Obama’s budget calls for big changes to 401(k)s, IRAs

{September 30th, 2013} by Paula Aven Gladych

Set aside for a moment the fight in Washington, D.C., over stopgap spending legislation. In his budget blueprint for 2014, President Obama has proposed a number of tax and other reforms that would mean big changes in how retirement is financed. What Congress does over the next couple of days could either avoid or trigger a […]

NAIFA President Pivots From Last Year’s Fight

{September 30th, 2013} by Linda Koco

SAN ANTONIO – “’Advisor 2020’could be a game changer,” said Robert O. Smith in opening remarks here at the annual meeting of National Association of Insurance and Financial Advisors. The NAIFA president was referring to a new project that the NAIFA is co-sponsoring with the GAMA Foundation. The project will help agencies recruit new advisors […]

18% of the workforce could retire within five years

{September 30th, 2013} by Michael K. Stanley

Eighteen percent of the workforce could retire within the next five years. The finding, in a recent report by the ADP Retirement Research Institute, a research arm of the global provider of human capital management solutions, is an appropriate reminder of the heft of the Baby Boomer generation and the impact their ageing will have […]

Behind the Scenes of Fixed Annuity Regulation

{September 30th, 2013} by Kim O'Brien

THE SAGA CONTINUES… THE INDUSTRY’S LEADING ADVOCATE, KIM O’BRIEN, PEELS BACK THE CURTAIN ON FEDERAL AND STATE REGULATION Edited by Robert Billingham These days, you don’t need to go to the movies to find drama. The most action-packed scenes are happening every day in our industry, and we are holding our breath in anticipation of […]

Class Calls ING Annuities a Fraud

{September 30th, 2013} by Matt Reynolds

SAN DIEGO (CN) – ING Life Insurance defrauds senior citizens by selling them indexed annuity contracts without telling them they are “embedded” with high-risk, complex derivatives, an 83-year-old man claims in a federal class action. Ernest Abbit sued ING USA Annuity and Life Insurance Co., alleging financial elder abuse, fraudulent inducement and other charges. Abbit […]

Advisors split on how best to track retirement readiness

{September 30th, 2013} by Paula Aven Gladych

Most financial advisors place a great deal of importance on retirement income planning, but these same advisors don’t agree on how best to track whether a client’s investments are achieving the desired result: sustainable retirement income. That’s according to Russell Investments’ Financial Professional Outlook, a quarterly survey of U.S. financial advisors that found 34 percent […]

Global Atlantic to Buy Insurer for Post-Goldman Growth (Correct)

{September 30th, 2013} by Zachary Tracer

Global Atlantic Financial Group, the insurer divested by Goldman Sachs (GS:US) Group Inc. this year, agreed to buy closely held Forethought Financial Group Inc. to expand sales of life and retirement products. The purchase will increase assets at Global Atlantic to more than $31 billion, the Bermuda-based insurer said today in a statement that didn’t […]

Global Atlantic Financial Group Agrees to Acquire Forethought Financial Group

{September 27th, 2013} by BUSINESS WIRE

HAMILTON, Bermuda–(BUSINESS WIRE)–Global Atlantic Financial Group (Global Atlantic), a multiline insurance and reinsurance company, today announced that it has entered into a definitive agreement to acquire Houston-based Forethought Financial Group, Inc. (Forethought), a financial services company with life insurance and annuity operations throughout the US. Forethought will continue to operate its life insurance and annuity […]

Minnesota Life Insurance Releases Insurance Upgrades [Professional Services Close – Up]

{September 27th, 2013} by Proquest LLC

Minnesota Life Insurance Company announced a new benefit for its indexed universal life products that keeps it at the forefront of the market. Minnesota Life, a subsidiary of Securian Financial Group, introduced its latest improved offering for new and existing policies. The Index Crediting Bonus, when applied, provides a one percent annual bonus based on […]

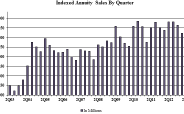

Wink CEO: Second-Quarter US Sales of Indexed Annuities Rise on Sales of Two Private Equity-Owned Companies

{September 27th, 2013} by Fran Lysiak

PLEASANT HILL, Iowa – Second-quarter 2013 sales of indexed annuities in the United States rose in large part on sales by two private equity-owned companies, according to the chief executive officer of Wink Inc. Total second-quarter sales rose to $9.2 billion, up 5.5% from the same period a year ago, and increased 17% from the […]

AIG CEO comes under fire after remark

{September 27th, 2013} by Arthur D. Postal

American International Group (AIG) president and CEO Robert Benmosche is under heavy fire from a senior Maryland Democratic congressman because he compared the intense criticism of bonus payments made in 2009 to AIG Financial Products (AIGFP) executives to the lynching of blacks during the civil rights battles of several decades ago. Benmosche issued a summary […]

Survey points to skepticism among the mass affluent

{September 27th, 2013} by Warren S. Hersch

Main Street investors remain pessimistic about their finances five years after the financial crisis, according to the “2013 Mass Affluent Investor,” a new study released this week by Spectrem Group. The mass affluent don’t feel wealthy enough to require financial advising services, though they have a net worth of $100,000 to $1 million (not including primary […]

Don’t ‘lean in’ to stereotypes, just be yourself

{September 27th, 2013} by Rajini Kodialam

Has the financial advisory industry disenfranchised women because they are expected to emulate male stereotypes? Earlier this week, I attended a “Lean In” event led by Sheryl Sandberg, focused on “Women, Work, and the Will to Lead”. Let me be honest, I don’t agree with everything in Sheryl’s book. I have worked with several incredible […]

20 women in insurance you need to know

{September 27th, 2013} by Corey Dahl, Vanessa De La Rosa, Emily Holbrook, Nichole Morford, Maria Wood

From the executive ranks of leading carriers to the local agencies that meet consumers’ needs each day, the insurance industry is increasingly being led by women. And for good reason. Women are uniquely equipped to meet the changing needs of consumers who want relational and holistic solutions — and, despite working in an industry that’s […]

Allstate Hiring 305 Agents In Pennsylvania

{September 26th, 2013} by Scott Kraus, The Morning Call (Allentown, Pa.) McClatchy-Tribune Information Services

Sept. 26–Allstate Insurance plans to hire 305 agents in Pennsylvania over the next year in an expansion it says is fueled by the growing economy. The company, based in Malvern, Chester County, is looking for both midcareer agency owners and managers and less-experienced applicants looking to break into the insurance business. The company will be […]

