Record IA Sales Top Previous Record By 5%

September 20, 2013 by Wink, Inc.

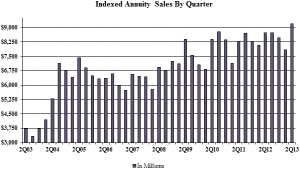

Pleasant Hill, Iowa. September 16, 2013– Forty-two indexed annuity carriers participated in the 64th edition of Wink’s Sales & Market Report, representing 99.8% of indexed annuity production. Total second quarter sales were $9.2 billion. In reviewing second quarter indexed annuity sales, production was up more than 17.0% when compared to the previous quarter, and up more than 5.5% when compared with the same period last year. “This was a record-setting quarter for indexed annuity sales, beating the previous third quarter 2010 record by nearly 5.0%!” exclaimed Sheryl J. Moore, President and CEO of both Moore Market Intelligence and Wink, Inc. She added, “Even year-to-date sales increased 1.5% over this same period, last year. What a great position for these products to be back on the uptick!”

Facts worth noting this quarter are that Allianz Life maintained their position as the #1 carrier in indexed annuities with a 13.62% market share. Security Benefit Life and American Equity also maintained their position as the second and third-ranked companies in the market; Great American, and EquiTrust rounded-out the top five, respectively. Security Benefit Life’s Total Value Annuity was the #1 selling indexed annuity for the fourth consecutive quarter.

Guaranteed Lifetime Withdrawal Benefit (GLWB) utilization rebounded in the second quarter, while additional experience data pointed to trends in rider elections and income commencement. Moore pointed-out, “This quarter marked a record for GLWB elections, with 67.3% of all indexed annuities sales opting to purchase the benefit (when available). The vast utilization of these benefits, and their income commencement, continue to show varied results that provide further insight into our nation’s needs for guaranteed lifetime income- remarkable!”

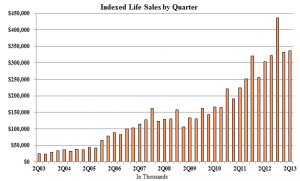

For indexed life sales, 48 insurance carriers participated in Wink’s Sales & Market Report, representing over 95.2% of production. Second quarter sales were $336.7 million. When evaluating second quarter indexed life sales, results were up more than 1.0% when compared with the previous quarter, and up more than 12.0% as compared to the same period last year. Ms. Moore remarked, “We had yet another impressive quarter for indexed life sales. Plus, year-to-date sales of indexed life also skyrocketed nearly 20.0%! She went on to comment, “Last quarter, I anticipated that sales of IUL would increase exponentially once new companies’ distributions were comfortable with their product. It is nice to see that now our most recent entrants in the IUL market have gotten their ‘toes wet,’ that their efforts are translating into to sales.”

Items of interest in the indexed life market this quarter included Pacific Life Companies taking over the #1 position in indexed life sales, with a 13.73% market share. AXA Equitable moved-up to become the second-ranked company in the market, while National Life Group (LSW), Aegon, and Minnesota Life rounded-out the top five companies, respectively. AXA Equitable’s Athena Indexed UL was the #1 selling indexed life insurance product for the ninth consecutive quarter. The average indexed UL target premium reported for the quarter was $5,770, a decline of nearly 50% from the prior quarter.

For more information go to www.LookToWink.com

The staff of Moore Market Intelligencehas combined experience of nearly three decades working with indexed insurance products. The firm provides services in speaking, research, training, product development, and marketing of indexed annuities and indexed life insurance. Their knowledge in product filing research and policy forms analysis, coupled with their unmatched resources in insurance distribution, give them the expertise to provide competitive intelligence that allows carriers to stay ahead of their competition.

Sheryl J. Moore is president and CEO of thisspecialized third-party market research firmand the guiding force behind the industry’s most comprehensive indexed life and indexed annuity due diligence tools, AnnuitySpecs. and LifeSpecs. Ms. Moore previously worked as market research analyst for top carriers in the indexed life and annuity industries. Her views on the direction on the indexed market are frequently heard in seminars and quoted by industry trade journals.

Ms. Moore is the author of the quarterlyWink’s Sales & Market Report. Serving as the insurance industry’s #1 resource of indexed insurance product sales since 1997, this report provides sales by product, company, crediting method, index, distribution, surrender charge period, and more. The report is formerly known as AnnuitySpecs.com’s Indexed Sales & Market Report, which has been rebranded under the company name Wink, Inc. Wink, Inc. will be the company name that distributes resources such as this sales report, AnnuitySpecs.com, andLifeSpecs.com.

Wink, Inc. is the company that distributes resources such as this sales report, along with the competitive intelligence tools AnnuitySpecs and LifeSpecs. Wink has the same ownership, same people, great service, and unparalleled competitive intelligence, all rebranded under one name, one new dynamic website at www.LookToWink.com.