more than 400 employers surveyed said a defined contribution plan was the primary retirement vehicle offered to their employees. The most frequent […]

American General Life Insurance Company Expands Presence in Index Annuity Market with the Launch of the Power Index Plus(SM) Annuity

{November 1st, 2013} by BUSINESS WIRE

Following April’s Launch of a New Index Annuity in the Brokerage General Agency Channel, American General Launches a New Product for Financial Institutions and Independent Broker-Dealers HOUSTON, Oct 30, 2013 (BUSINESS WIRE) — American General Life Insurance Company (American General) announced the launch of its newest index annuity, Power Index Plus(SM). This latest income solution […]

Allstate Sees Third-Quarter Net Income Drop on Lincoln Benefit Life Disposition

{November 1st, 2013} by Michael Buck

NORTHBROOK, Ill. – Allstate Corp.’s third-quarter net income available to shareholders fell 57.1% under the prior-year period to $310 million as the company recorded a $475 million after-tax loss related to the disposition of Lincoln Benefit Life Co., according to a written statement. Allstate earlier this year agreed to sell Lincoln to Resolution Life Holdings […]

MetLife Returns to Third-Quarter Profit

{November 1st, 2013} by Fran Lysiak

NEW YORK – MetLife Inc. swung to third-quarter profit, compared with a $984 million net loss the same period a year ago. Net income for MetLife (NYSE: MET) was $942 million, MetLife said in a statement. Operating earnings included results of an annual actuarial assumption review, which boosted operating earnings by $28 million as well […]

Genworth CFO: LTC Premium Hikes, Continued Improvement in US Mortgage Insurance Helped 3Q Net

{November 1st, 2013} by Fran Lysiak

RICHMOND, Va. – Genworth Financial Inc.’s significant jump in third-quarter net income is mostly due to premium rate increases on its long-term care insurance business and continued improvement in its mortgage insurance operations in the United States, despite a slight loss in this business for the quarter, says the company’s chief financial officer. Net income […]

Financial Planning Can Be Scary For Investors

{November 1st, 2013} by Cyril Tuohy

Fear Factor? Defunct television shows aside, advisors say that many people are paralyzed when it comes to financial planning. But are people scared because they don’t have a financial plan? Or do they not bother making plans because they are scared? “It’s a combination of both,” said Kenneth A. Moraif, senior advisor with Money Matters, […]