3 famously flubbed attempts to market to women

{September 26th, 2013} by Corey Dahl

It’s easy to launch a product for women, right? Make it pink, add some sparkles, work the words “shopping” and “girlfriend” into your marketing copy… The ladies will come running. Or not. Click here to read…

Fed to join IAIS to help guide global insurance supervision

{September 26th, 2013} by Elizabeth Festa

The Federal Reserve Board — sparked by the interest of Gov. Dan Tarullo in ongoing talks of global insurance supervisory standards — is seeking to become one of the many U.S. members of the International Association of Insurance Supervisors (IAIS), according to sources. The Fed is also said to be negotiating with the National Association of […]

Second wave of VA buyout offers comes from Axa

{September 26th, 2013} by Darla Mercado

Advisers and clients are getting Axa Equitable Life Insurance Co.’s second wave of variable annuity buyout offers — and the verdict is mixed. Back in July, the insurer filed an offer with the Securities and Exchange Commission, giving a certain group of clients who own its Accumulator variable annuity the option to terminate their guaranteed-minimum-income […]

We must embrace Dave Ramsey as an expert

{September 26th, 2013} by Rodney Ballance

Did you know that Dave Ramsey is actually the third highest rated talk radio host in America? He has a listening audience of over two million people. His message is well received in the Christian community, and churches pay him millions of dollars every year to share his financial ignorance with the masses. No matter […]

IRI Research to Explore Retirement Needs of Same-Sex Couples

{September 26th, 2013} by Catherine Weatherford

WASHINGTON, D.C. – The Insured Retirement Institute (IRI) announced yesterday a new research initiative that will explore the retirement needs of same-sex couples. IRI’s focus on this market was heightened by the U.S. Supreme Court’s decision in United States v. Windsor. The Supreme Court struck down Section 3 of the federal Defense of Marriage Act […]

New Designation for Financial Advisors Seeks to Reassure Skeptical Consumers

{September 26th, 2013} by The American College

BRYN MAWR, PA – September 26, 2013 – The American College of Financial Services announced this week that it is launching the Financial Services Certified Professional™ (FSCP™) designation – a rigorous program designed to help advisors understand client needs in a comprehensive manner rather than directly “selling product” without due diligence. The FSCP™ is the […]

Advisors Bullish About Remainder Of 2013

{September 26th, 2013} by Cyril Tuohy

A new poll by the SEI Advisor Network finds that three out of four financial advisors say business profits will increase this year over last year. The poll also finds a majority (58 percent) of advisors predict the S&P Index will close above 1,650 by the end of the year. The S&P 500 closed at […]

Advisors, banks can report elder financial abuse

{September 26th, 2013} by Maria Wood

Financial institutions can report suspected financial abuse of the elderly under certain circumstances without violating the individual’s privacy. That was main takeaway from guidance issued by the Consumer Financial Protection Bureau and seven other federal agencies yesterday. For advisors and employees of financial institutions like banks who believe an elderly person may be the victim […]

In DOMA’s wake, more good news for same-sex couples

{September 26th, 2013} by Warren S. Hersch

The U.S. Supreme Court’s June decision to strike down Section 3 of the Defense of Marriage Act was a major milestone for same-sex couples seeking marriage equality. That decision has led to additional developments favoring gay and lesbian couples, all of which are good news for financial advisors. The latest salvo comes from the Internal […]

Quick Takes On The Annuity Scene

{September 25th, 2013} by Linda Koco

The past few weeks have percolated with news on living benefits, annuity flows, deferred income annuities and more. Here are some short takes on that. We’ll do some up-close looks later on. Living benefit riders do impact client behavior: Before starting lifetime income from fixed indexed annuities, policyowners who have a guaranteed lifetime withdrawal benefit […]

Advisors’ Biggest Annuity Worries

{September 25th, 2013} by Samantha Allen

Despite a tarnished reputation, annuities make sense for some clients. Even so, advisors on a panel at the Insured Retirement Institute’s annual Vision conference in Chicago on Tuesday highlighted some of the biggest challenges they face in using annuities for clients. One of the major hurdles is the increasing complexity of annuity products. Not only […]

A Look Behind The New ‘Structured Annuities’

{September 25th, 2013} by Linda Koco

Structured variable annuities — also known as indexed variable annuities, registered indexed annuities or just structured annuities — have begun showing up on annuity dance cards, but industry practitioners aren’t quite sure what they are. Or why they are. One reason for the mystery is there aren’t many on the market just yet, and they […]

Nationwide’s John Carter Named IRI Board Chairman

{September 25th, 2013} by InsuranceNewsNet

WASHINGTON, D.C. – The Insured Retirement Institute (IRI) today announced the election of John Carter, President and Chief Operating Officer of Nationwide Retirement Plans, as the new Chairman of the IRI Board of Directors. As Chairman, Mr. Carter follows Larry Roth, Immediate Past Chairman of the IRI Board. IRI also announced the election of eight […]

20% Of Americans Expect Never To Retire

{September 24th, 2013} by ProQuest Information and Learning Company

Working until you drop is no longer confined to the pages of Victorian novels according to the sobering findings of a new report published recently by HSBC. According to a release, the study discovered that nearly one in five (18 percent) working-age Americans expect they will never be able to afford to completely retire, believing […]

How to speed up the underwriting process — and place more cases

{September 24th, 2013} by Gregory E. Schwabe

Advisors today are faced with the immense challenge of assessing a client’s risk class in an underwriting environment that seems to change every week. Just staying on top of which companies are better at underwriting prostate cancer, diabetes, overweight applicants or those with heart disease is an impossible task. As an advisor, the best you […]

When retirement products miss the mark

{September 24th, 2013} by Darla Mercado

In the world of insurance and asset management, sometimes it doesn’t pay to be the company with the most revolutionary product. Life insurance and fund family executives recounted their brushes with product failures at the Insured Retirement Institute’s annual conference in Chicago on Monday afternoon during a panel entitled “Product Innovation: A Look Ahead.” Back […]

LIMRA: Gen X Concerned About Having Enough Money To Retire

{September 24th, 2013} by InsuranceNewsNet

WINDSOR, Conn., Sept. 23, 2013 — Generation X Americans tended to be more concerned that they would not have enough money for retirement than younger and older consumers, according to a new retirement study by LIMRA. Only a quarter of Generation Y consumers (aged 18 to 32) and 3 in 10 Baby Boomers (age 49- […]

