Insurer CEOs Confident On Growth Prospects; Lag On Fundamental Strategy Shifts: PwC

March 14, 2013 by Anand Rao and Eric Trowbridge

Insurance carrier chief executives are upbeat about their companies’ growth prospects, with nearly 90 percent of those recently surveyed saying they are at least reasonably confident about their revenue growth over the next 12-to-36 months.

Executive Summary

Insurance industry executives are confident about revenue growth in 2013, according to a PwC survey, but PwC consultants question whether insurers are moving fast enough to keep pace with fundamental changes in customer demands, technological advances and other transformations impacting the business climate.

The insurance industry CEOs are less optimistic in their expectations for the global economy overall, with just over three-quarters anticipating a stable or improved global economy, PwC’s 16th Annual Global CEO Survey revealed.

The survey captures the thinking of 1,330 CEOs in various industries in 68 countries, including 92 insurance CEOs in the property/casualty and life/health sectors in 39 countries, who are less worried about their organizations’ growth than peers in other industries. Across all industries, CEOs were less bullish about revenue growth, with just over 80 percent saying they’re at least reasonably confident in an uptick this year.

Targets For Growth

In spite of their overall optimism about revenues, familiar problems that tighten the squeeze on margins in developed markets remain for insurance carrier CEOs, including limited product differentiation and a low perception of value among customers. While most insurer CEOs still view their main opportunity for growth as organic growth in existing domestic markets (see related chart, “Carrier CEO Survey: Growth Opportunities”), those growing outside the United States see greater potential in the still largely under-penetrated emerging markets of South America, Asia, Africa and the Middle East.

Latin America in particular tops the list of the regions CEOs are eyeing for growth, according to survey figures revealing that 88 percent of the industry’s CEOs expect growth in Latin America in the next 12 months. As more and more people there (and in other rapidly developing economies) move into the middle class, they buy cars and homes and invest in retirement products—all of which bodes well for insurers.

Of course, focusing more on emerging markets is not without its challenges. Notably, the move to new and unfamiliar markets is opening up insurers to risks about which they have virtually no data. In order to not just respond to but proactively manage these risks (and, of course, those in mature markets), insurers will increasingly use “big data” analytics to understand their customers and distributors better, as they go through different life stages, design products that meet the needs of the customers, and facilitate a seamless interaction with customers across different channels.

Focus On The Customer

Compounding these challenges is the fact consumers—regardless of location—have become accustomed to the choice and accessibility of online shopping, as well as the one-click interaction of mobile apps, and increasingly expect this transparency and convenience from insurers. Most CEOs are conscious of these developments and their potential to reshape the key competitive battlegrounds and business opportunities within the industry.