Tangled up in Pru

{September 23rd, 2013} by Elizabeth Festa

Domestic insurers and reinsurers other than Prudential Insurance could face consolidated regulation by the Federal Reserve Board, judging from the Sept. 19 majority opinion of the Financial Stability Oversight Council (FSOC) on the SIFI-designated insurer, although members would be quick to point out under the Dodd-Frank Act (DFA) that each case is judged upon its […]

11 Money Lessons From ‘Breaking Bad,’ ‘Modern Family’ And Other Emmy Favorites

{September 23rd, 2013} by Maggie McGrath

Host Neil Patrick Harris may have said it best in his introduction to the 65th Annual Primetime Emmy Awards: “I love television, because it’s more than entertainment; it’s education!” Surprising, but true: there are money lessons to be had from best drama series winner Breaking Bad, best comedy series Modern Family and other small screen […]

Advisors: CYA with paper

{September 23rd, 2013} by Bruce Sankin

The interpretation of your client’s answers on a client account form can make the difference between winning and losing a financial dispute or arbitration with a client. Knowing this information could help you avoid any negative comments in your file or on your U-4. Who would have thought that a piece of regulatory paperwork could […]

Keys To Snapping Up Top Agents

{September 23rd, 2013} by Cyril Tuohy

Insurance agencies stand a much better chance of snagging that future Million Dollar Round Table inductee if they offer sales training, career advancement potential, retirement savings plans, employer-provided sales leads and employer-provided health insurance benefits — in that order — according to a new survey. The survey by Combined Insurance, a provider of individual supplemental […]

Record IA Sales Top Previous Record By 5%

{September 20th, 2013} by Wink, Inc.

Pleasant Hill, Iowa. September 16, 2013– Forty-two indexed annuity carriers participated in the 64th edition of Wink’s Sales & Market Report, representing 99.8% of indexed annuity production. Total second quarter sales were $9.2 billion. In reviewing second quarter indexed annuity sales, production was up more than 17.0% when compared to the previous quarter, and up […]

Desperately Seeking GLWBs On Fixed Annuities

{September 20th, 2013} by Sheryl J. Moore

Since 2004, these benefits have practically become a requirement on the variable annuity (VA) sale. In fact, 84% of all VAs have opted for an optional GLWB1. Why? It is hard to guarantee a specified lifetime income amount on a product that has cash values which can rise and fall, based on the market’s performance. […]

Indexed annuity, life sales rise in Q2

{September 20th, 2013} by Maria Wood

Overcoming a first-quarter slump, indexed annuity and indexed life sales bolted upward in the second quarter. According to the most recent Wink’s Sales & Market Report from Wink, Inc., total sales of indexed annuities hit $9.2 billion in Q2. That tally represents a 17 percent jump in production when compared to the previous quarter and […]

Prudential loses appeal, is designated a SIFI by FSOC

{September 20th, 2013} by Elizabeth Festa

Unsurprisingly, minds failed to be changed, and Prudential Insurance lost is appeal before the Financial Stability Oversight Council (FSOC) this week, despite strong opposition from the independent insurance expert on the insurer’s ability to cause systemic risk to or within the economy if it failed. The council presumably voted again 7-2, meeting the two-thirds of […]

Life insurance ownership lower among Latinos

{September 20th, 2013} by Warren S. Hersch

Given the rapid expansion of the Latino population in the U.S. — the growth rate among Hispanics is projected to be triple that of any other ethnic group over the next 20 years — one might expect them to be a rich source of prospects for life insurance professionals. Cracking the Latino market may, however, […]

‘Safe Money Radio’ Host Charged In $2M Fraud

{September 20th, 2013} by Paul Walsh, Star Tribune (Minneapolis)

Sept. 19–A one-time host of “Safe Money Radio” in western Minnesota has allegedly contradicted the show’s title by swindling nearly$2 million out of investors who said they had invested proceeds from the sale of their farms or life savings. Jeffrey C. Rodd, 49, of Redwood Falls, was charged this week in federal court with four […]

Survey Shows Most Seniors Allow Life Insurance To Lapse

{September 20th, 2013} by Proquest LLC

In a survey conducted by ICR for life settlement provider The Lifeline Program, 55 percent of seniors have allowed their life insurance policies to lapse, viewing it as a liability instead of an asset. According to a release, further, more than 80 percent of adults aged 66 and over were not aware that they can […]

Insurers Challenged With Finding Risk Management Talent

{September 20th, 2013} by Carrie Burns

Executives responding to a recent Accenture survey report shortages of talent in a number of areas, including risk business and data analytics, risk technologists and regulatory change program management. Organizations are facing increased risks as many have grown their risk management team over the last two years, but they still need to address specific technology-related […]

Recruiting Gen Y Advisors Top Priority For Industry

{September 20th, 2013} by Source Media, Inc.

Get younger or go home. That’s the crux of the recruiting dilemma facing the financial advisory business, according to a new Pershing study. Financial services firms have to start recruiting the half-million college students who may be interested in becoming advisors, or risk having demand for financial advice outstrip supply within 10 years, according to […]

A Broader Approach To Reach Generation X

{September 20th, 2013} by Cyril Tuohy

For advisors, the bad news about selling life insurance to Generation X is that this generation, already underinsured, is falling even further behind in terms of coverage. The good news is that Gen X is keenly aware of it. The most important insight for advisors, however, may well be that there’s an opportunity for financial […]

Peer to Peer

{September 20th, 2013} by Michael K. Stanley

Millenials state their case on who should sell to them. For a generation that, for the most part, has trouble committing to what the are going to have for dinner on any given night. Click here to read…

Insurers liable for agent

{September 20th, 2013} by Arthur D. Postal

The Washington State Supreme Court has reaffirmed that insurance companies are totally responsible for the acts of their agents. Click here to read..

Advisor bilks parents of $1.3 million

{September 20th, 2013} by Harry Lew

A not-so-dutiful son has pleaded guilty to stealing more than $1.3 million from his parents. Over many years, the advisor pretended to be managing his parents’ investments. However, in reality he was siphoning money from their accounts and using their money for his own purposes. Click here to read…

Finra backs incentive comp disclosure rule

{September 20th, 2013} by Mark Schoeff Jr.

The board of the Financial Industry Regulatory Authority Inc. has approved a proposal that would require brokers to disclose the amount of incentive pay they received to switch firms. Recruiting compensation of $100,000 or more — including signing, upfront or back-end bonuses, loans, accelerated payouts and transition assistance — would have to be disclosed to […]

U.S. risk council says Prudential needs close oversight

{September 20th, 2013} by Emily Stephenson

WASHINGTON, Sept 19 (Reuters) – Insurer Prudential Financial Inc said on Thursday that U.S. regulators had voted to designate the company as systemically risky, bringing it under stricter regulatory oversight. A group of regulators known as the Financial Stability Oversight Council had been weighing whether Prudential was so big that its failure could threaten U.S. […]

Why advisors need to talk their loved ones about life insurance

{September 20th, 2013} by Dennis Postema

BLOG: When I was 20 years old, I suddenly lost my older brother in a car accident. This event was extremely tragic to my entire family. The days to follow included picking out a casket, cemetery plots, programs and songs for the funeral. It was extremely trying for everyone in my family to have to […]

Labor Dept. Again Delays Proposal On Fiduciary Rule

{September 19th, 2013} by Cyril Tuohy

New rules surrounding fiduciary standards will have to wait, and wait, and wait some more as financial advisors last week learned that the U.S. Department of Labor has pushed back yet again its proposals to amend the definition of a fiduciary. But is anyone all that surprised? House Republicans and Senate Democrats over the summer […]

The ‘key’ to selling to women

{September 19th, 2013} by Maribeth Kuzmeski

Are women really a “niche” market? If women are a niche, then I guess men are, too, right? But you rarely hear that a financial advisory firm is targeting men. Click here to read…

Yellen Is Now Front-Runner For Fed Chief, But Options Remain

{September 19th, 2013} by Jim Puzzanghera and Christi Parsons, Los Angeles Times

With Lawrence Summers removing himself from consideration to be the next Federal Reserve chairman, Janet Yellen becomes the acknowledged front-runner for the economic policy position. But President Barack Obama still could go in another direction, and speculation swirled Monday about other potential candidates, including former Fed Vice Chairman Donald Kohn and former Treasury Secretary Timothy […]

Most boomers confident in retirement preparedness

{September 18th, 2013} by Warren S. Hersch

More than 7 in 10 baby boomers believe they’re financially prepared for retirement, new research shows. That’s the word from TD Ameritrade Inc., which unveiled this finding in a new report, “2012 Baby Boomers: What Separates those who are financially prepared for retirement from those who are not?” Conducted last October by Head Research, the […]

Moms Rule: Principal Financial Group Named to 2013 Working Mother 100 Best Companies for the 12(th) Time

{September 18th, 2013} by BUSINESS WIRE

DES MOINES, Iowa–(BUSINESS WIRE)–September 17, 2013– Working Mother magazine today named the Principal Financial Group(R) as one of the “2013 Working Mother 100 Best Companies” for its commitment to progressive workplace programs, including child care, flexibility, advancement and paid family leave. The 100 Best Companies are featured in the October/November issue of Working Mother and […]

Annuity Sales Data: A Blessing And A Curse

{September 18th, 2013} by Linda Koco

It’s a blessing and a curse at the same time. The “It” is the host of annuity sales statistics that come out each quarter. On the blessing side of things, annuity specialists are fortunate to be able to see the statistical highlights from an assortment of researchers on annuity sales. That gives a multi-dimensional look […]

NY DFS reopens probe into AIG

{September 18th, 2013} by Arthur D. Postal

New York Department of Financial Services (DFS) has reopened a probe into the risk management practices that led to American International Group’s (AIG) emergency takeover by the Federal Reserve Board in 2008. In the DFS probe, disclosed in a June letter written by DFS superintendent Benjamin Lawsky, DFS examiners allege that AIG may have failed to […]

Annuities: focusing on the big picture

{September 18th, 2013} by Shawn Moran

Imagine going shopping for a new car. The car you own is worn out and tired, and you are tired of it. It long ago lost that new car smell. You are excited about the possibilities of what you might drive next, and so, armed with lots of information that you have read online about […]

Allianz Launches Indexed Variable Annuity

{September 18th, 2013} by Cyril Tuohy

Allianz Life has launched a new indexed variable annuity (IVA) branded as Allianz Index Advantage for investors willing to trade gains in market growth for a level of protection when markets fall. IVAs differ from their fixed indexed annuity cousins by increasing the amount of potential return through much higher caps on the interest credit […]

FIA holders like those ‘free’ withdrawals

{September 18th, 2013} by Maria Wood

An increasing number of fixed indexed annuities (FIAs) are now sold with guaranteed lifetime withdrawal benefits (GLWBs). Though common historically on variable annuities, GLWBs on FIAs are something of a new phenomenon ‑ as is policyholder behavior in regards to the utilization of those riders. With that in mind, Ruark Consulting, LLC recently undertook its […]

ACLI calls Lawsky’s letter on reserves ‘irresponsible’

{September 18th, 2013} by Elizabeth Festa

In a letter to state insurance commissioners, the American Council of Life Insurers (ACLI) called the top New York insurance regulator’s remarks on life insurance reserving “irresponsible” and inaccurate, the former because they erode trust in the state regulatory system and the industry and the latter for actuarial reasons. The letter was written by ACLI […]

Carriers Use The Web To Steer Buyers Into Distribution Chain

{September 17th, 2013} by Cyril Tuohy

A decade ago, you couldn’t walk into an insurance trade show without overhearing the whispers of “disintermediation” among distributors and financial advisors, and how the Internet was going to fundamentally alter the way life insurance products were sold. The Internet was going to replace an entire distribution channel, so said some of the industry’s wisest […]

Study Sheds Light On Life Insurance Ownership

{September 17th, 2013} by PR Newswire Association LLC

RADNOR, Pa., Sept. 16, 2013 /PRNewswire/ — Lincoln Financial Group (NYSE: LNC) today released new findings from its recent M.O.O.D. (Measuring Optimism, Outlook, and Direction) of America study that show a high level of empowerment and a positive outlook on the future among respondents who own life insurance. According to the survey results, which are being […]

Progress and Perils in Washington D.C.: Message from the President

{September 17th, 2013} by Kim O'Brien

Just like Rodney Dangerfield, the fixed annuity and particularly the fixed indexed annuity “don’t get no respect” – until NOW! Something very important happened this summer in which NAFA played a major role: Senator Orin Hatch (R-Utah) introduced The Secure Annuities for Employee (SAFE) Retirement Act of 2013 (S. 1270). Under SAFE, state and local […]