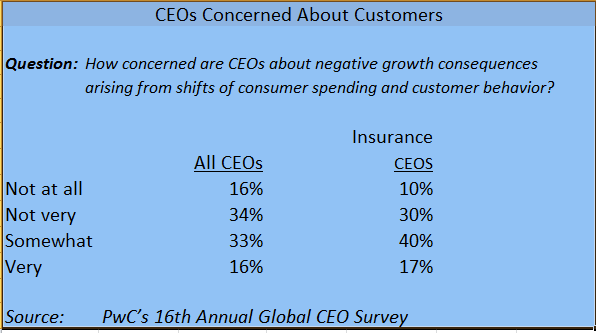

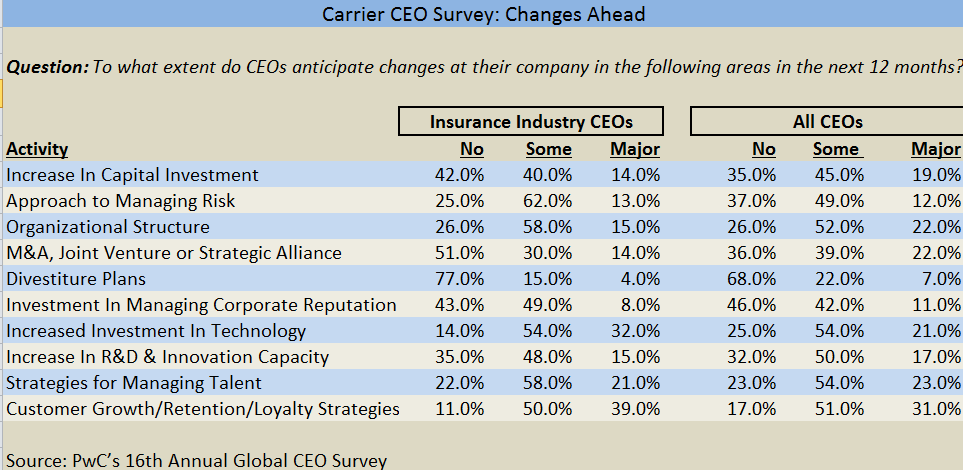

Building the customer base and improving customer service are the top two priorities for investment. Nearly 60 percent of industry leaders are concerned about shifts in consumer spending and behavior. In response, nearly 90 percent of CEOs say their companies are planning to change their strategies for managing customer growth, loyalty and retention, with nearly 40 percent anticipating major changes to these strategies—and almost nine in ten planning to strengthen their social media engagement.

The Central Role Of Technology

With analytics playing an increasingly vital role in customer acquisition, customer retention and service, as well as risk and capital management, technology is at the heart of the competitive developments within the insurance sector. Insurers are leading the way in funding, with 86 percent of industry leaders planning to increase investment in technology.

However, technological advances aren’t happening in a vacuum, and could allow a major online, mobile, social network, or other new entrant to move into the market. Most established players face the impediment of expensive and unwieldy legacy systems, but new entrants could develop automated underwriting and customer relationship management capabilities from scratch at substantially lower cost structures than incumbents. This would allow them to undercut established players, while offering the fast and responsive coverage people want. In turn, cloud computing would allow them to develop a service model built around cheap and flexible just-in-time virtual outsourcing.

The Need To Innovate

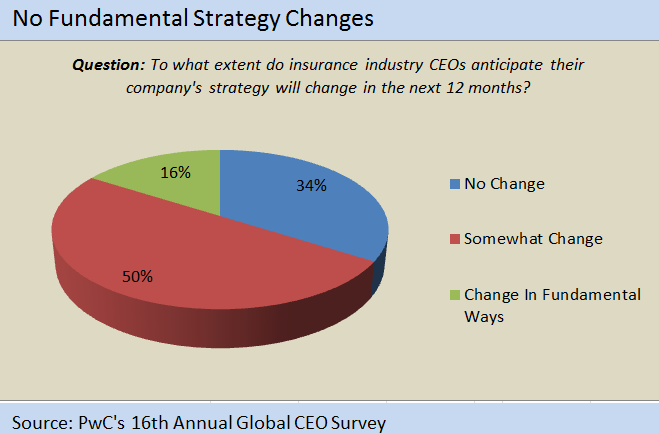

Surprisingly, however, most insurance CEOs (55 percent) say they aren’t concerned about the speed of technological change or the threat from new entrants (58 percent), and few insurers are comfortable with using new data sources and analytical techniques to shape how they make decisions. In addition, survey findings raise questions about whether or not insurers are moving quickly enough to keep pace, with only 16 percentanticipating the fundamental strategic shifts that they may need to make. Underlying all of this is an apparent preference for incremental change over radical innovation. In fact, only 15 percent of survey respondents are planning a major increase in their investments in innovation.

Ongoing success is likely to require a cultural shift as insurers seek to better manage risk, meet more exacting customer expectations, and remain competitive. At the heart of this shift is an environment that encourages people to embrace innovation, engage more closely with customers, and provide them with more effective risk solutions.Several insurers are already taking steps to change institutional culture, notably by seeking to engage more closely with customers. However, many of them are finding it difficult to translate these objectives into discernible changes in how people think and behave in their everyday activities. Culture will only deliver the organization’s key strategic goals (for innovation and sharp customer focus, for example) if it is second nature and firmly part of the habits and routines of staff at all levels.

Existing Business Models Are At Risk

In conclusion, while many insurance CEOs have fixed their sights on the immediate challenges of low interest rates, slowing demand in mature markets and the resulting pressure on share values, they cannot afford to ignore the following transformational changes on the horizon:

• Diverging trajectories of growth in different parts of the world.

• Customer demand for more transparent and accessible products.

• A technological revolution in the form of social, mobile, analytics, and cloud computing that will transform all aspects of insurance.

• A heightened threat of new entrants picking off profitable business.

• Rapid change that is putting existing business models at risk.

The insurers that adapt effectively will focus keenly on the customer and have a superior capacity for innovation and reinvention. They’ll also be able to anticipate— not just react to—change, and be nimble enough to quickly capitalize on emerging opportunities. Businesses that fail to respond could find themselves priced out of the market, falling short of customer expectations, and under threat from aggressive new entrants.