Cerulli projects contraction in number of advisors

{September 17th, 2013} by Warren S. Hersch

The force of the financial advisory field will decline by 8 percent by year-end 2017, according to a new report. Cerulli Associates discloses this finding in “Intermediary Distribution 2013: Product Distribution in a Shrinking Industry.” The study focuses on financial products and distribution, including market-sizing, advisor product use and asset manager sales forces. Click here to […]

ING U.S. files for public stock offering

{September 17th, 2013} by Maria Wood

ALSO: Moshe Milevsky’s QWeMA acquired by CANNEX ING U.S. Inc. has filed a statement with the SEC regarding a potential public offering of common stock currently held by ING Group. The move follows the company’s initial public offering (IPO) in May, in which it raised $600 million. According to ING U.S., the company will not […]

Wink, Inc. Releases Second Quarter, 2013 Indexed Sales Results

{September 17th, 2013} by Wink, Inc

Record Indexed Annuity Sales Top Previous Record by 5% Wink, Inc. Releases Second Quarter, 2013 Indexed Sales Results Pleasant Hill, Iowa. September 16, 2013– Forty-two indexed annuity carriers participated in the 64th edition of Wink’s Sales & Market Report, representing 99.8% of indexed annuity production. Total second quarter sales were $9.2 billion. In reviewing second […]

5 things to know about the Hispanic market

{September 17th, 2013} by Nichole Morford

The Hispanic market is large (at 52 million, it already outnumbers the population of Canada) and growing larger (by 2030, it could tally 79 million). It is also young: According to recent LIMRA research, 75 percent of Hispanics in the U.S. are under the age of 45. This emerging market has in many ways already […]

A brief history of life insurance

{September 17th, 2013} by Corey Dahl

Did you know that life insurance has been around since the days of ancient Rome? Or that Lloyd’s of London got its start as a coffee spot for sailors? In honor of Life Insurance Awareness Month, we’ve compiled a few pivotal moments in life insurance history to give you a better idea of the product’s […]

Lawsky: NAIC’s new reserving system will lead to shortfall

{September 17th, 2013} by Elizabeth Festa

with Lincoln National statement– New York Department of Financial Services (DFS) Superintendent Ben Lawsky says that the life insurance industry continues to be under-reserved and that the compromise constructed by state regulators for a new reserving method has failed, possibly imperiling policyholders and even the system of state-based regulation. The issue is underpinned by one of […]

The issue of product affordability

{September 16th, 2013} by Daniel Williams

In National Underwriter’s 2013 Multicultural Markets Research Study, product affordability was cited as the No. 1 challenge for advisors serving the African American (70 percent) and Hispanic (47 percent) markets. (Figure 7) While on the surface, product affordability may appear to be the root cause for the lack of insurance sales in these markets, is it the […]

6 advantages of selling to multicultural markets

{September 16th, 2013} by Nichole Morford

Alexandra Galindez, vice president of women and multicultural marketing at Prudential, says this about the emergence of multicultural markets in the U.S.: “If you look at the projected population growth rates from 2015-2030, it is clear that the U.S. is becoming increasingly diverse. Research has shown that these markets tend to be underserved by the […]

Aviva USA sales, workforce decline

{September 16th, 2013} by Victor Epstein

Since May 1, about 43% of workers have either left or been told their jobs are being eliminated. Jobs and annuity sales at Aviva USA are both plummeting as Apollo Global Management moves closer to completing its $1.8 billion bid for the business, and some insurance agency leaders are concerned by the changes. The deal […]

New York Regulator Sees Abuse Increasing Under New Insurance Rules

{September 12th, 2013} by MARY WILLIAMS WALSH

Several big life insurers are going to have to set aside a total of at least $4 billion because New York regulators believe they have been manipulating new rules meant to make sure they have adequate reserves to pay out claims. The development stems from contentions by insurance companies that states’ regulations are forcing them […]

AIG Not Renewing Reinsurance with Rival Berkshire: Source

{September 12th, 2013} by Zachary Tracer and Noah Buhayar

American International Group Inc. has decided against signing new reinsurance contracts with Berkshire Hathaway Inc. after Warren Buffett’s company started a commercial insurer competing against AIG, according to a person with knowledge of the decision. AIG stopped entering into the deals with Berkshire units including National Indemnity Co. and General Re about two months ago, […]

Locking horns over the fiduciary standard

{September 12th, 2013} by Paula Aven Gladych

With the Department of Labor and Securities and Exchange Commission creeping ever-closer to unveiling their proposed changes to the fiduciary standard, there’s little doubt that regulators are about to unleash big changes on stock brokers and insurance agents. The very meaning of “investment advice” for retail investors may be fundamentally altered in what promises to be […]

US insurers’ purchases of RMBS top $1.2 billion

{September 12th, 2013} by Warren S. Hersch

U.S. insurers spent an aggregate $1.21 billion on residential mortgage-backed securities issued by 18 trusts in the first half of 2013, new research reveals. SNL Financial discloses this finding in a report based on quarterly statutory statements filed by the insurers with the National Association of Insurance Commissioners. The transactions appear in Schedule D, Part […]

Few Americans rate their financial savvy an “A

{September 12th, 2013} by Warren S. Hersch

An overwhelming majority of Americans believe that financial education is important, but few give a top-notch rating to their knowledge of saving, investing and retirement, according to a new report. Genworth Financial discloses these findings in a September 2013 survey, “Psychology of Financial Planning.” Conducted in partnership with J&K Solutions LLC and Toluna Inc., the […]

Advisor Sounds Cautionary Note On Bank-Sold Annuities

{September 12th, 2013} by Cyril Tuohy

At first blush, the higher second-quarter numbers of fixed and indexed annuities sold through banking institutions would appear to be a good sign: consumers are looking to take advantage of recent stock market gains but ultimately want to protect themselves from a sudden loss. Fixed annuity bank and credit union sales hit the $3.2 billion […]

Women Advisors Break Through The Barriers

{September 12th, 2013} by Cyril Tuohy

Last month, when Guardian Life named financial advisor Michele Lee Fine as the first female top producer in its 153-year history, the company recognized what women have known all along: they are ideally suited to advising people in their financial affairs. In the eyes of some women’s groups, the recognition by Guardian may have been […]

Life Application Activity Declines 1.9% In August

{September 12th, 2013} by MIB Life Index

Braintree, MA. (September 10, 2013) – U.S. application activity for individually underwritten life insurance declined 1.9% in August, year-over-year, all ages combined, according to the MIB Life Index. August numbers were bolstered slightly by insurance applications gathered in one fewer business day (22) than the August 2012 comparative period (23). After declining in seven of […]

Gen X Seriously Short On Life Insurance

{September 12th, 2013} by Jeff Reeves, Special for USA TODAY

In the wake of the 2008 financial crisis, middle-aged Americans are increasingly overlooking life insurance due to shaky personal finances. A New York Life survey released Thursday shows Americans born from 1965 through 1976, commonly known as Generation X, reported life insurance needs almost$449,000 greater than what their current coverage provides. And that’s just the […]

For Advisors, Social Media About Influence, Not Sales

{September 12th, 2013} by Kenneth Corbin

WASHINGTON — There are few marketing issues in the advisor sector that in recent years have inspired more interest — and uncertainty — than the use of social media in the practice. Evangelists for tapping into sites like Twitter and Facebook stress that even while they represent a fundamentally different communications platform from the traditional […]

Iowa Launching Fraud Fighters Program

{September 12th, 2013} by Associated Press

DES MOINES, Iowa (AP) — The Iowa Insurance Division has launched a new anti-fraud program to help Iowans protect their money. The program is called Iowa Fraud Fighters — Shield Your Savings. It comes in response to a wave of new cons targeting senior citizens. The program aims to raise their financial literacy. Insurance CommissionerNick […]

Ill. Announces A Multi-Million Dollar Settlement With Transamerica

{September 12th, 2013} by Targeted News Service

CHICAGO, Sept. 9 –The Illinois Department of Insurance issued the following news release: Illinois Department of Insurance (DOI) Director Andrew Boron today announced an agreement with Transamerica as part of a multi-million dollar settlement with several states regarding its use of the Social Security Administration’s Death Master File (DMF). Under the settlement, Transamerica will pay$11.2 […]

3% Is The New 5% For Fixed Annuities

{September 12th, 2013} by Fran Matso Lysiak

Three percent “is the new 5% when it comes to fixed annuities,” the chief executive officer of Beacon Research said of the credited rates insurers are offering. Total second-quarter 2013 U.S. sales of fixed annuities, including indexed, were$17.1 billion, up just 0.2% from the same period a year ago but sales increased 14.6% sequentially, according […]

House Passes NARAB II

{September 11th, 2013} by Susan Rupe

The U.S. House of Representatives passed the National Association of Registered Agents and Brokers Reform Act of 2013 (NARAB II) on Tuesday. The measure had been backed by a number of financial services organizations, including the National Association of Insurance and Financial Advisors (NAIFA) and the Insured Retirement Institute (IRI). The bill moves to the […]

12 years later, the nation pauses to remember 9/11

{September 11th, 2013} by The Associated Press

Sept. 11 victims’ loved ones gathered at ground zero Wednesday to commemorate the attacks’ anniversary with the reading of names, moments of silence and serene music that have become tradition. At the 2-year-old memorial plaza in New York, a bell tolled during a moment of silence at 8:46 a.m. EDT, the moment when American Airlines […]

Getting the Pulse of Life Month

{September 10th, 2013} by Steven A. Morelli

The LIFE Foundation coordinates the annual observance of September as Life Insurance Awareness Month (LIAM). This effort carries a greater burden each year as the number of life insurance policies in effect in the United States continues to decline. LIFE is joined by 100 companies and industry groups in the yearly awareness campaign, but recently, […]

Is a Million Dollars Enough Today?

{September 10th, 2013} by Mark Peterson

Over the years, many clients may have obtained million-dollar life insurance policies to help address survivor needs. Although a million-dollar policy might have sufficed to provide that needed survivor benefit 10 years ago, or even eight years ago, some of today’s clients may need policies with face values that are twice that amount. Why the […]

Whole Life Vs. Universal Life: UL Evolves into Legacy-Protector and Robust Wealth Generator

{September 10th, 2013} by Guy Baker

When I first came into the insurance profession in the early ’70s, the staple product was whole life. I loved whole life. What was there not to love? Whole life offered guaranteed premiums, guaranteed cash value and a long history of dividend payments that eventually could make the premiums disappear (based on dividend performance). Whole […]

Aviva confirms additional 326 planned layoffs

{September 10th, 2013} by Victor Epstein

Aviva USA’s headquarters is on Mills Civic Parkway in West Des Moines More employees at Aviva USA are losing their jobs than previously disclosed, with an additional 326 being notified that their positions will be eliminated over the next two years. The planned job eliminations mean that about 780 of the 1,800 people employed […]

Aspen: A World-Class Location Hosts the 2013 NAFA IMO Summit

{September 10th, 2013} by Ann d'Eon

A View of St. Regis Resort, Aspen The 2013 NAFA IMO Summit will be held in the spectacular village of Aspen at the deluxe St. Regis resort on October 16-18, 2013. NAFA members can experience this 180 room prestigious resort located at the base of Aspen Mountain at a special rate of $229 plus tax. […]

Seven Groups Who May Need Life Insurance The Most

{September 10th, 2013} by PRNewswire

ERIE, Pa., Sept. 9, 2013 /PRNewswire/ — The financial services consulting group LIMRA reports that life insurance ownership has reached a 50-year low. With 35 million households lacking any form of life insurance – including group policies typically offered through employers – the death of an income earner could be as financially catastrophic as it […]

Fidelity & Guaranty Life’s IPO a credit positive

{September 10th, 2013} by Maria Wood

Fidelity & Guaranty’s Life recently announced $100-million IPO is a credit positive, according to an analysis by Moody’s Investors Service. Ann G. Perry, vice president, senior credit officer for Moody’s, writes that the move is a credit positive because it establishes a public equity market for Fidelity & Guaranty Life (FGL) and lessens its capital […]

Aegon called to the carpet in multistate settlement

{September 10th, 2013} by Elizabeth Festa

States wrote another chapter in their series of multistate life insurance settlements regarding the use of the Death Master File (DMF) database with Netherlands-based Aegon’s agreement to pay $11.2 million to insurance regulators. Under the agreement, the company and its affiliates will complete one full comparison of all policyholders against the DMF and will enhance […]

Ash Brokerage Corporation announced the premiere of “Steve Savant’s Money, the Name of the Game”

{September 10th, 2013} by Steve Savant

Fort Wayne, Ind. (September 6, 2013) – Ash Brokerage Corporation announced the premiere of “Steve Savant’s Money, the Name of the Game,” a weekly 30-minute talk show program for consumers and hosted by Steve Savant. Steve is one of the leading authors of online content on insurance products and services to the producer and consumer […]

New NAPFA national chair assumes office

{September 9th, 2013} by Paula Aven Gladych

Linda Leitz has taken over as national chair of the National Association of Personal Financial Advisors. She was elected by NAPFA’s National Board of Directors to the position on Jan. 31, 2013, and started her term on Sept. 1. She will serve until Aug. 31, 2014. Leitz is the founder and co-owner of It’s Not […]

A sales skills primer, part 3

{September 9th, 2013} by Sandy Schussel

To be truly successful at getting new clients, your passion for your work must be accompanied by three essential skills: The ability to ask provocative questions. The ability to listen with total focus on your client. The ability to relate compelling stories and metaphors. Click here to read…

2008 Financial Crisis: Could It Happen Again?

{September 9th, 2013} by Kevin McCoy, USA TODAY

Fear gripped the USA five years ago. As Americans awoke on Monday, Sept. 15, 2008, they learned that Lehman Bros. had collapsed in bankruptcy, inflicting billions of new losses on a financial system already rocked by a cratering housing market and a tightening credit crunch. Upending Wall Street’s weekend hopes that the nation’s fourth-largest investment […]

Keys To Entering The Hispanic Market

{September 9th, 2013} by Cyril Tuohy

Financial advisors looking to sell life insurance to Hispanic consumers need to know two facts about this growing demographic: the Hispanic population is growing fast and Hispanic Americans, many of whom come from or live with large families, place a premium on protection. Oh, yes, and one more thing: the median age of Hispanics in […]

Life-Annuity Insurers Accelerate Marketing, Distribution Strategies

{September 9th, 2013} by Michael Warner, Conning Inc

HARTFORD, Conn., Sept. 4, 2013 /PRNewswire/ –Life insurer consumer marketing and distribution strategies have been evolving rapidly, and the pace of change will accelerate as insurers continue their focus on high net worth individuals while gearing up to deal with a rapidly changing population and new technology, according to a new study by Conning. “Conning’s […]

Why Women Are Terrified To Hire A Financial Advisor

{September 9th, 2013} by PRWeb

San Diego, CA (PRWEB)September 03, 2013 Divorce. Children. Retirement. Bernie Madoff. There are a multitude of reasons women have great need for proper financial planning, and just as many keeping them from hiring an advisor, including feeling completely overwhelmed and just plain terrified. Women hold more than half the wealth in this country and are […]

The Career Threat You’ve Never Heard About

{September 6th, 2013} by Joe Jordan

It’s tough being a financial professional. For every way you can succeed, there are countless obstacles you must overcome. From staying current on product knowledge and regulations to dealing with difficult or unhappy clients , your training prepares you for many of these challenges. However, the biggest threat to your career is also the one […]

5 ways to use social media for Life Insurance Awareness Month — and beyond

{September 6th, 2013} by Holly Bonds

It’s September, and Life Insurance Awareness Month (LIAM) has arrived. Life insurance and annuity producers should be taking advantage of this opportunity to market their services to clients. One of the first rules of marketing is to be where your customers are, and social media sites are the pulse of consumer interaction. Click here to […]

Spouses have crucial impact when planning retirement

{September 6th, 2013} by Michael K. Stanley

Spouses tend to a have profound impact on one another’s retirement planning according to recent research from the University of Missouri (UM). Angela Curl, an assistant professor with UM’s School of Social Work had this finding published in Clinical Gerontologist. In the article, “Anticipatory Socialization for Retirement: A Multilevel Dyadic Model,” Curl culled and analyzed data […]

American Equity CEO uses stock options to trade 4,000 shares

{September 6th, 2013} by Victor Epstein

John Matovina, chief executive officer of American Equity Investment Life Holding, exercised some of his stock options Wednesday by purchasing 4,000 of its shares at $9 and selling them at $20.21, according to a new filing with the Securities and Exchange Commission. The transaction netted him about $44,840. The SEC regulates the securities industry and […]

Why women lag behind men in retirement saving

{September 6th, 2013} by Marlene Satter

Everyone knows that almost no one is saving enough for retirement these days. What may be a surprise is that women trail men in retirement savings by a hefty margin, and are more likely to default on loans from retirement plans than men. But why does this happen? And, perhaps more important, what can be […]

LIMRA: Life premiums up 6% year-to-date

{September 5th, 2013} by Warren S. Hersch

Individual life premium grew 4 percent in the second quarter, resulting in a 6 percent increase for the first half of 2013, according to LIMRA’s latest individual life insurance sales survey. Policy count, which had been increasing slightly over the last two years, continued to decline in the second quarter, down 2 percent for the […]

Positive outlook for life insurance stocks

{September 5th, 2013} by AP Staff Writer

NEW YORK (AP) – An analyst upgraded some life insurance companies on Wednesday, saying a recent pullback in the stocks provides a good buying opportunity. Jay Gelb of Barclays boosted MetLife Inc. and Prudential Financial Inc. to “Overweight” from “Equal Weight,” saying both have big U.S. operations that will benefit from rising U.S. interest rates. […]

Financial planning groups wrestle to define fee-only advisers

{September 5th, 2013} by Mark Schoeff Jr. and Dan Jamieson

Some NAPFA members might be out of CFP Board compliance Financial planning groups will endeavor to mend a rift over how to determine who is a fee-only investment adviser at a meeting in Chicago next week. The gathering of the leadership of the Financial Planning Coalition is not being convened specifically to deal with differences […]

Should advisers rethink life insurance in same-sex estate plans?

{September 5th, 2013} by Darla Mercado

Life insurance was a primary source of estate planning and wealth enhancement for gay couples In the wake of an IRS ruling and the Supreme Court’s repeal of a key provision of the Defense of Marriage Act, advisers are beginning to rethink the role of life insurance in same-sex couples’ trust and estate plans. Last […]

Man Dupes Family For 12 Years On Fake Life Insurance Policy

{September 5th, 2013} by Jody Callahan, The Commercial Appeal, Memphis, Tenn. McClatchy-Tribune Information Services

Sept. 05–A family already suffering from heartbreak must now deal with the realization that a man allegedly conned them for more than a decade with a fake life-insurance policy. Jerry Gardner, 61, has been arrested for fraud and theft of property. He is being held on$2,000 bond. According to police, this family’s nightmare began last […]

Sales of fixed annuity products jump in Q2

{September 4th, 2013} by Michael K. Stanley

Propelled by an improved interest rate environment, second-quarter fixed annuity sales posted sequential gains for the first time in two years. According to a recent study conducted by Beacon Research, rising interest rates coupled with the steepest yield curve in close to two years afforded carriers the opportunity to increase the rates they offered on […]

Symetra’s Edge Pro Fixed Indexed Annuity Surpasses $1 Billion in Sales

{September 4th, 2013} by Press Release

BELLEVUE, Wash.–(BUSINESS WIRE)–September 03, 2013– Symetra Life Insurance Company today announced that total sales of its Symetra Edge Pro(R) Fixed Indexed Annuity have crossed the $1 billion mark. Introduced in April 2011 and sold through banks and broker-dealers, Edge Pro is designed to help meet the retirement planning needs of customers looking for diversification and […]

The Big Reveal On Quarterly Annuity Sales

{September 4th, 2013} by Linda Koco

Annuity professionals sure would like to know which direction annuity sales are going. Every time the quarterly annuity sales numbers come out, annuity professionals ask themselves if this a smoke signal or just yesterday’s news. That question is especially relevant in these times of major shifts in the annuity industry. These include not only the […]

Lincoln National jumps into new fixed annuity business

{September 4th, 2013} by Darla Mercado

Lincoln National Corp. is rolling out its first deferred-income annuity, jumping into a small but rapidly growing product category. The carrier, which already has a major presence as a seller of variable and indexed annuities, today launched Lincoln Deferred Income Solutions, an annuity that permits clients to pay now for a stream of income they’ll […]

Metro employer expected to cut 90 jobs in October

{September 4th, 2013} by KCCI News

DES MOINES, Iowa —The buyer of Aviva USA intends to trim about 90 Aviva jobs in the Des Moines area as it cuts about 10 percent of the insurer’s workforce. The Des Moines Register says Aviva employees were told about the cutbacks in a letter sent Tuesday by Jim Belardi. He’s chief executive officer of […]

Apollo to cut 10% of the Aviva USA workforce

{September 4th, 2013} by Victor Epstein

The private equity firm purchasing West Des Moines-based Aviva USA sent a letter to their future staffers today, outlining their intention to trim about 10 percent of the insurer’s workforce. The letter from Jim Belardi, chief executive officer of Apollo Global Management’s Athene insurance arm, indicated 154 positions will be eliminated at Aviva USA – […]

Annuity Sales Rising

{September 4th, 2013} by FA Staff

Annuity sales for the second quarter of 2012 were up 9.9 percent to $54.5 billion, from $49.6 billion in the first quarter, the Insured Retirement Institute announced Tuesday. However, the sales were down 1.4 percent from the $55.3 billion that were sold in the second quarter last year. The numbers were compiled from data from […]

Leonardi, NAIC slam FSB report on U.S. insurance system

{September 3rd, 2013} by Elizabeth Festa

The National Association of Insurance Commissioners (NAIC) is taking deep offense to the latest perceived blow by the Financial Stability Board (FSB) to the U.S. system of insurance regulation. The FSB’s critical peer review of the United States, focusing on the state of insurance supervision, was released earlier this week. The report recognized that state regulators […]

Hispanics are a Natural Market for Life Insurance

{September 3rd, 2013} by Emily Holbrook

In the next 20 years, Hispanics are projected to grow three times more than any other ethnic group in the U.S. This, among other aspects, helps to make the demographic a natural market for life insurance. That’s according to the recent LIMRA study, “Financial Protection for Hispanics,” which points out several characteristics of the Hispanic […]

Tennessee clarifies insurance-only advisor activities

{September 3rd, 2013} by Harry Lew

Insurance agents who sell fixed and variable annuities often find themselves discussing a client’s investments in order to identify assets to fund new purchases. Conservative advisors often pursue dual registration in order to have a free rein during these discussions. More “adventurous” ones remain insurance-only, opening themselves up to competitor complaints and regulatory scrutiny. Click […]

10 timely life insurance riders

{September 3rd, 2013} by Stephan R. Leimberg, Robert J. Doyle Jr., Keith A. Buck

In addition to the many required legal provisions of a life insurance contract, many life insurance contracts include special provisions, permit special endorsements, and/or allow special riders to be attached to the basic contract. The purpose of these provisions and riders often is to enhance the flexibility and fit of the policy to the policyowner’s needs. […]

What genetic testing means for life insurers

{September 3rd, 2013} by Emily Holbrook

Genetic testing: it’s the crystal ball of health predictions. Are you more likely to develop cancer, Alzheimer’s or Huntington’s disease later in life? With a few strokes of a cotton swab, you can have that information. Click here to read…

Indexed annuities sales at banks hit record high

{September 3rd, 2013} by Maria Wood

Second-quarter statistics from the Bank Insurance & Securities Research Associates (BISRA) underscore the continued sales growth of indexed annuities. In Q2, indexed annuities sales through banks and credit unions maxed out at a record high of $1.06 billion, one-third higher than in the first quarter and two-thirds above the number recorded a year earlier in […]

Zurich Suicide Aftermath Threatens Ackermann’s Legacy

{September 3rd, 2013} by Nicholas Comfort & Elena Logutenkova

Josef Ackermann tried to shake up Zurich Insurance Group AG. (ZURN) Now, allegations that he was partly responsible for the suicide of the chief financial officer are casting a shadow over his 35-year-long career. Pierre Wauthier, who was found dead on Aug. 26 at his home near Zug, Switzerland, mentioned Ackermann in a suicide note. […]

Another view of social media: Stop hyping it

{September 2nd, 2013} by Robert Sofia

Adviser social media activity must be balanced with other traditional interaction methods The financial industry has a tendency to blame mainstream media for hyping financial news, and yet, is guilty of the same thing where social media is concerned. You’ve seen the headlines — “Adviser lands $90 million account on LinkedIn,” “Financial advisers rave about […]

The Life Insurance Blog to Participate in Life Insurance Awareness Month Alongside LIFE Foundation

{September 2nd, 2013} by PRLog

Life Insurance Awareness Month is hosted by the LIFE Foundation every year throughout the month of September PRLog (Press Release) – Sep. 1, 2013 – MYRTLE BEACH, S.C. — The Life Insurance Blog is utilizing its position in the life insurance industry to help the LIFE Foundation with its 10th annual Life Insurance Awareness Month […]